Multibagg AI is an AI-native Equity Research Platform built to help investors make better, research-backed investment decisions and outperform the market. Being AI-native means the platform uses AI at its core to solve real investor problems.

Indian investors face four critical challenges in their stock market journey. Multibagg AI solves all four using AI.

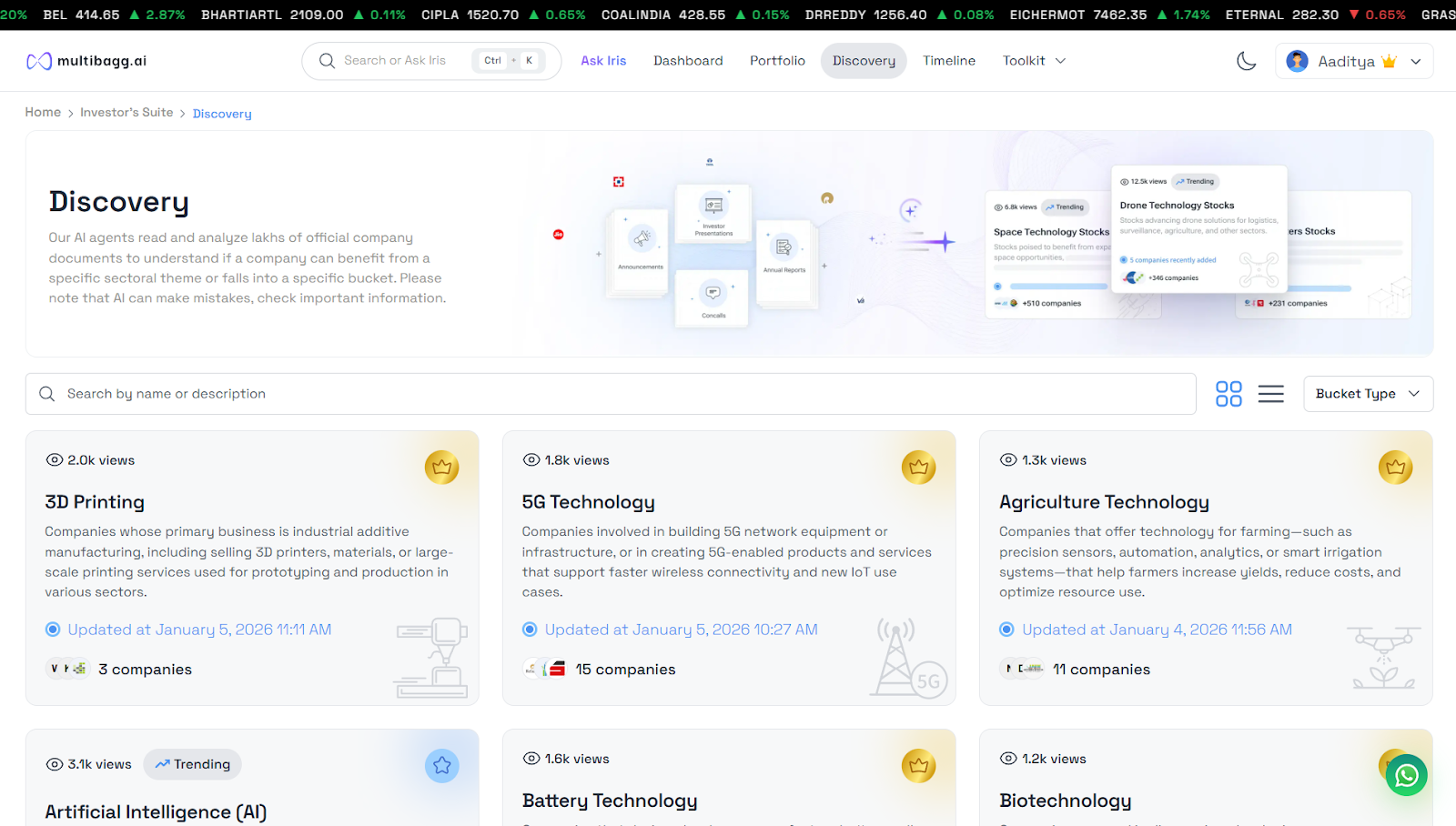

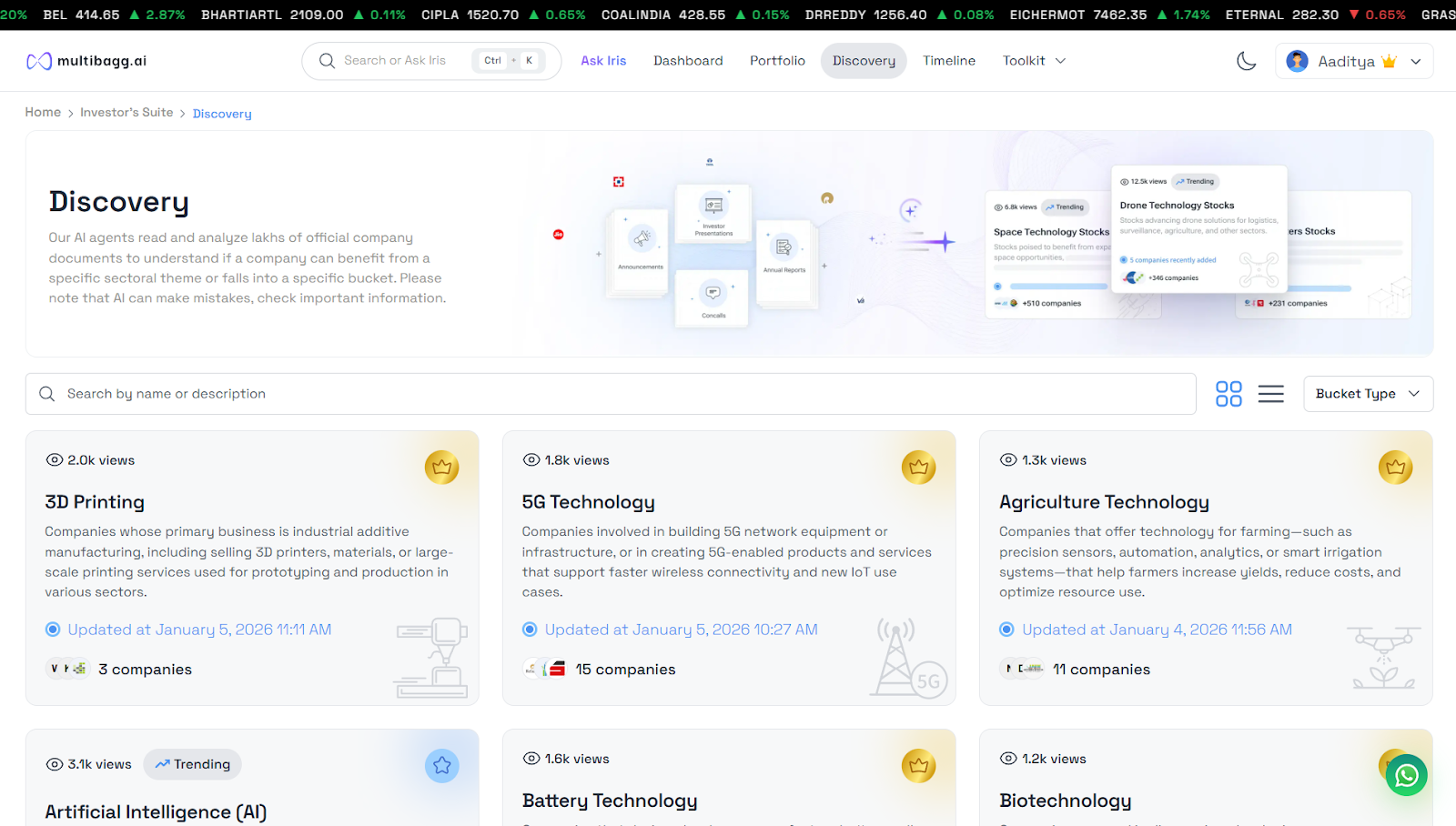

Problem 1: Stock Discovery

India is a stock discoverer’s market, but identifying quality stocks, emerging themes, and the next big opportunity is difficult. To solve this, we built Discovery, where our AI engine processes massive volumes of exchange filings like investor presentations, concalls, and annual reports, and tags companies into thematic buckets such as AI, Blockchain, and Semiconductors in near real time.

For example, Discovery tagged Castrol India under the Data Centers theme. At first glance, this seems incorrect because Castrol is a lubricant company. However, the AI explains its reasoning: Castrol manufactures coolants for data centers and could benefit from the AI and data center boom.

This is where AI shines. Humans can analyze a few documents across limited companies, but AI can read millions of documents across every company to surface asymmetric insights.

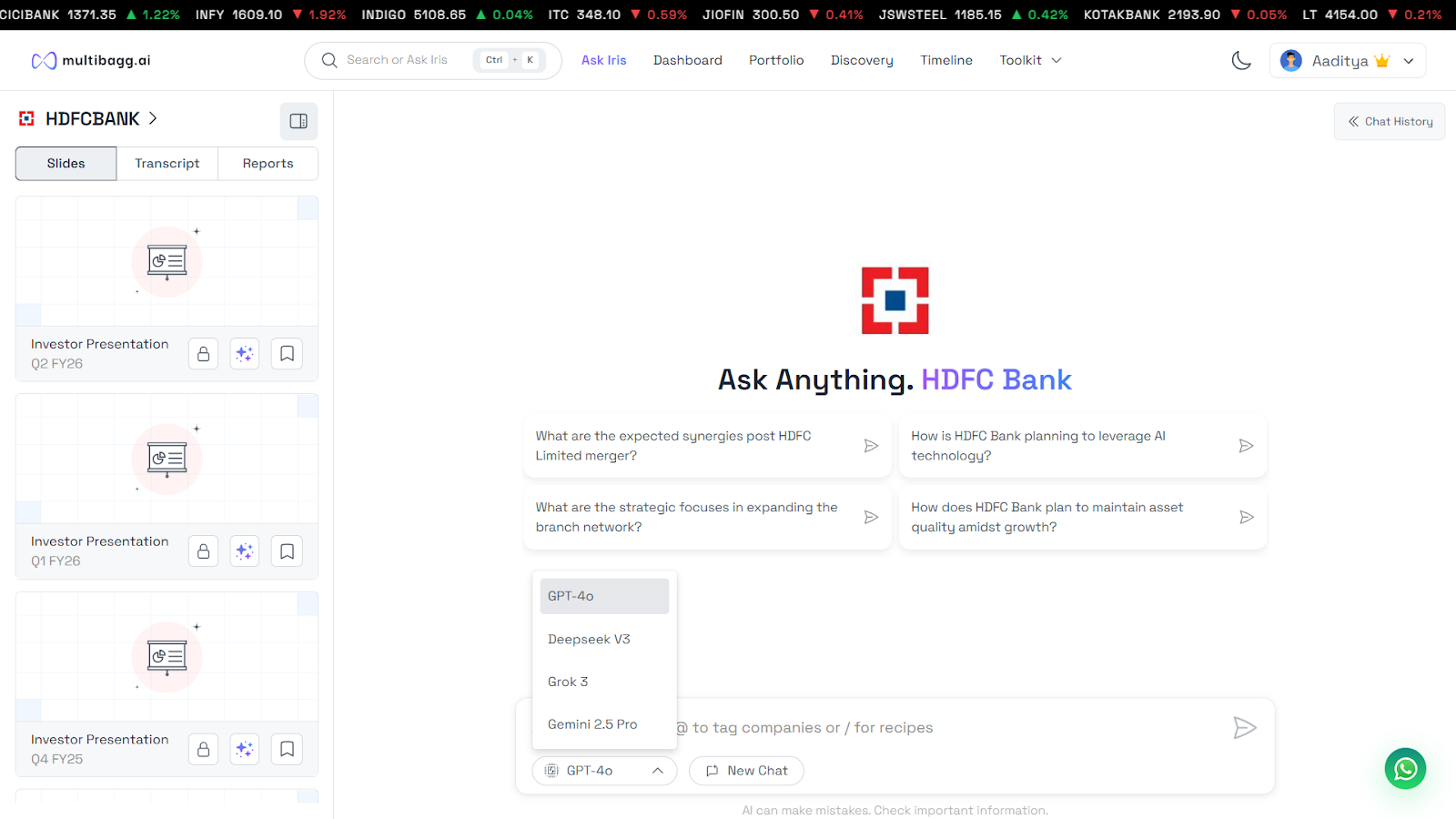

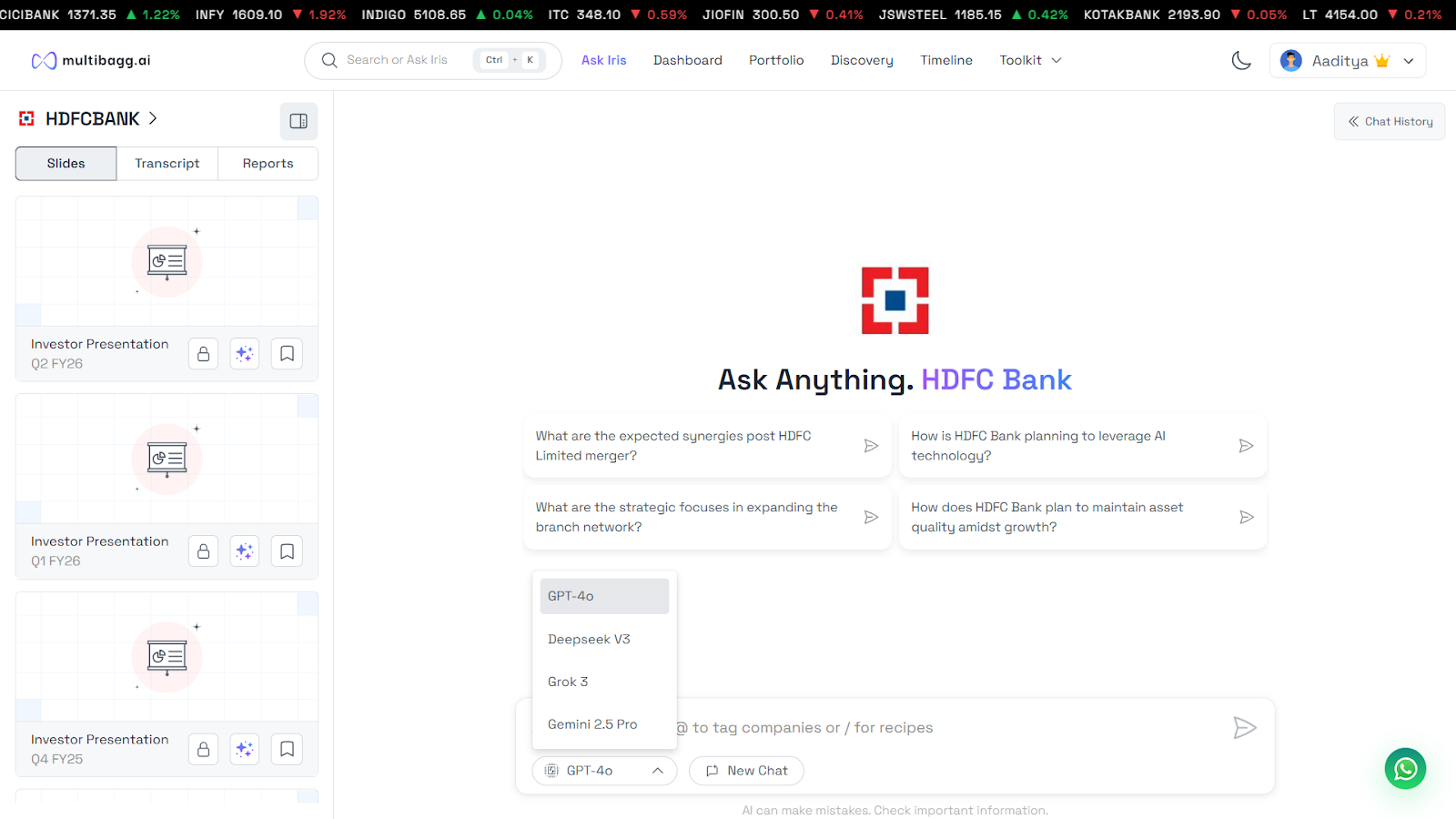

Problem 2: Deep Research

Discovering a company is just the first step. Serious investing requires deep research. For this, we built Iris, one of the most powerful AI chatbots in the stock market space.

You can ask Iris to analyze financials, summarize the latest concall, explain a company’s AI strategy, or assess management quality. Iris acts as a one-stop research assistant not just for stocks, but also for IPOs, ETFs, and indices.

Iris also guides your research journey. When you start analyzing a company, Iris suggests the right questions to ask and helps you dig deeper with follow-up questions so you can make informed decisions.

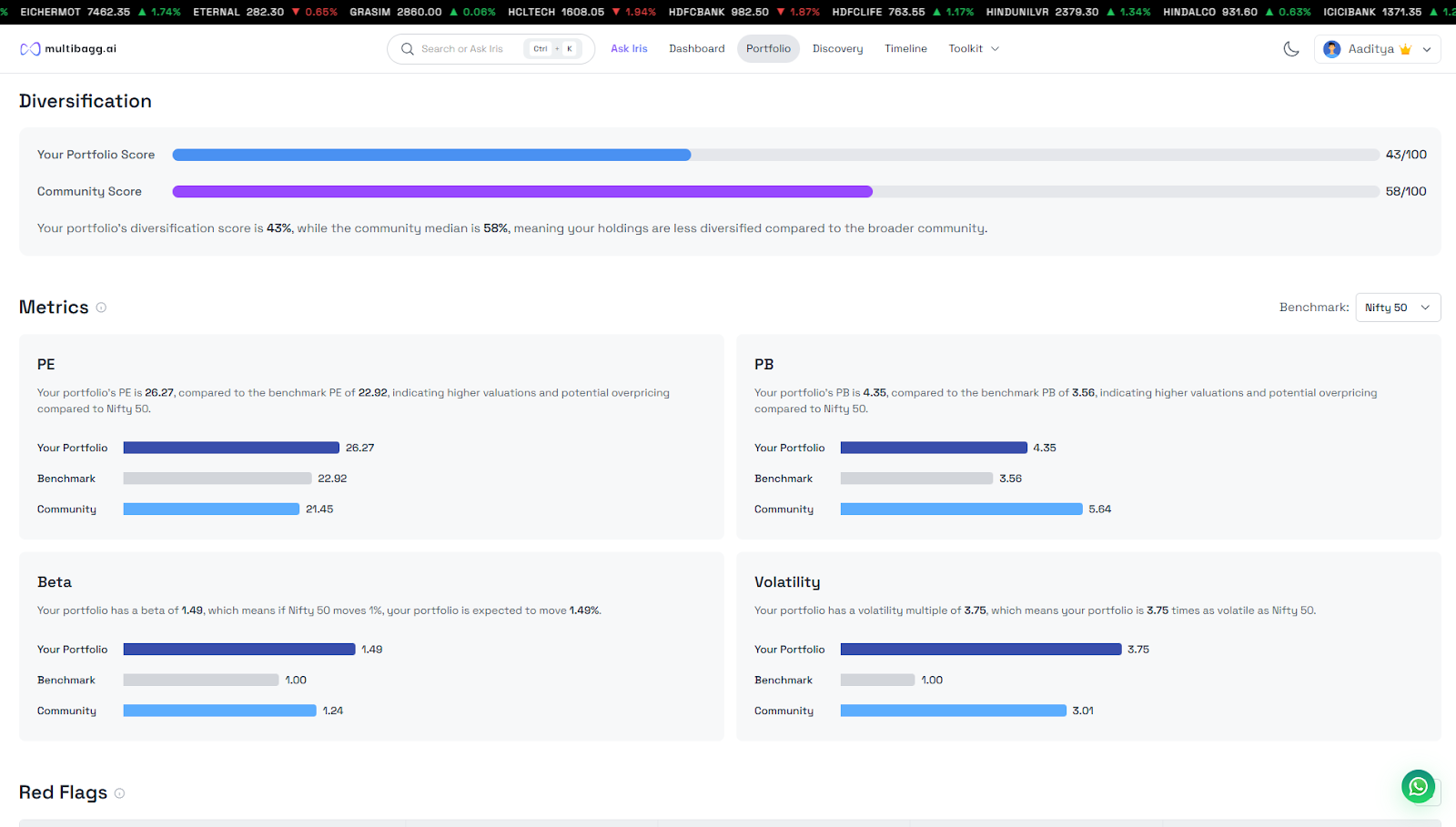

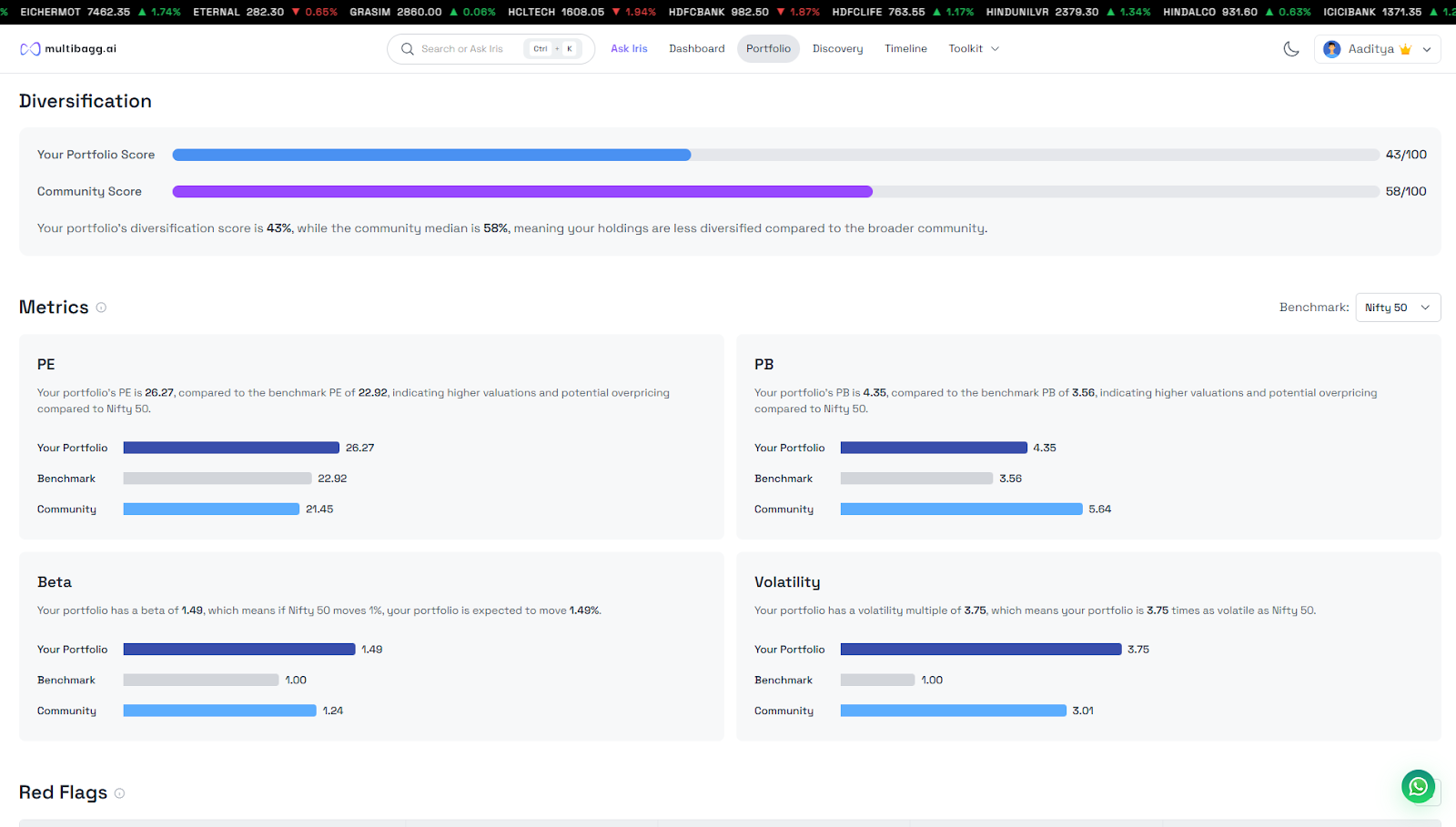

Problem 3: Portfolio Analysis

After discovering, researching, and investing, the next challenge is understanding your portfolio. A portfolio with good companies can still be risky if it lacks diversification.

With the Portfolio Dashboard, you can securely connect your broker account to Multibagg AI in under 10 seconds. You’ll instantly see portfolio intelligence such as asset allocation, sector exposure, diversification, one-year forecasts, red flags, and metrics like PE, PB, and volatility, benchmarked against indices.

You can also ask Iris questions about your portfolio, such as whether promoters are selling stakes in any of your holdings, and get instant answers.

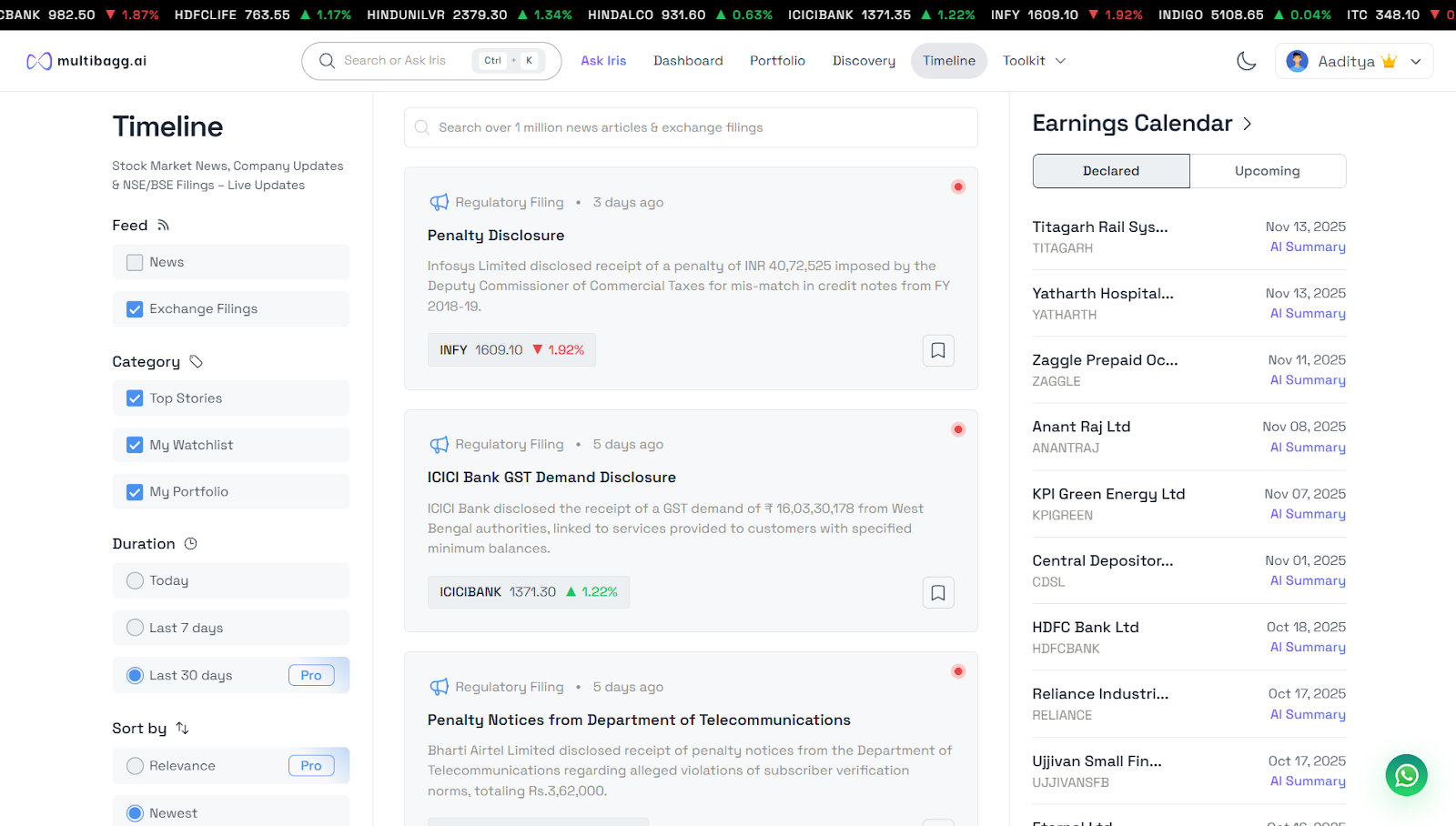

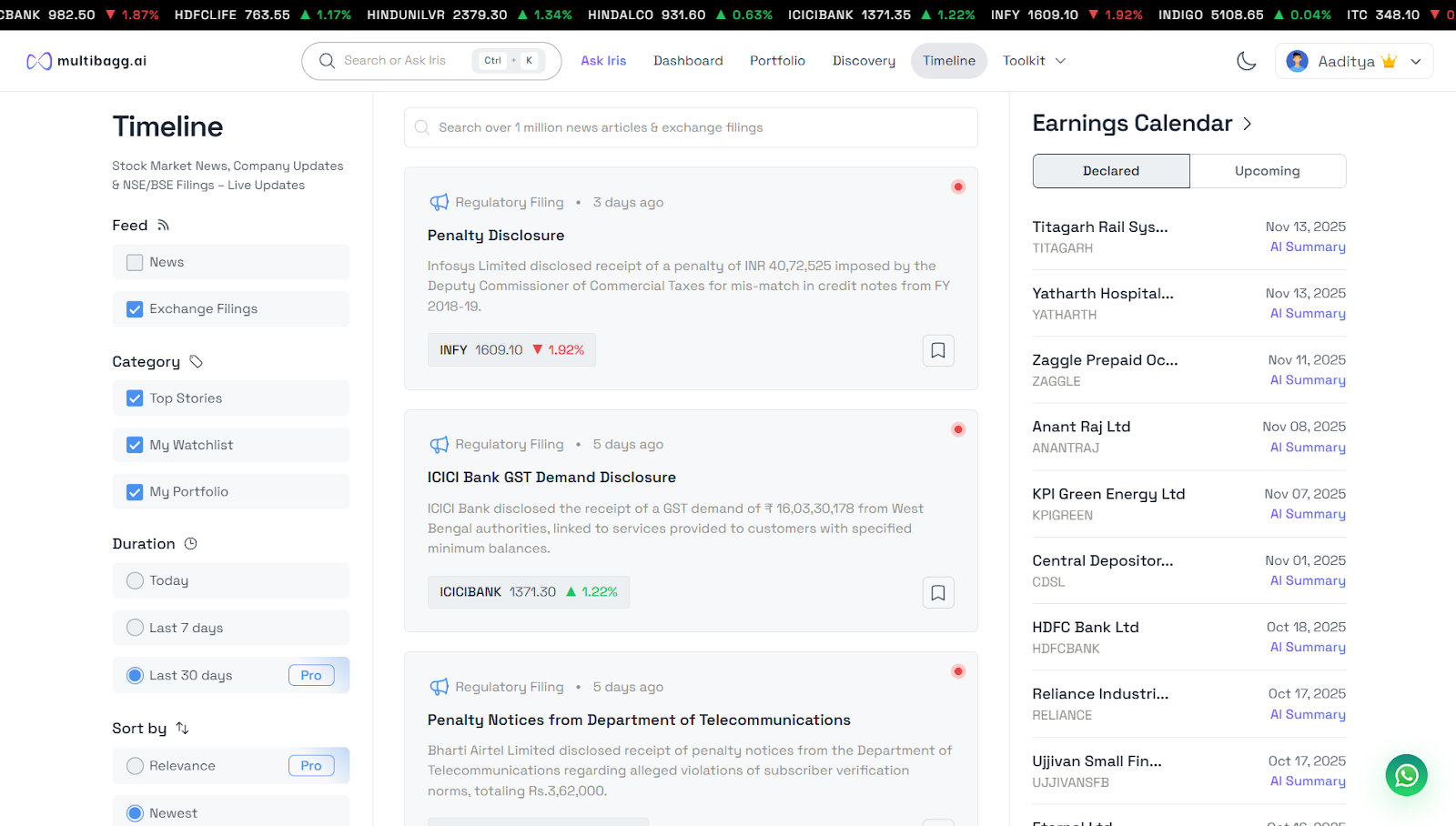

Problem 4: Company Tracking

Most investors track dozens of companies across portfolios and watchlists. Staying updated with daily corporate developments across all of them is nearly impossible.

To solve this, we built Timeline.

We process thousands of NSE and BSE filings daily and surface only the most important updates as concise one-liners. Even a one-minute scroll keeps you informed. Multiple filters let you customize the feed based on your preferences.

Multibagg AI is a one-stop solution to the four biggest problems Indian stock market investors face. And this is just the beginning.

We bring institutional-grade research tools to everyday investors so they don’t have to rely on finfluencers or Telegram tips, and can instead make their own informed decisions.

Log in to multibagg.ai. Get the AI advantage. Become a pro investor.