Welcome to Multibagg AI

Log in to access personalized features

Multibagg AI vs ChatGPT: Which One Is Built for Real Investors?

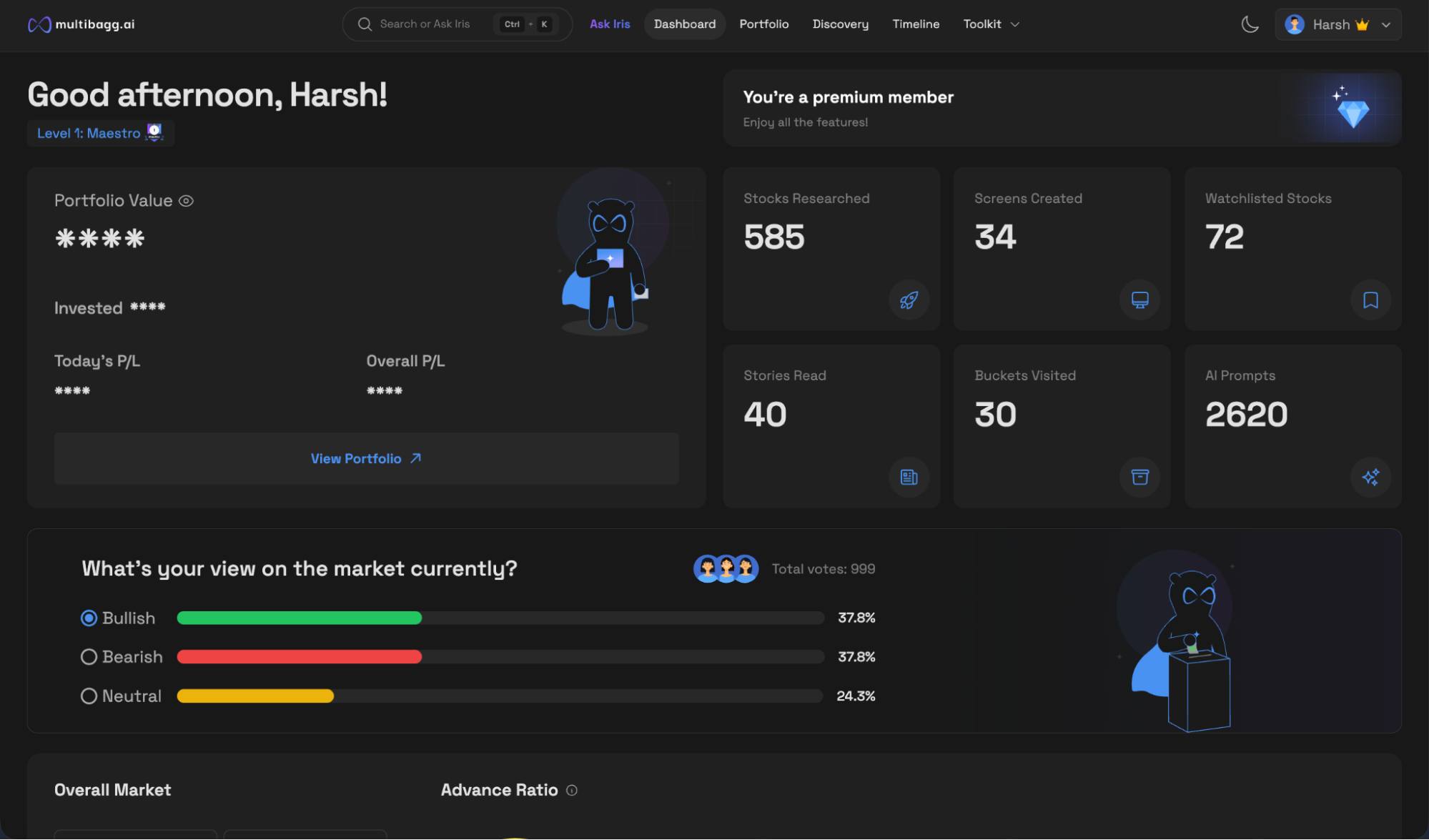

Multibagg AI is a comprehensive stock research and analysis platform designed to solve four critical challenges investors face:

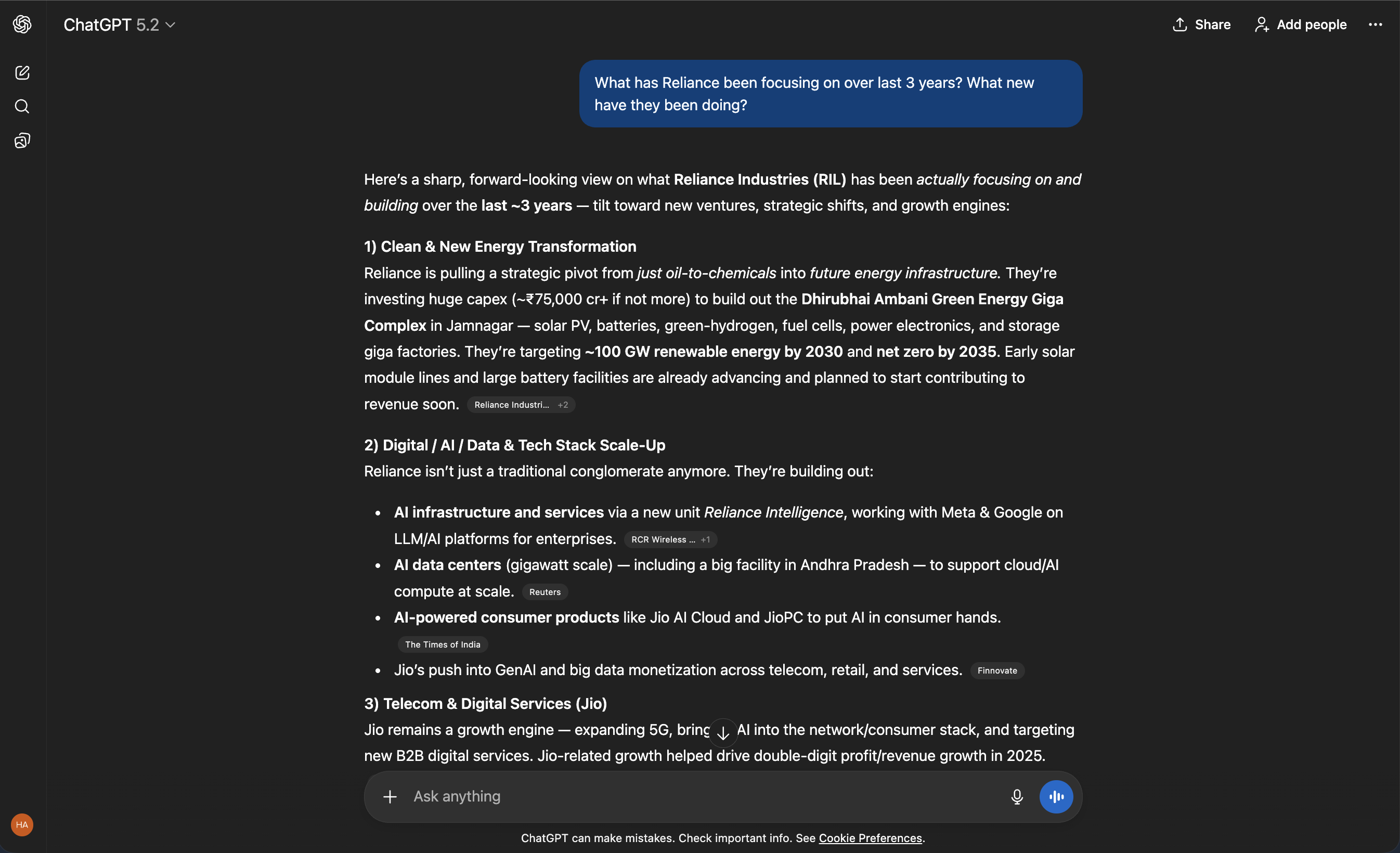

ChatGPT, developed by OpenAI, is a general-purpose AI assistant. It is extremely capable at answering questions across domains, but it is not built as an investing platform and does not explicitly solve the full investing workflow end to end.

Let’s compare Multibagg AI and ChatGPT across 9 key parameters and conclude with a clear final takeaway.

Let’s start with the basics.

The best technology should feel like magic, and the best design should feel like no design.

That is exactly how Multibagg AI feels.

The UI is minimal, modern, and elegant. Navigation is seamless across stock pages, charts, portfolios, screeners, and timelines. Everything is designed around an investing workflow, making it obvious what to do next even for first-time users.

ChatGPT’s UI is a chat interface only. While very clean and familiar, it lacks any dedicated views for stocks, portfolios, charts, or timelines. Insights live inside a conversation and do not persist in a dashboard format.

Verdict: Multibagg AI’s UI/UX is far superior for investing.

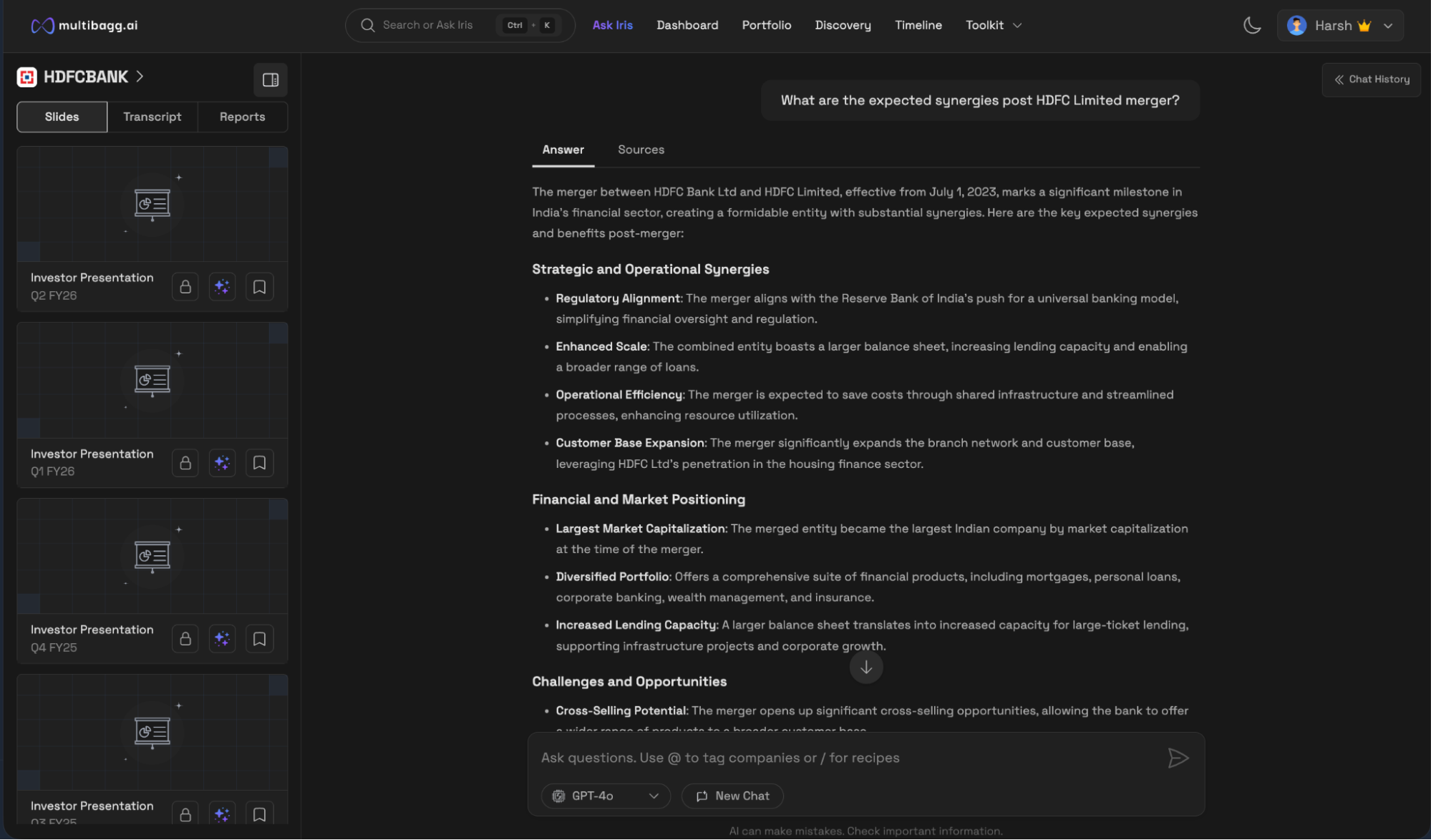

Multibagg AI offers a powerful chatbot called Iris.

Users can ask anything related to stocks, IPOs, ETFs, indices, or portfolios, such as:

“What are the red flags in my portfolio?”

“Summarise Company X’s latest concall.”

“Screen for high ROE, low-debt companies in consumer staples.”

The key advantage is that answers come from official exchange filings, concalls, and Multibagg AI’s proprietary datasets, with source documents accessible within the chat itself.

ChatGPT can answer a very wide range of finance questions and explain concepts. However, it is not connected to structured investor datasets, portfolios, or live filings. It may also generate responses based on generic information from web rather than authoritative sources unless constrained carefully.

Verdict: Multibagg AI wins on investing chatbot relevance and accuracy.

Multibagg AI covers almost every relevant data point for investing: price charts, peers, financial statements, analyst verdicts, forecasts and projections, insider trades, corporate actions, announcements, investor presentations, concalls, and annual reports. It also uses millions of curated news articles for sentiment analysis.

ChatGPT does not maintain or present structured financial datasets. It can summarise data you provide, explain concepts, or discuss markets at a high level, but it cannot reliably surface comprehensive datasets or historical financials.

Verdict: Multibagg AI is a clear winner.

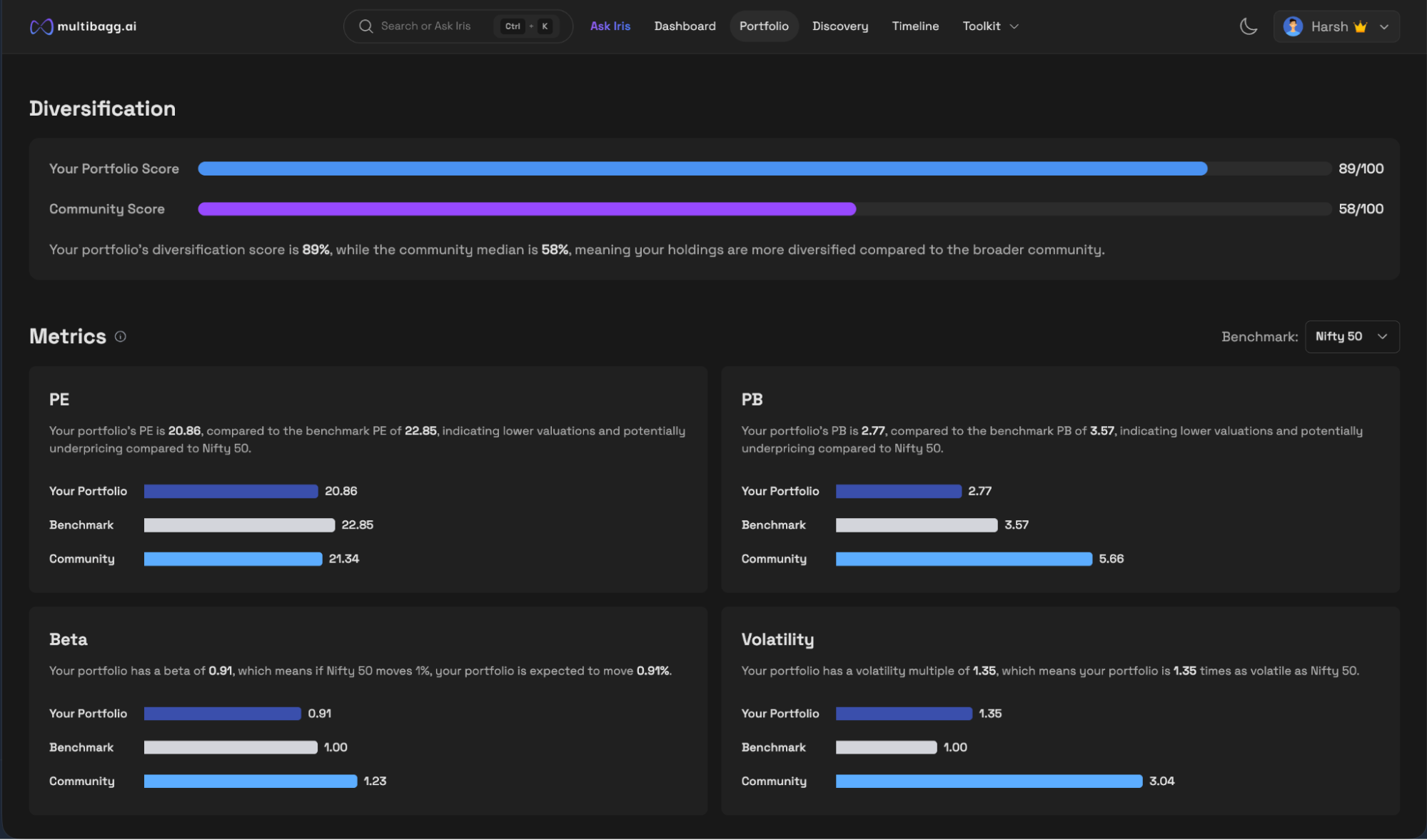

Multibagg AI allows users to connect portfolios natively to brokers in seconds. The portfolio dashboard shows allocation, diversification, benchmarking, red flags, insider activity, news impact, and AI-powered insights. Users can query the portfolio through Iris directly.

ChatGPT cannot connect to live portfolios, monitor holdings, track exposures, or generate portfolio-level insights automatically. At best, it can help you think through a hypothetical portfolio you describe manually.

Verdict: Multibagg AI is the clear winner.

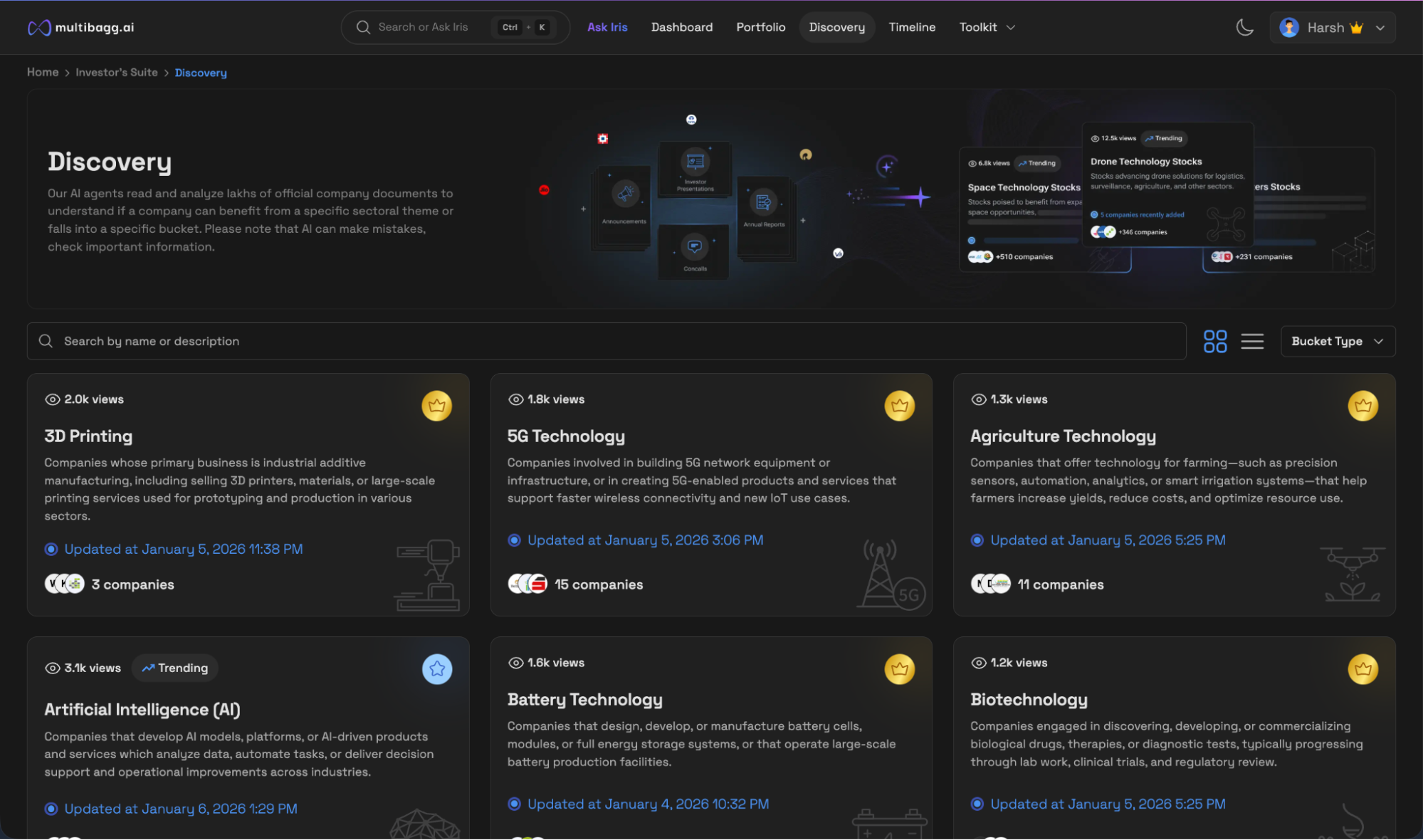

Multibagg AI offers real-time, AI-powered discovery buckets. When a company appears, users can see why and when it was flagged, add it to watchlists, or open it in screener mode for deeper analysis.

ChatGPT does not have any built-in discovery engine. It cannot proactively surface new investment ideas unless you ask specific questions and even then it relies on general knowledge, not a live market signal engine.

Verdict: Multibagg AI wins.

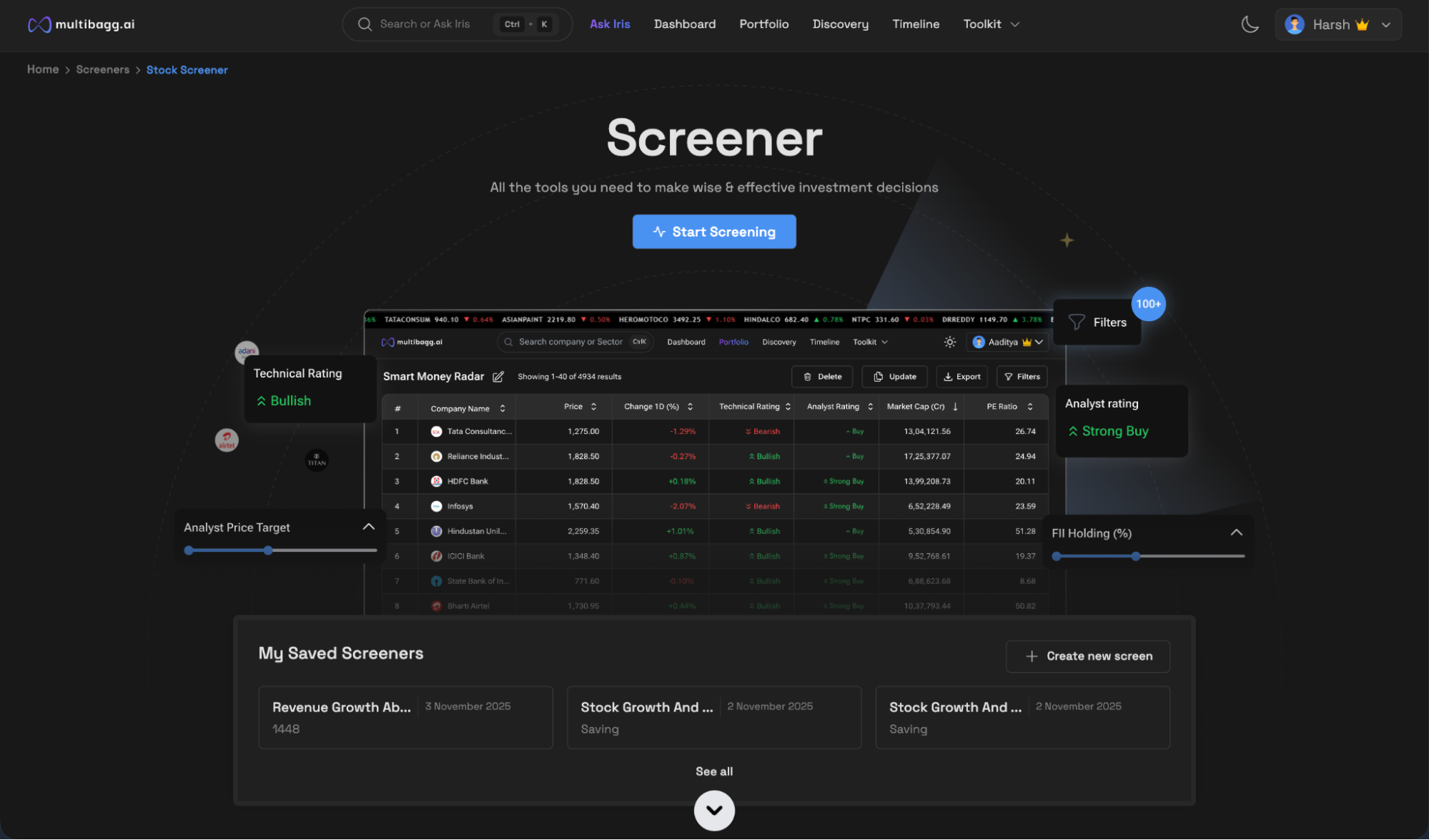

Multibagg AI’s screener is among the best, offering filters across stocks, IPOs, ETFs, indices, sectors, industries, deals, and intraday setups. Users can save screens, export results, and integrate screening with deeper research and AI analysis.

ChatGPT does not have a built-in screener. You can ask it to describe screener criteria or suggest filters, but it cannot perform structured screening on a dataset or return a filtered list of stocks.

Verdict: Multibagg AI wins.

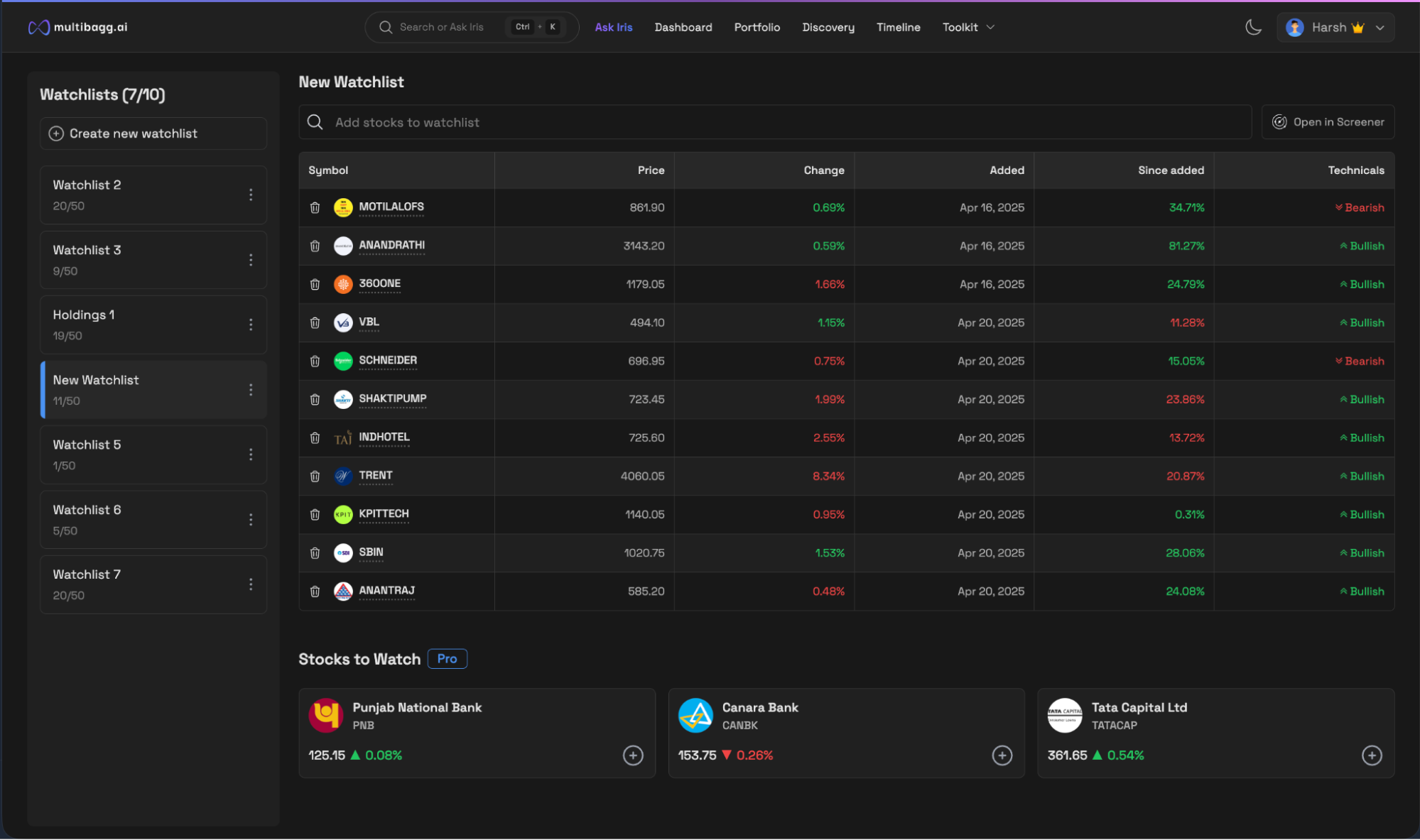

Multibagg AI offers an intuitive watchlist where performance is tracked from the exact date a stock is added.

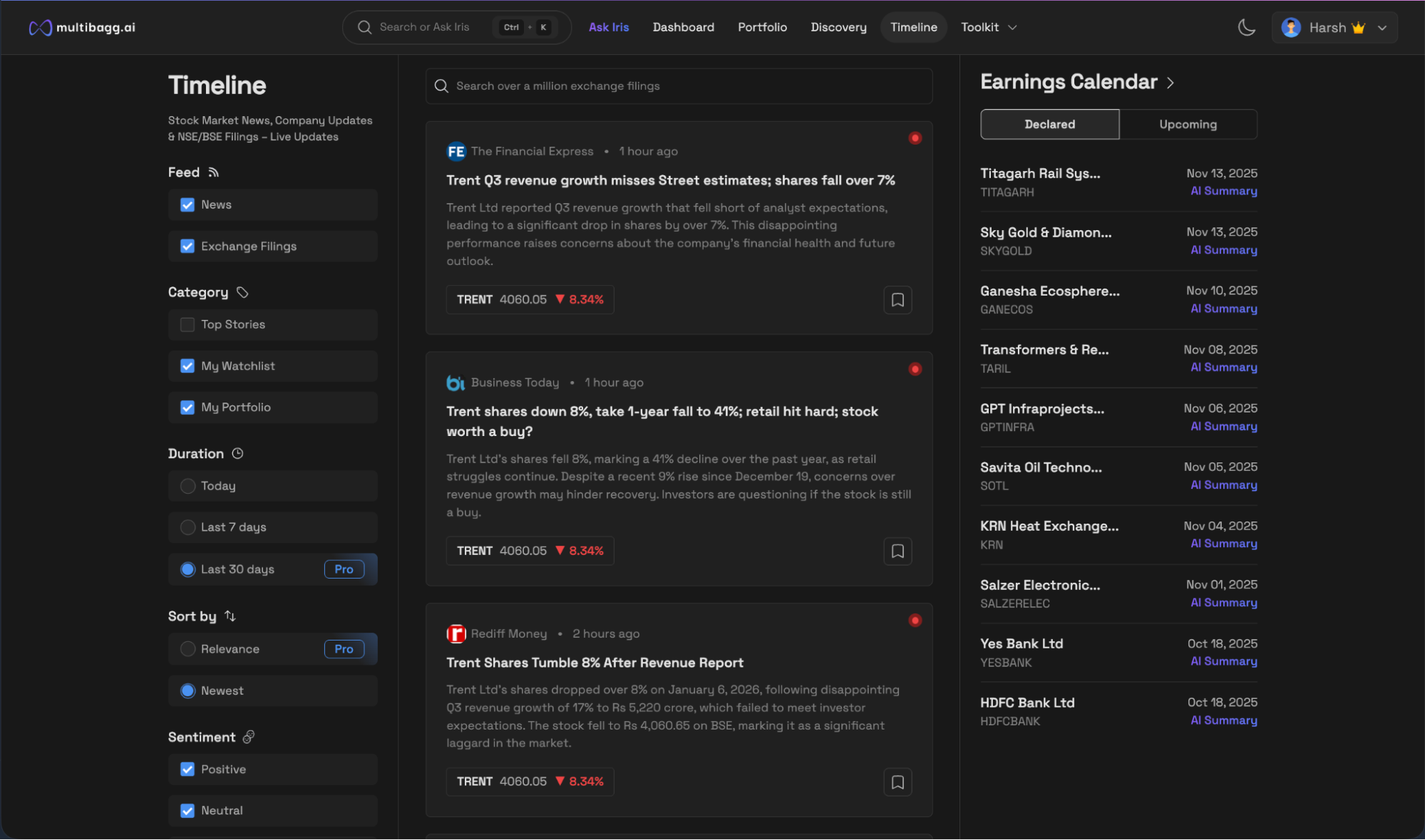

The experience extends into the Timeline feature, which works like a social feed for stocks. Users can filter news by relevance, sentiment, type, and time period and is integrated across sections. Updates are real time, and price movement is shown alongside news, making it easy to understand impact. News refresh is significantly faster, allowing users to stay on top of developments immediately.

ChatGPT does not provide watchlist tracking or timeline features. It does not monitor stocks in the background or deliver curated, structured updates.

Verdict: Multibagg AI wins.

Multibagg AI offers onboarding videos and guided tours to help users learn how to use the platform efficiently. It focuses on enabling users to become autonomous investors using the tools provided.

ChatGPT is excellent for learning and explaining concepts, including financial theory, investing basics, and advanced topics with numerous study materials available. It can teach you almost anything you ask about markets or finance at any depth.

Verdict: ChatGPT wins on education and explainability.

ChatGPT Plus pricing unlocks access to more capable general-purpose AI models, but does not unlock deeper financial datasets, portfolio intelligence, discovery engines, screeners, or investing workflows. It remains a powerful reasoning and explanation tool, not an investing platform.

Multibagg AI, at a significantly lower annual cost, bundles AI-led discovery, structured financial data, filings, portfolio intelligence, screeners, timelines, and an investing-native chatbot into a single integrated workflow designed specifically for investors.

Verdict: Multibagg AI clearly wins on pricing value and ROI for investors.

ChatGPT is an excellent general-purpose AI for learning, reasoning, and explaining ideas across domains. It shines at conceptual clarity and exploration.

Multibagg AI is built specifically for investors. It connects discovery, structured data, filings, portfolios, screeners, tracking, and AI-powered insights into a single, cohesive workflow designed for real investing outcomes.

If you want answers and explanations, ChatGPT works well.

If you want structured workflows, data, conviction, and investing decisions, Multibagg AI is the stronger platform.

Final takeaway:

ChatGPT is great for learning and reasoning.

Multibagg AI delivers an AI-first, end-to-end investing workflow at a fraction of the cost, with far higher practical value for serious investors.