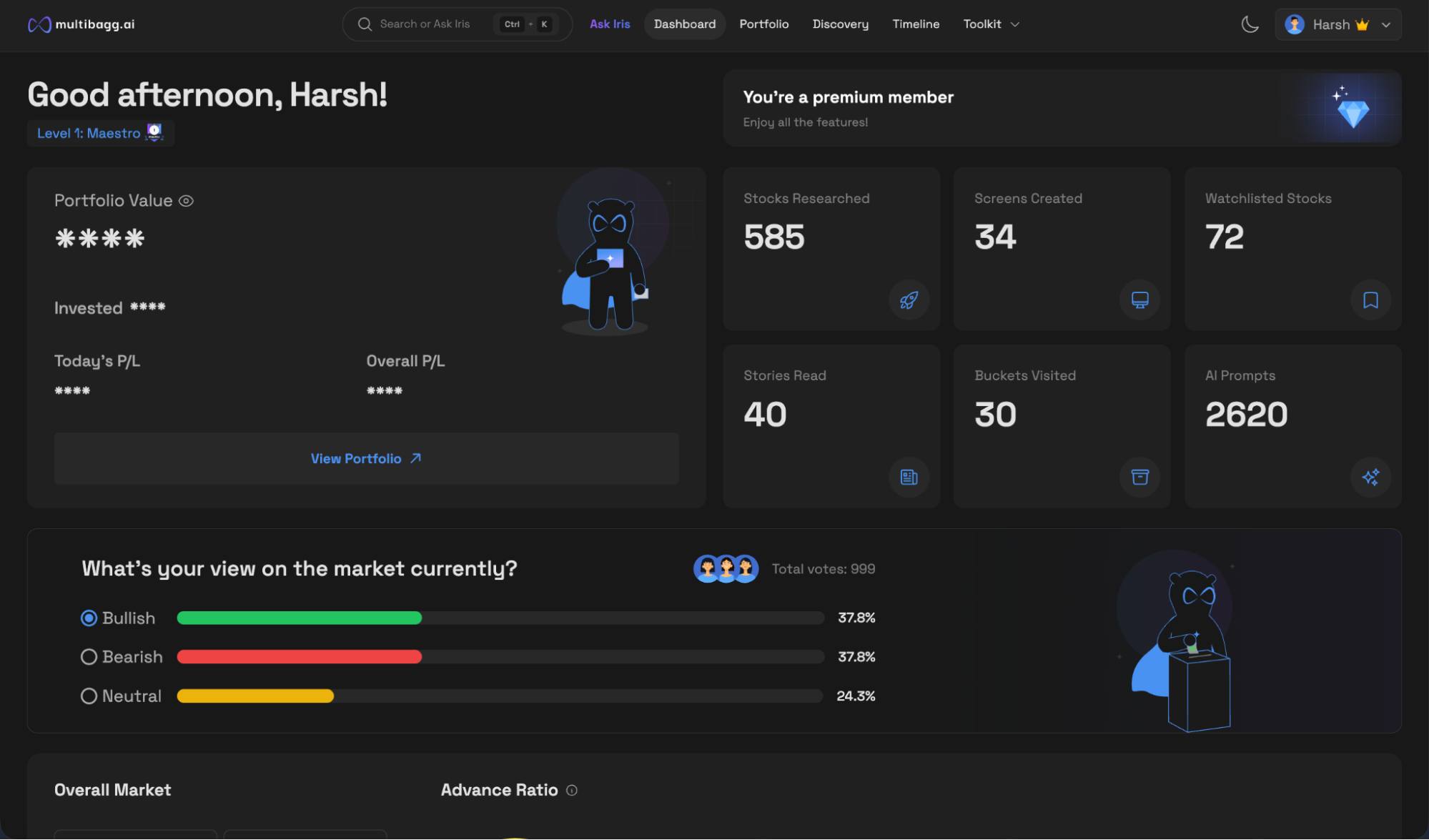

Welcome to Multibagg AI

Log in to access personalized features

Multibagg AI is a comprehensive stock research and analysis platform designed to solve four critical challenges investors face:

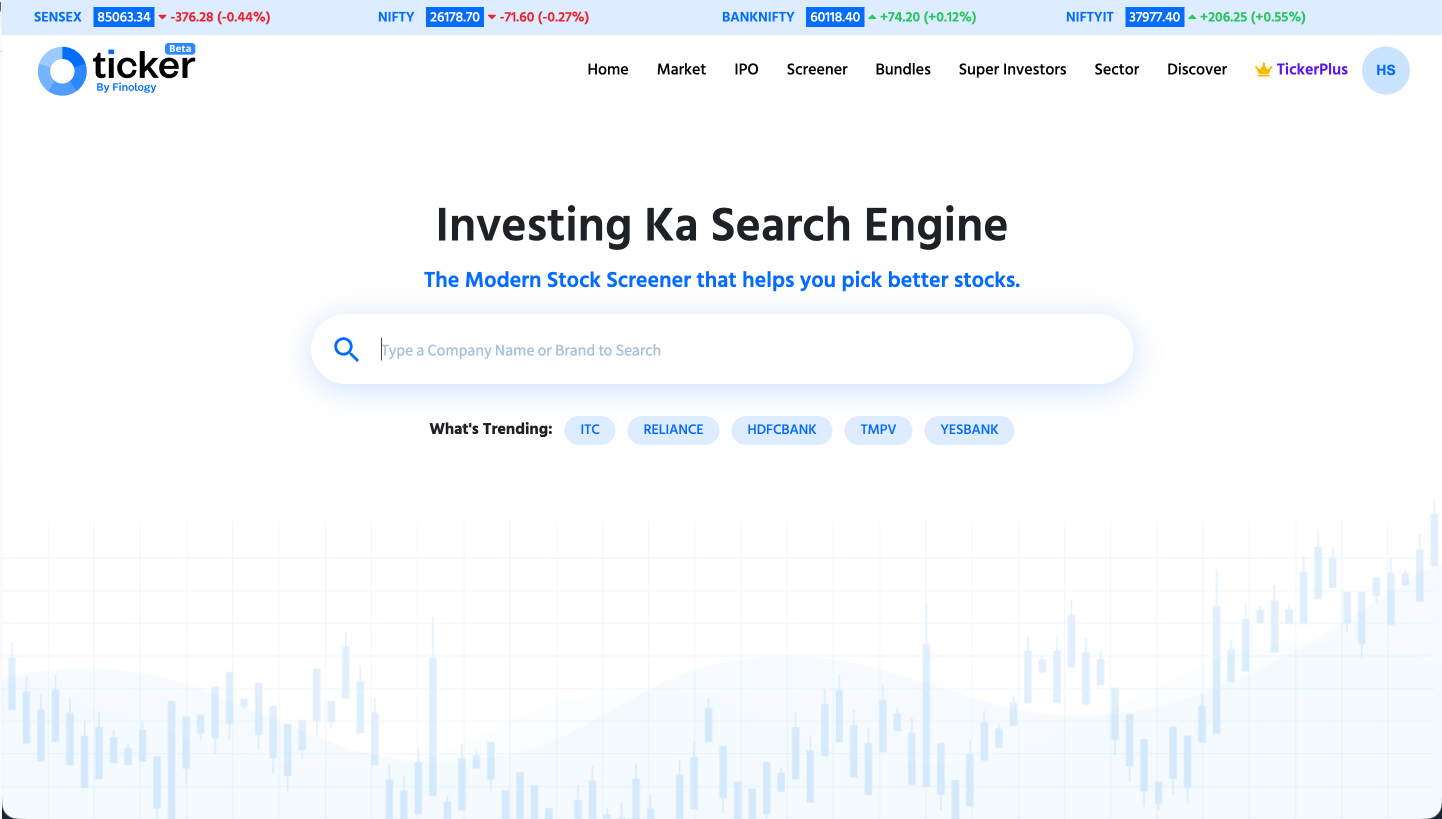

Finology is primarily an investing education and basic analysis platform. It focuses more on teaching concepts via YouTube and offering simplified tools rather than providing an end-to-end, execution-focused investing workflow.

Let’s compare Multibagg AI and Finology across 9 key parameters and conclude with a clear final takeaway.

Let’s start with the basics.

The best technology should feel like magic, and the best design should feel like no design.

That is exactly how Multibagg AI feels.

The UI is minimal, modern, and elegant. Navigation across stock pages, charts, timelines, portfolios, and screeners is seamless. The platform guides users clearly, making it obvious what to do next, even for first-time users. Every flow feels intentional and distraction-free.

Finology has a clean and simple UI, especially compared to legacy platforms. However, the experience feels more content-first than workflow-first. While visually neat, it lacks depth in interactions and does not guide users through a complete investing journey.

Verdict: Multibagg AI wins.

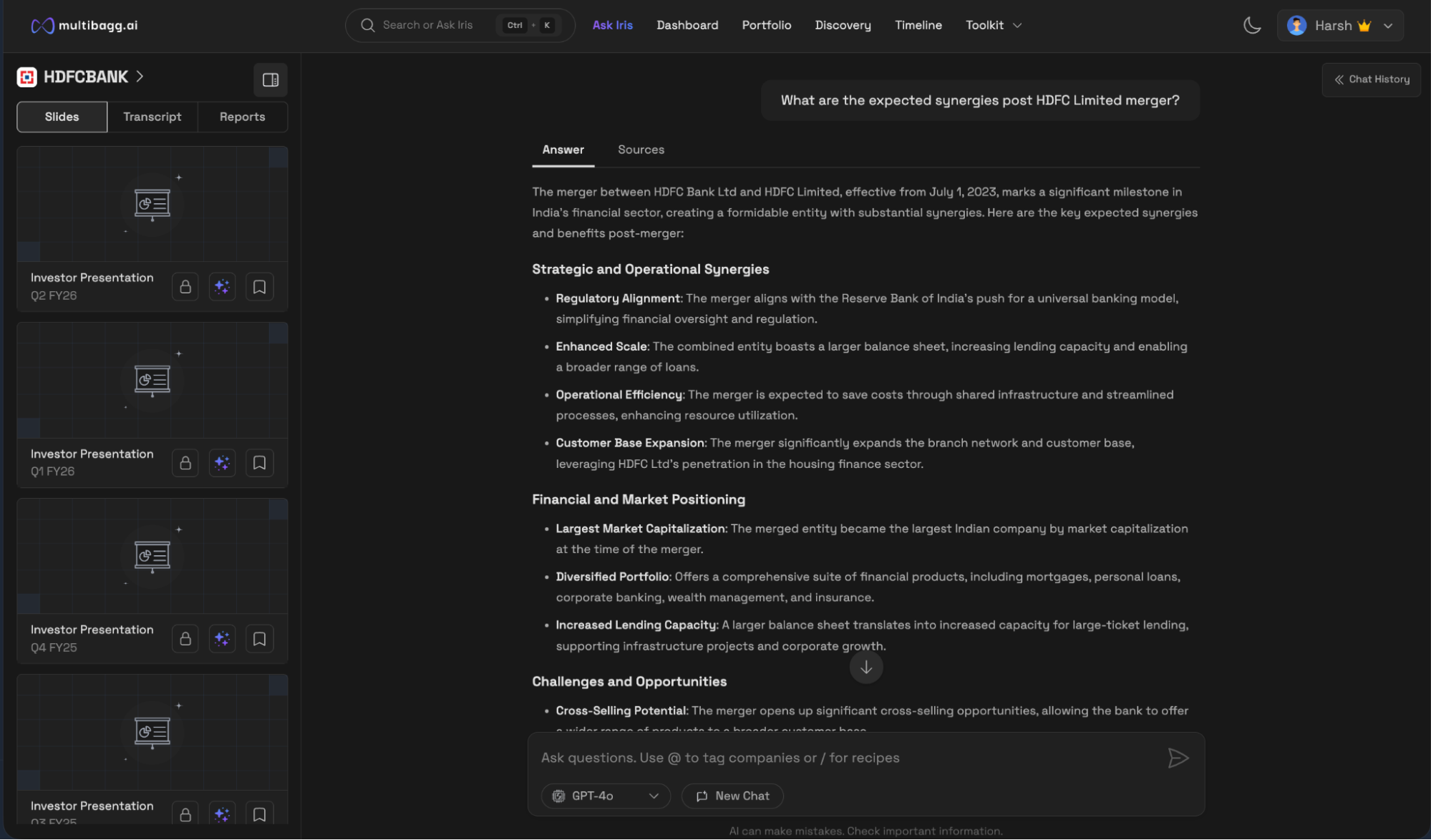

Multibagg AI offers a powerful chatbot called Iris.

Users can ask questions related to stocks, IPOs, ETFs, indices, sectors, and even portfolio-level queries like:

“What are the red flags in my portfolio?”

“Which stocks in my watchlist have deteriorating fundamentals?”

Answers are grounded in official exchange filings and Multibagg AI’s proprietary knowledge base, with source-backed responses.

Finology does not offer any chatbot or conversational AI. All interaction is manual and page-based.

Verdict: Multibagg AI is the clear winner.

Multibagg AI covers almost every relevant data point in a structured, highly usable format: price charts, peers, financial statements, analyst verdicts, forecasts, insider trades, corporate actions, announcements, investor presentations, concalls, and annual reports. It offers more than 10 years of historical data, with frequent updates and sentiment analysis powered by millions of news articles.

Finology provides basic fundamentals and simplified financial views. However, data depth is limited, and some datasets are not updated frequently, which restricts serious analysis.

Verdict: Multibagg AI is the clear winner.

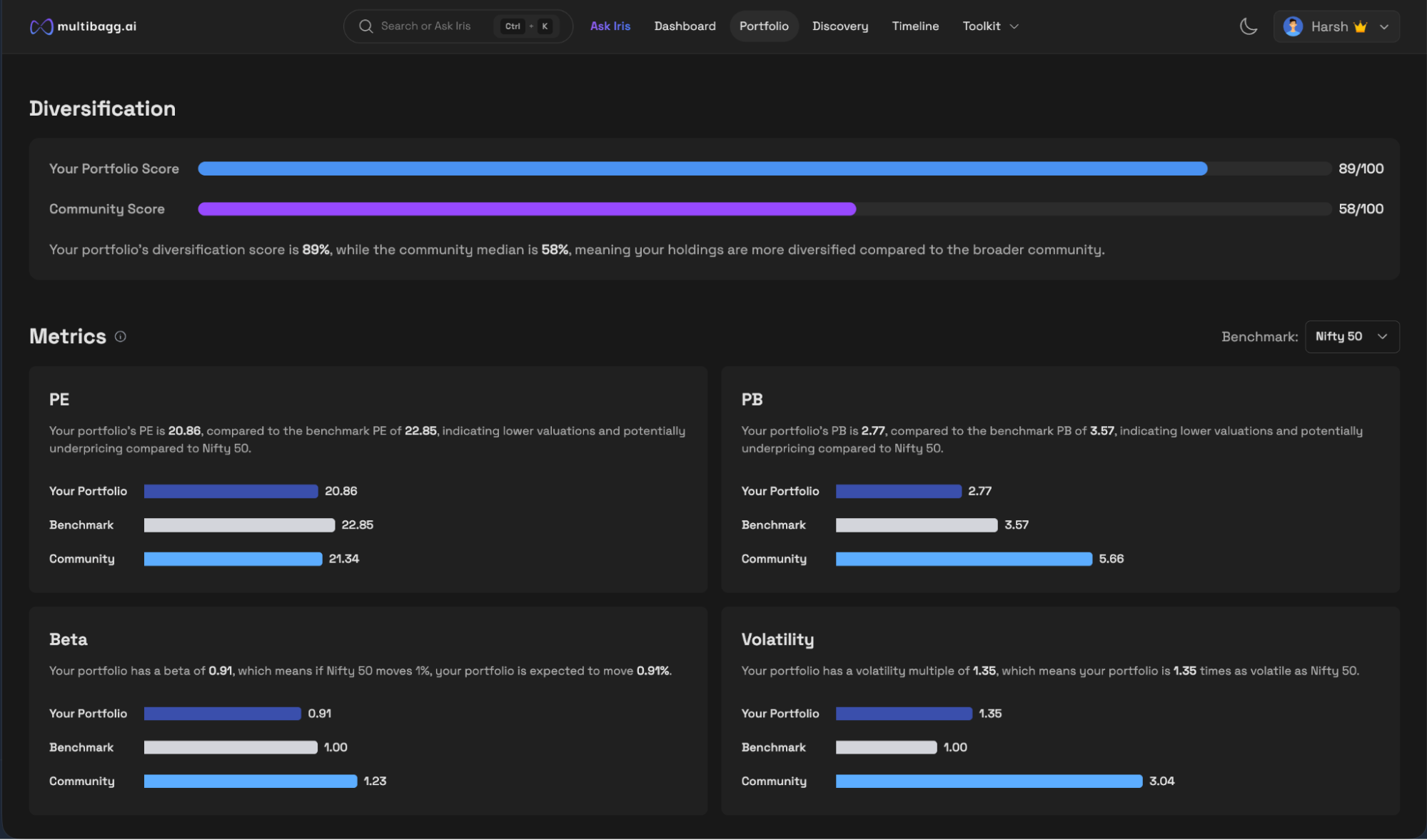

Multibagg AI allows users to connect portfolios natively from all major Indian brokers. Portfolio dashboards load in seconds and offer asset allocation, diversification, benchmarking, red flags, insider activity, and AI-powered portfolio insights.

Finology offers portfolio tracking, but connectivity is either broken or not user-friendly, with mostly manual uploads and very basic insights. There is no AI-led interpretation or deep portfolio intelligence.

Verdict: Multibagg AI is the clear winner.

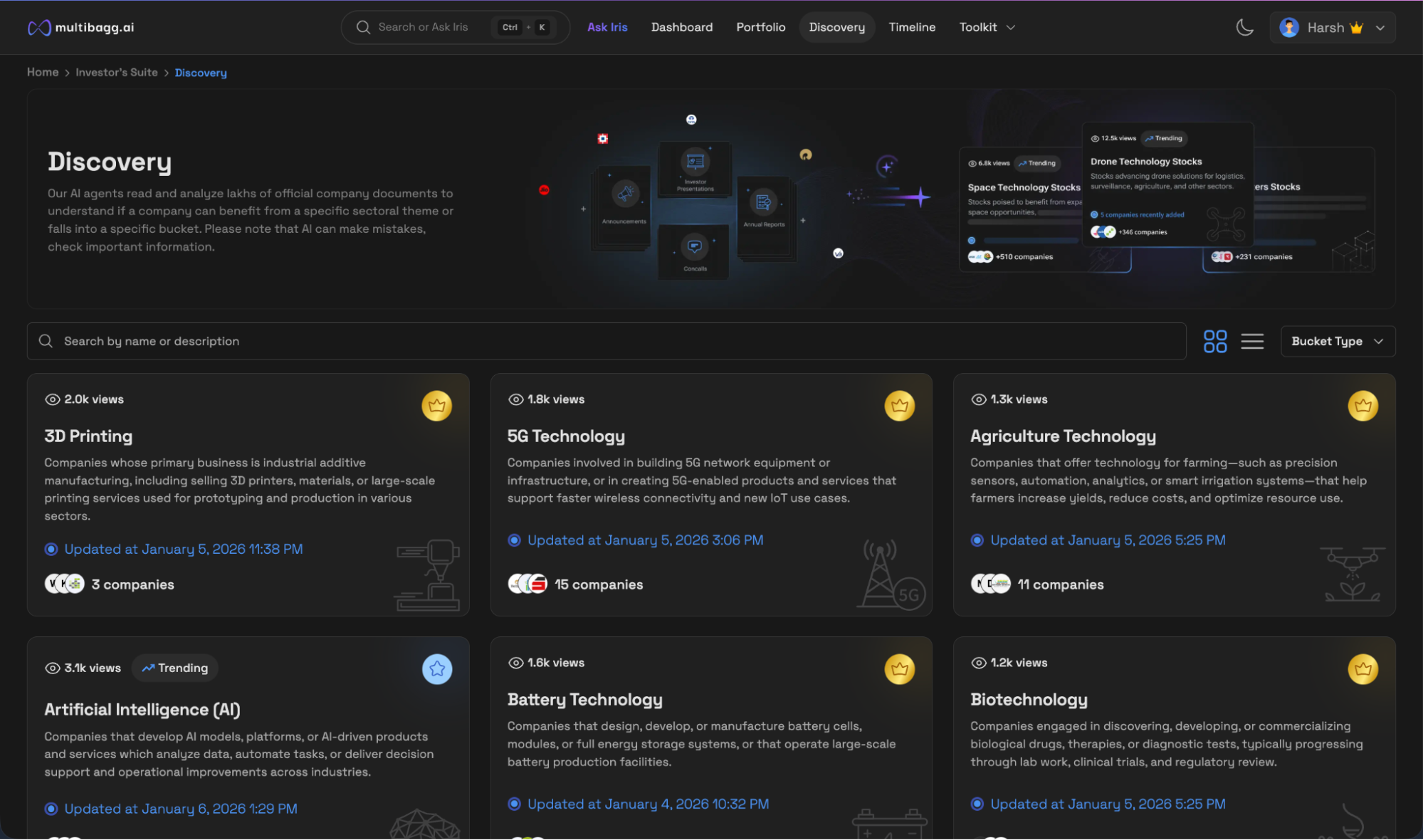

Multibagg AI’s discovery buckets are truly AI-powered and operate in real time. Users can see why a stock appeared in a bucket and when it was flagged, making discovery transparent and actionable.

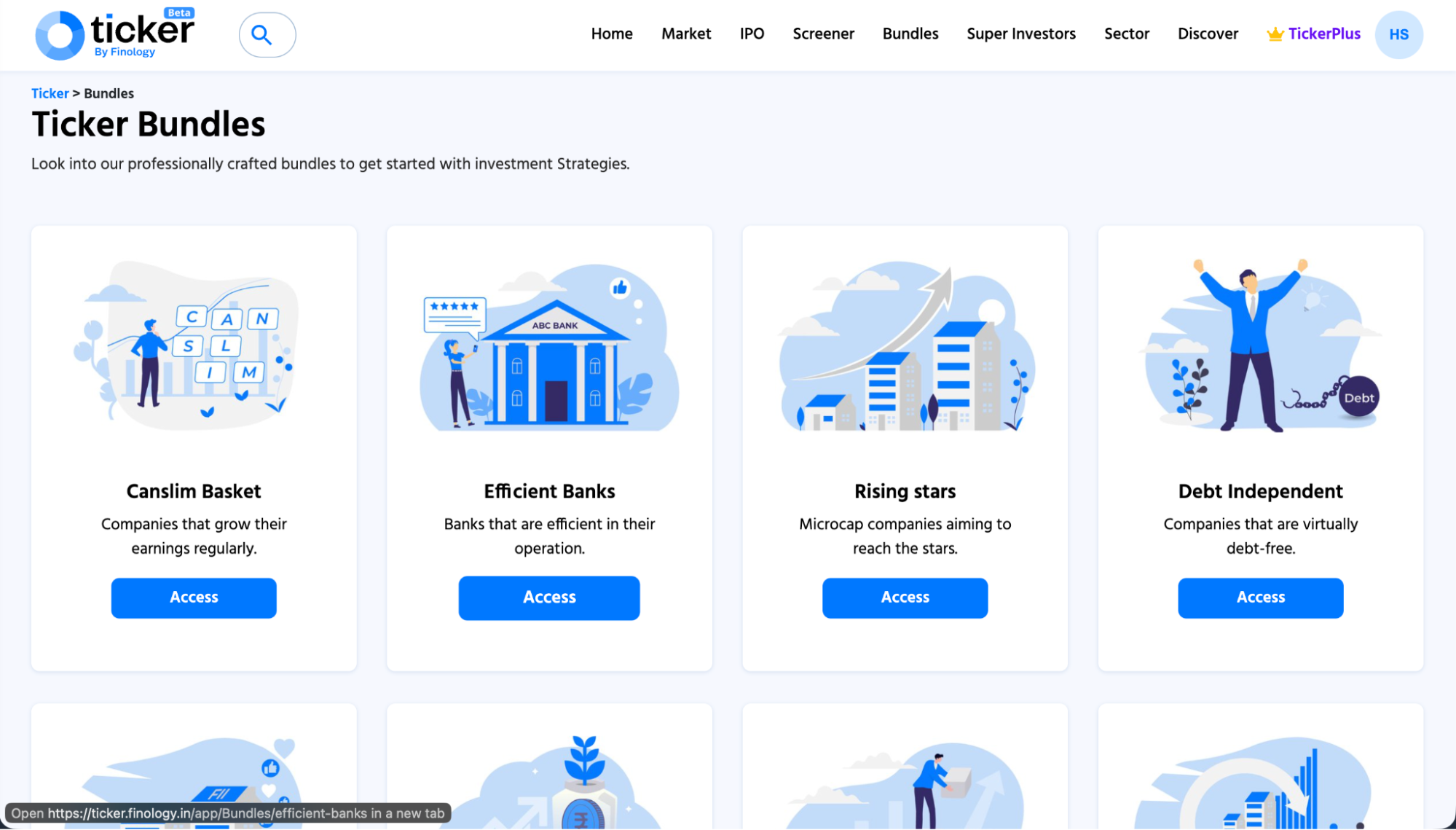

Finology offers discovery in the form of bundles, but these are limited in scope and lack depth, reasoning, or real-time signals. They feel more curated than intelligent.

Verdict: Multibagg AI is the clear winner.

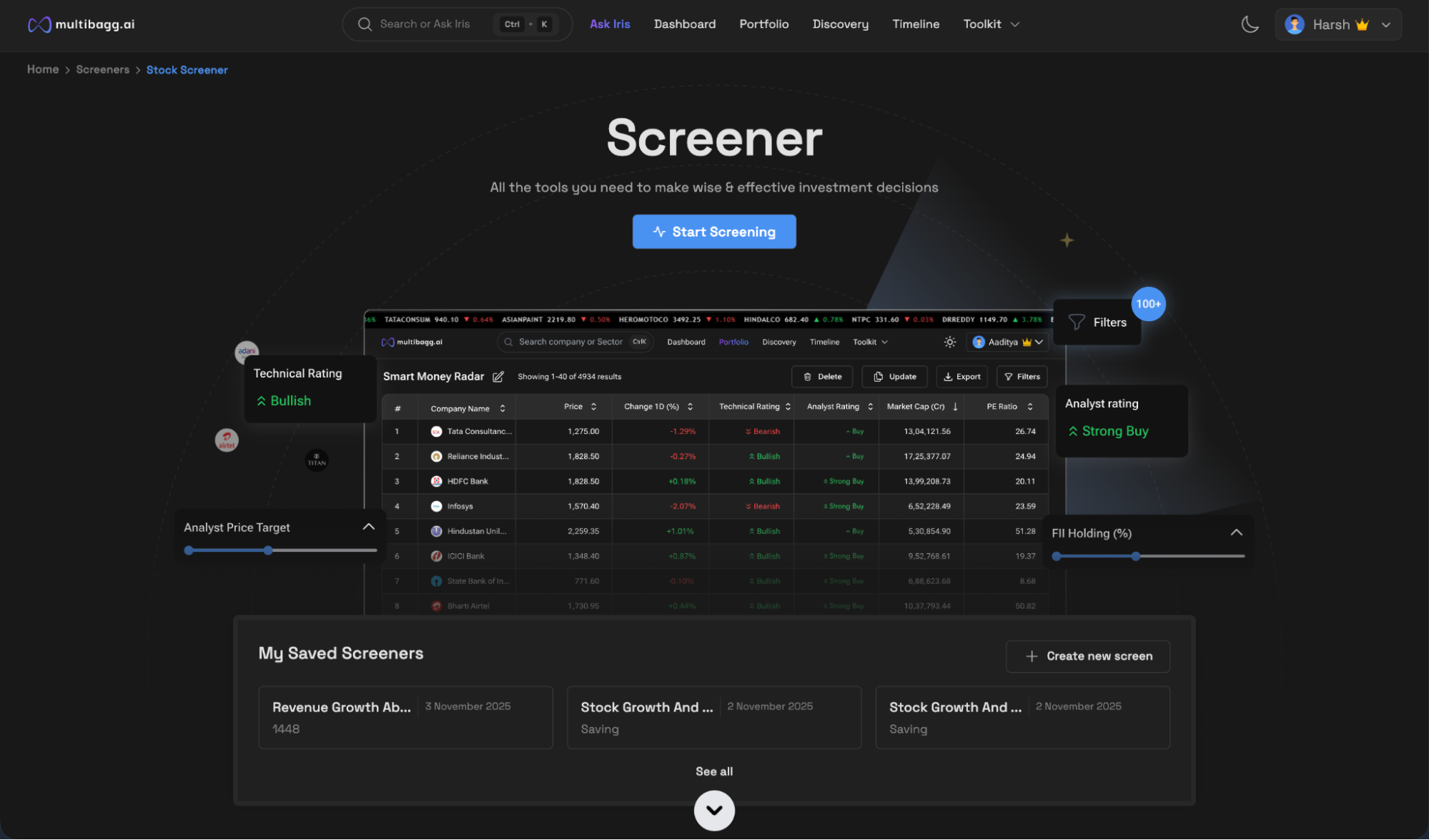

Multibagg AI’s screener is among the most advanced in the market. It supports stocks, IPOs, ETFs, indices, sectors, and industries with 100+ filters, saved screens, Excel exports, and AI-assisted workflows.

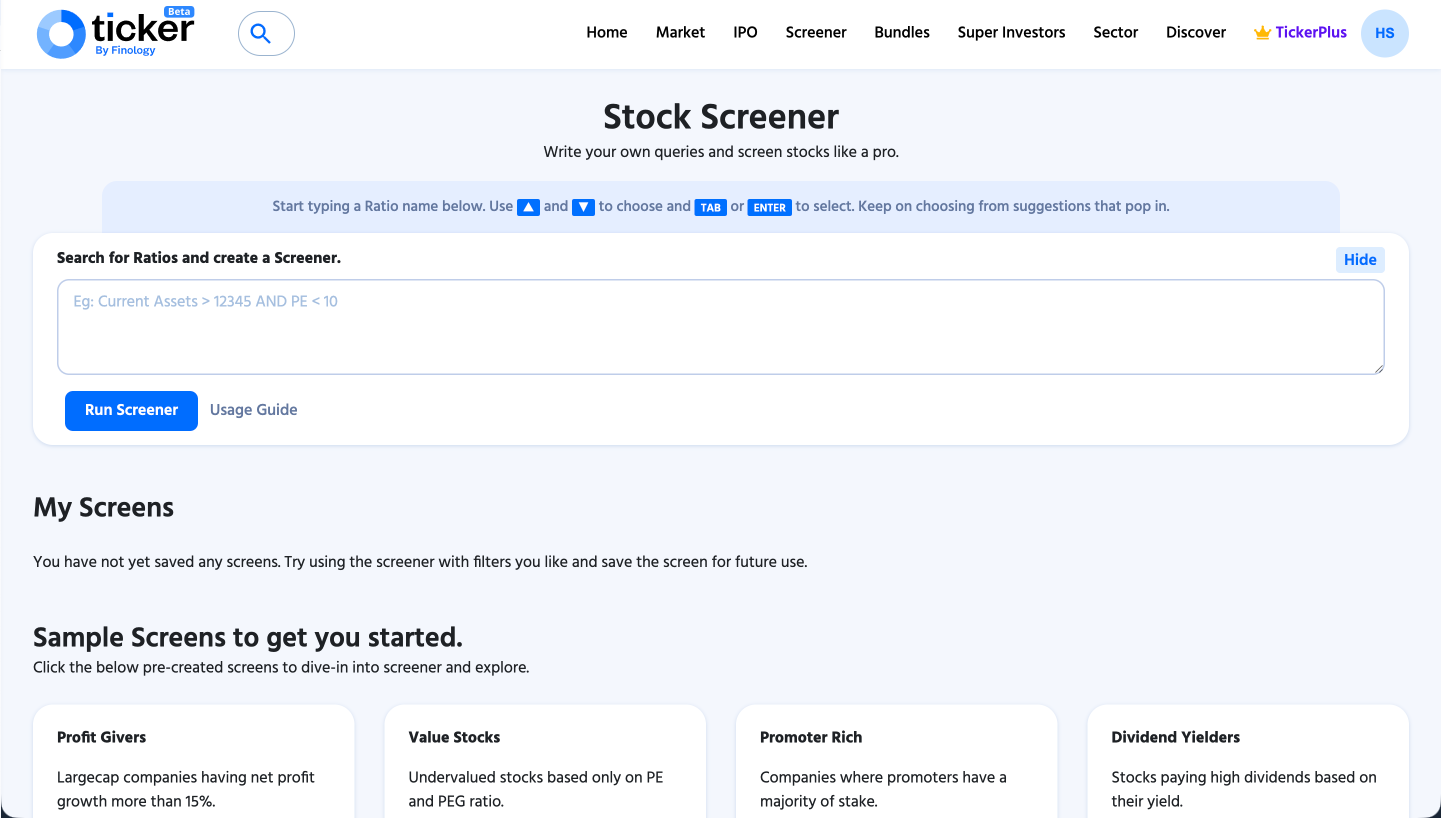

Finology provides a basic screener with limited filters. There is no AI-based or natural-language screening, and flexibility is minimal.

Verdict: Multibagg AI is the clear winner.

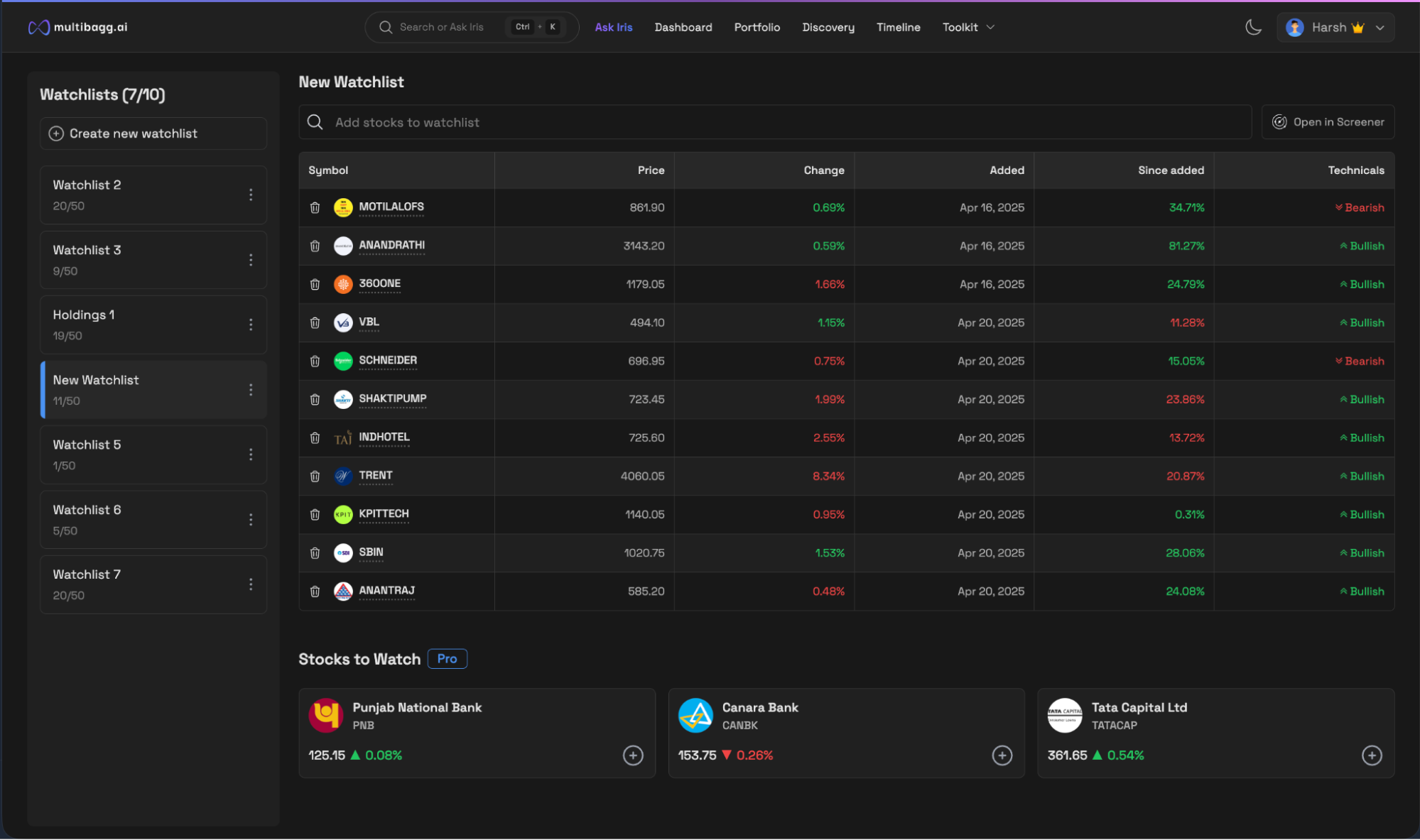

Multibagg AI offers an intelligent watchlist where performance is tracked from the exact date a stock is added. The experience extends into the Timeline, a real-time feed combining news, announcements, sentiment, and price movement, making it easy to understand impact.

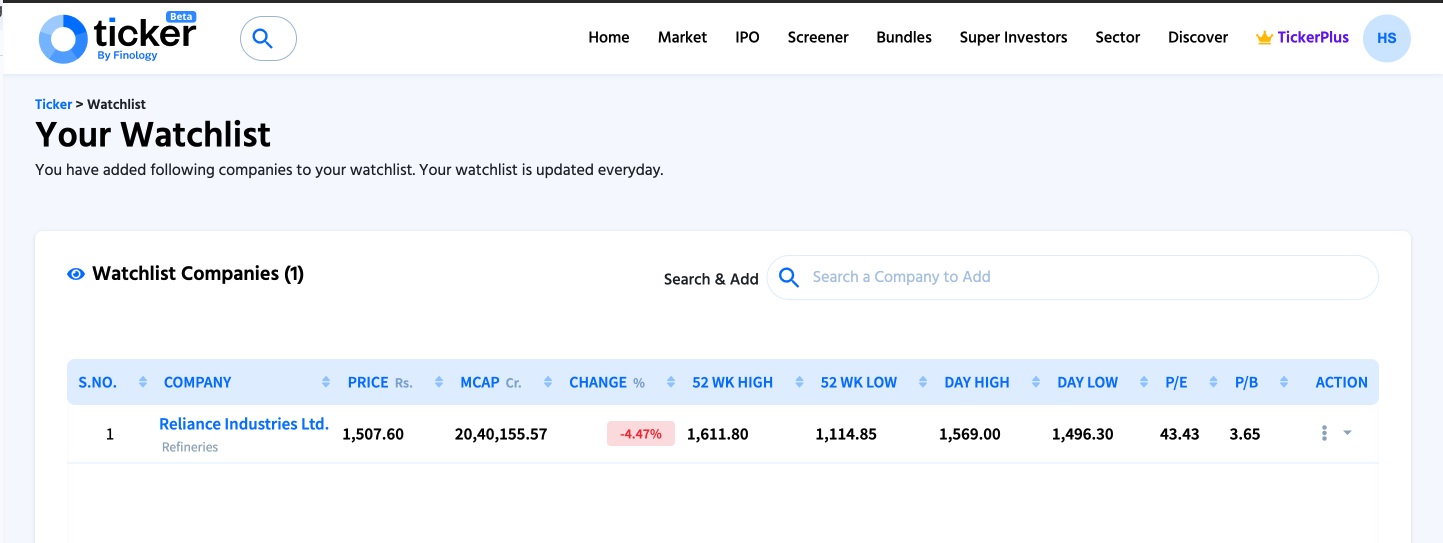

Finology supports watchlists, but there is no custom news feed, no sentiment layer, and no real-time narrative around stock movements.

Verdict: Multibagg AI is the winner.

Multibagg AI offers onboarding videos and guided tours but assumes a certain level of investing maturity.

Finology strongly focuses on education, supported by extensive content and creator-led learning, including popular videos and explainers by Pranjal Kamra on YouTube. For beginners, Finology provides strong conceptual grounding.

Verdict: Finology is the winner.

Finology is priced affordably and is well-suited for users who want learning-focused investing content and basic tools.

Multibagg AI, at a higher annual price, bundles AI-driven discovery, deep research, conversational analysis, portfolio intelligence, timeline-based tracking, and advanced screening into a single platform. It replaces multiple tools and manual workflows.

Verdict: Finology wins on price, while Multibagg AI offers higher value for serious investors.

If your primary goal is learning the basics of investing through structured content and creator-led education, Finology works well and offers good value.

But if you want to discover ideas proactively, research companies faster using AI, manage portfolios intelligently, and stay updated in real time with minimal effort, Multibagg AI is the better choice.

In a world where time and attention are scarce, Multibagg AI is built for clarity, speed, and decision-making, while Finology focuses more on education than execution.

Final takeaway: Finology is strong for investing education and beginners.

Multibagg AI gives you an AI-first, end-to-end investing workflow with everything an investor needs – all under one platform.