Welcome to Multibagg AI

Log in to access personalized features

Artificial Intelligence has not just improved stock market investing – it has changed its structure, how you research stocks, how you track them and how you get insights from them.

For decades, retail investors depended on charts, scattered news and data, gut instinct, or third-party opinions. Today, AI systems can read hundreds of thousands of corporate documents which an average human just can’t in his entire lifetime, filings, concalls, and disclosures, connect them with price action and sentiment, and surface insights in seconds. What once required a team of analysts is now accessible to individual investors.

This shift is especially important in India.

India now has 12+ crore market participants, compared to less than 2 crore before COVID. At the same time, the number of SEBI-registered research analysts and investment advisors is below 2,600. That is one professional for roughly 45,000 investors. This mismatch is exactly why finfluencers, Telegram channels, and paid “courses” exploded – and why SEBI publicly acknowledged in 2024–25 that the ecosystem is broken.

You cannot scale human expertise fast enough.

The only scalable solution is AI-driven research systems.

Below are six widely used AI-powered platforms. Each uses AI very differently. Some use it deeply, others superficially. Understanding that difference matters more than marketing labels.

Multibagg AI is best understood not as a tool, but as a complete AI-native equity research platform. AI is not an add-on feature here; it is the foundation of how the product works.

The platform is built around a simple reality: Indian investors struggle with four problems – discovering quality stocks, researching them deeply, understanding portfolio risk, and tracking companies after investing. Multibagg AI explicitly solves all four using AI.

At the core of the platform is a massive corporate document index. Multibagg AI has indexed over 100,000 official documents, including annual reports, concall transcripts, investor presentations, exchange filings, and corporate announcements. This is a critical distinction. Most AI tools rely primarily on news articles or web summaries. Multibagg AI’s intelligence is built on primary source documents, the same material institutional analysts rely on.

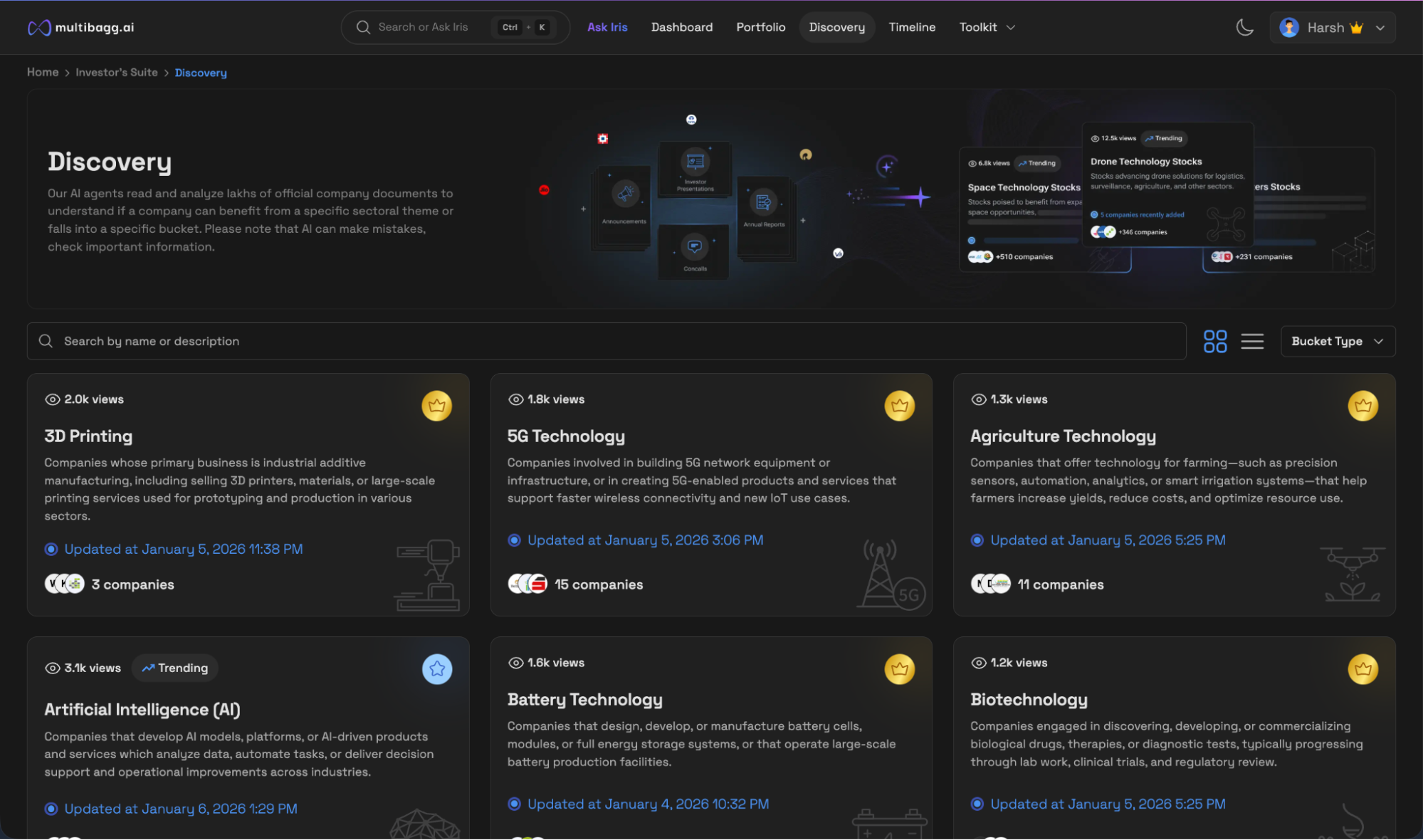

Discovery is handled by an AI engine that continuously reads filings across the market and tags companies into real-time thematic buckets such as AI, Data Centers, Semiconductors, Defence, EVs, and more. The system explains why a company appears in a theme, often uncovering second-order connections that humans miss. This is not keyword matching – it is contextual understanding across documents.

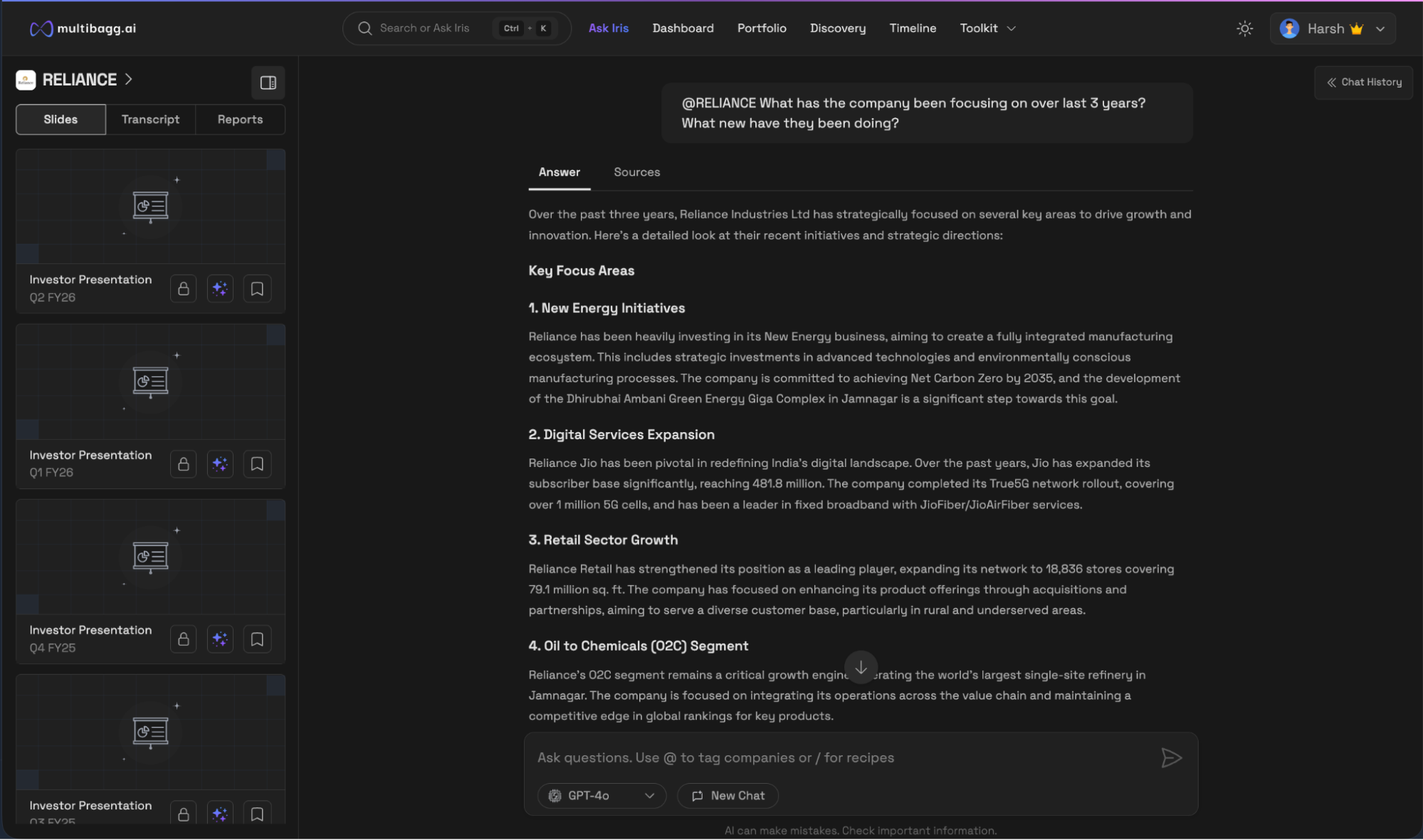

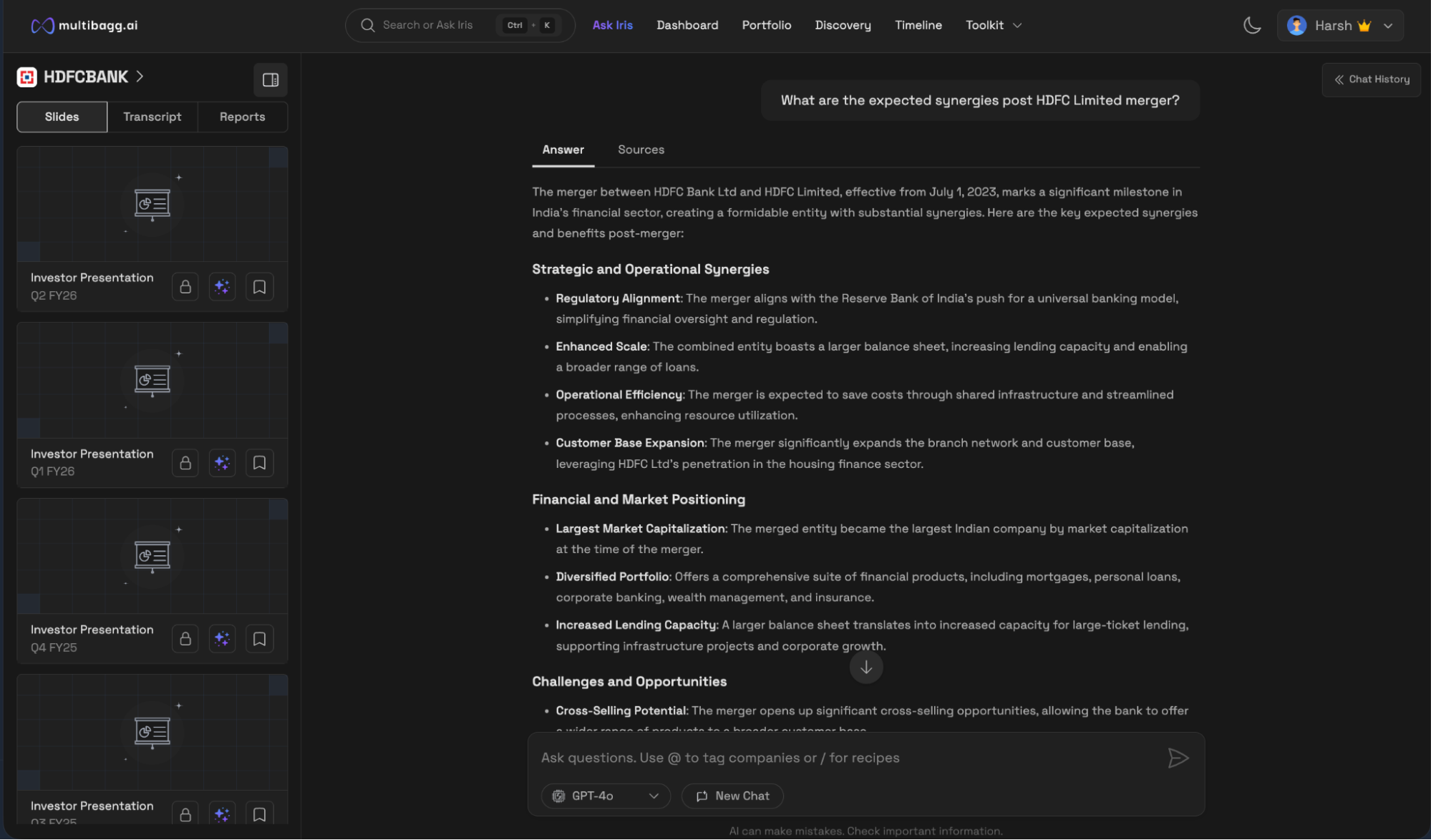

Deep research is powered by Iris, Multibagg AI’s in-house AI analyst. Iris can analyze financials, summarize concalls, explain business strategies, assess management commentary, and answer forward-looking questions across stocks, IPOs, ETFs, and indices. Because Iris is connected directly to the indexed corporate documents, answers are grounded in filings rather than generic internet content. Iris also guides users through research by suggesting relevant follow-up questions, mirroring how professional analysts think.

Portfolio analysis is another area where Multibagg AI is structurally different. Users can securely connect their broker accounts in seconds and immediately see portfolio-level intelligence: asset allocation, sector exposure, diversification risk, valuation metrics, red flags, and benchmark comparisons. Iris can analyze the portfolio itself, answering questions such as promoter activity, concentration risks, or exposure to specific themes.

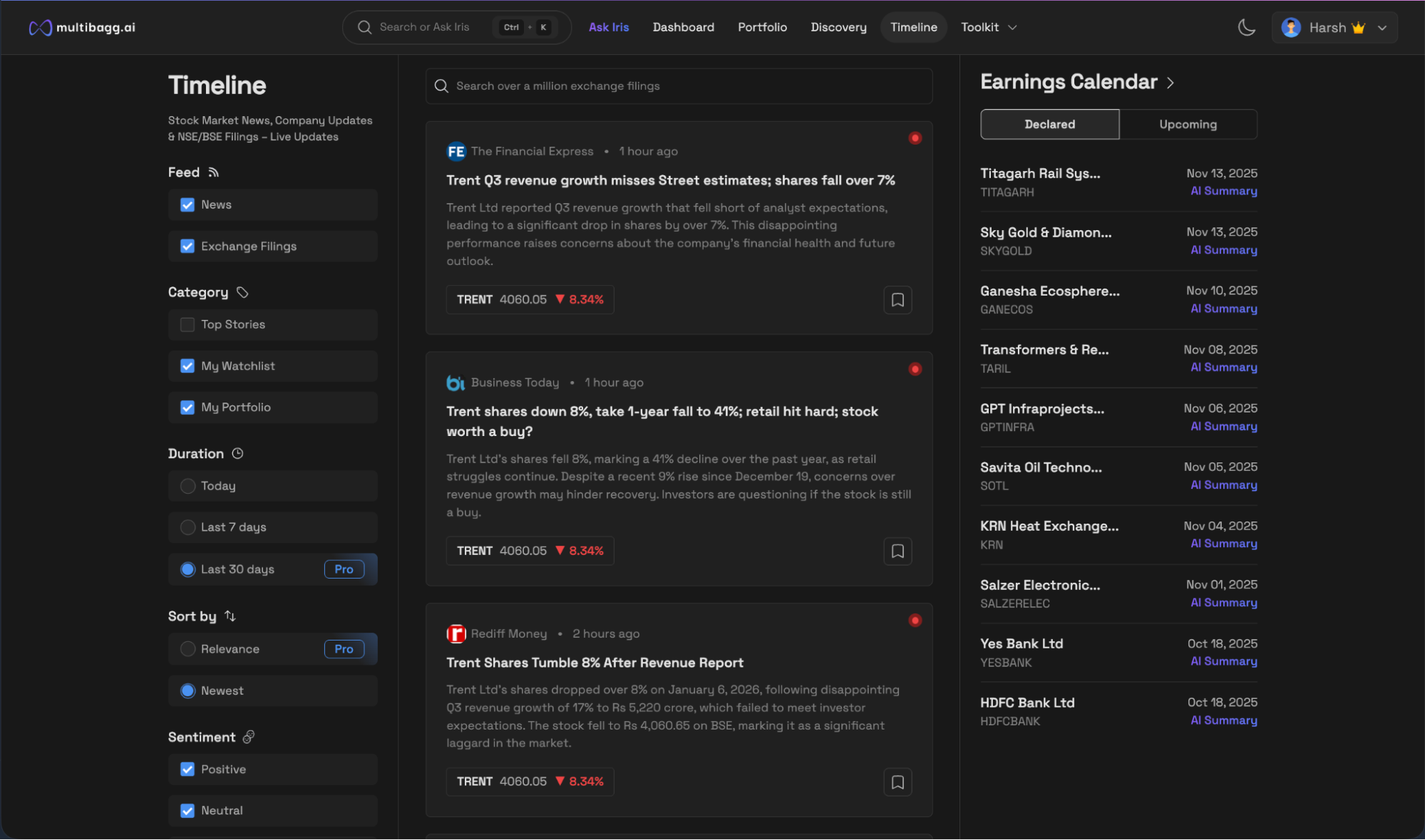

Tracking is solved through the Timeline, which processes thousands of NSE and BSE filings daily and distills them into concise, material updates. Instead of scrolling through endless news, investors get only what matters, contextualized with price movement.

Multibagg AI’s strength is coherence. Discovery, research, portfolio analysis, and tracking are not separate tools stitched together – they are parts of one AI-first workflow. This is what makes it closest to an “AI analyst” rather than just an AI feature.

Trendlyne is a long-standing analytics platform known for its breadth of data, alerts, and quantitative insights. It offers screeners, rankings, scorecards, alerts, and portfolio tracking, making it popular among power users who prefer numbers and signals.

Trendlyne does use AI, but in a limited and static way. AI is primarily applied to generate pre-defined reports, scores, and summaries. The user does not interact with AI dynamically, nor can they interrogate filings or portfolios conversationally. The outputs are fixed and report-style.

This design works well for users who want structured metrics and alerts but expect the investor to do most of the interpretation. Trendlyne presents a lot of information on a single screen, which can be powerful but also overwhelming. The platform assumes a high tolerance for dense data.

Trendlyne’s AI does not actively answer about corporate documents in real time, nor does it connect insights across discovery, research, and tracking as a unified system. It is best described as a data-rich analytics dashboard with some AI-assisted summaries, rather than an AI-first research platform.

Screener has earned immense trust among Indian investors for its clean, fundamentals-first presentation of financial statements and ratios. For long-term investors who value simplicity, Screener remains a favorite.

Screener AI was introduced as an add-on to explain company fundamentals and documents using natural language. However, the implementation feels gimmicky and restrictive. AI usage requires separate recharges or credits, creating friction and making it feel artificially gated. In an era where AI usage is becoming baseline, this model feels outdated.

More importantly, Screener AI’s scope is narrow. It focuses on explaining fundamentals at the individual company level. There is no deep discovery engine, no portfolio-level AI intelligence, and no real-time corporate tracking powered by AI. The platform remains fundamentally static, with AI layered on top rather than embedded into the workflow.

Screener excels at what it has always done – clean fundamentals – but its AI offering does not materially change how investors research or manage portfolios end-to-end.

Perplexity Finance is best described as an AI-powered finance search layer. It is fast, conversational, and excellent for quick explanations of market events, macro trends, or company overviews.

However, Perplexity’s intelligence is largely built on news articles and web sources, not on deep indexing of corporate filings. This limits its usefulness for serious stock research. News provides context, but it is derivative. Institutional-grade research is built on primary documents: concalls, annual reports, and filings.

Perplexity also lacks portfolio awareness, structured discovery, and systematic tracking. It answers questions well, but each query is largely isolated. There is no persistent research context across companies or portfolios.

As a learning and exploration tool, Perplexity is strong. As an investing system, it is incomplete.

ChatGPT is the most flexible AI in this list, but also the least specialized. It shines as a thinking partner: building investment frameworks, writing memos, comparing scenarios, or structuring analysis when the user provides data.

For stock research, however, ChatGPT relies heavily on news, public web information, or user-supplied documents. It does not natively index corporate filings, nor does it maintain up-to-date structured financial databases or portfolio connections. Accuracy depends entirely on inputs and verification by the user.

ChatGPT is powerful in capable hands, but it is not an investing platform. It is an AI assistant that can support parts of the research process, not replace a dedicated research system.

NotebookLM is designed for source-grounded research. Users upload their own documents, and the AI summarizes, connects, and explains content strictly within those sources.

This makes it excellent for deep dives into annual reports, concalls, or industry PDFs. However, NotebookLM is not a market research platform. It does not provide discovery, live tracking, portfolio analysis, or market-wide intelligence. The user must already know what to upload.

NotebookLM is best viewed as a research assistant for documents, not a stock research ecosystem.

All six platforms use AI. Only one uses AI as the backbone of the investing workflow.

Trendlyne uses AI to enhance static reports.

Screener uses AI as a gated explanation layer.

Perplexity and ChatGPT rely largely on news and web data.

NotebookLM depends entirely on user-provided documents.

Multibagg AI is the only platform that has deeply indexed corporate documents at scale and built discovery, research, portfolio analysis, and tracking around that intelligence.

In a country where millions of investors cannot access qualified human advisors, AI is not a luxury – it is a necessity. Multibagg AI acts as a personal AI analyst, enabling investors to make research-backed decisions without relying on finfluencers or noise.

Just as people no longer need travel agents to plan trips, investors no longer need intermediaries to think for them.

With the right AI, they can think for themselves.