Welcome to Multibagg AI

Log in to access personalized features

Multibagg AI is a comprehensive stock research and analysis platform designed to solve four critical challenges investors face:

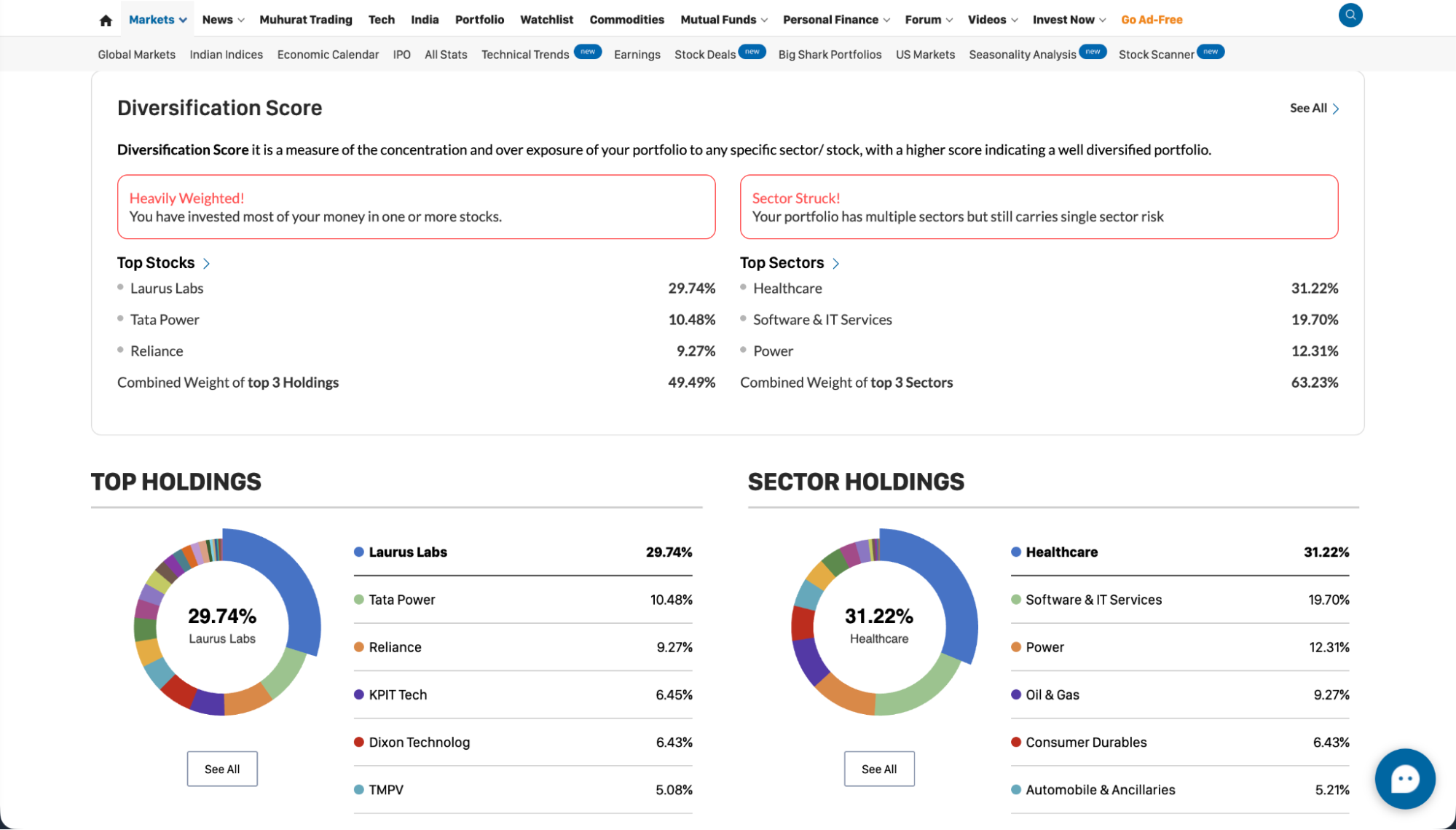

Moneycontrol is primarily a stock and finance news platform that tries to address parts of problem 2 and 3, but doesn't explicitly cover the other two parts.

Let’s compare Multibagg AI and Moneycontrol across 9 key parameters and conclude with a clear final takeaway.

Let’s start with the basics.

The best technology should feel like magic, and the best design should feel like no design.

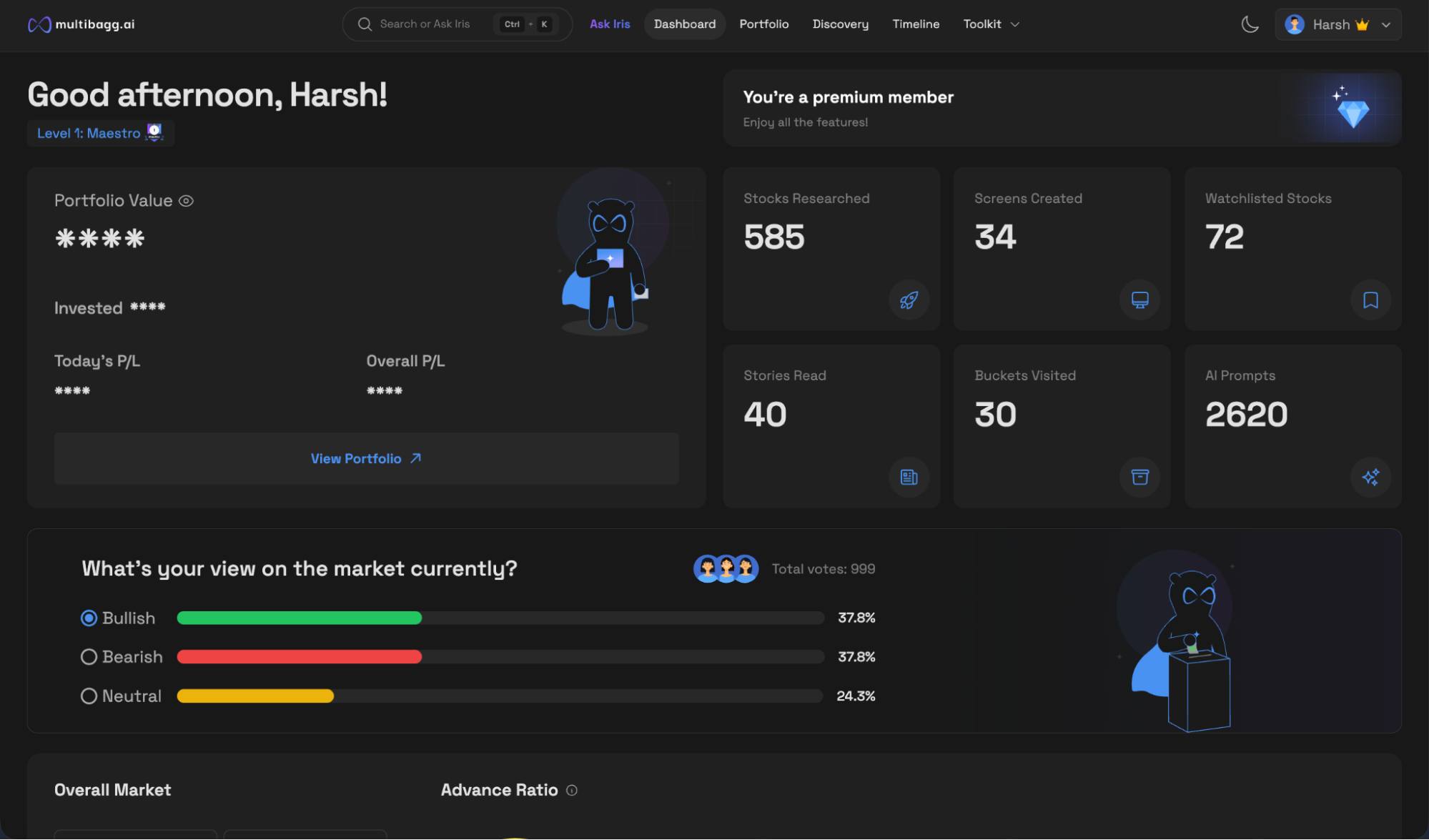

That is exactly how Multibagg AI feels.

The UI is minimal, modern, and elegant. Navigation is seamless across stock pages, charts, and timelines. You can select any two time points and instantly see return percentages. Thoughtful design touches are visible everywhere. When a user lands on the platform for the first time, they immediately know what to do. The journey is clearly laid out, with guided flows for someone interacting with a Search or Ask-AI style platform for the first time. Even feature names are self-explanatory.

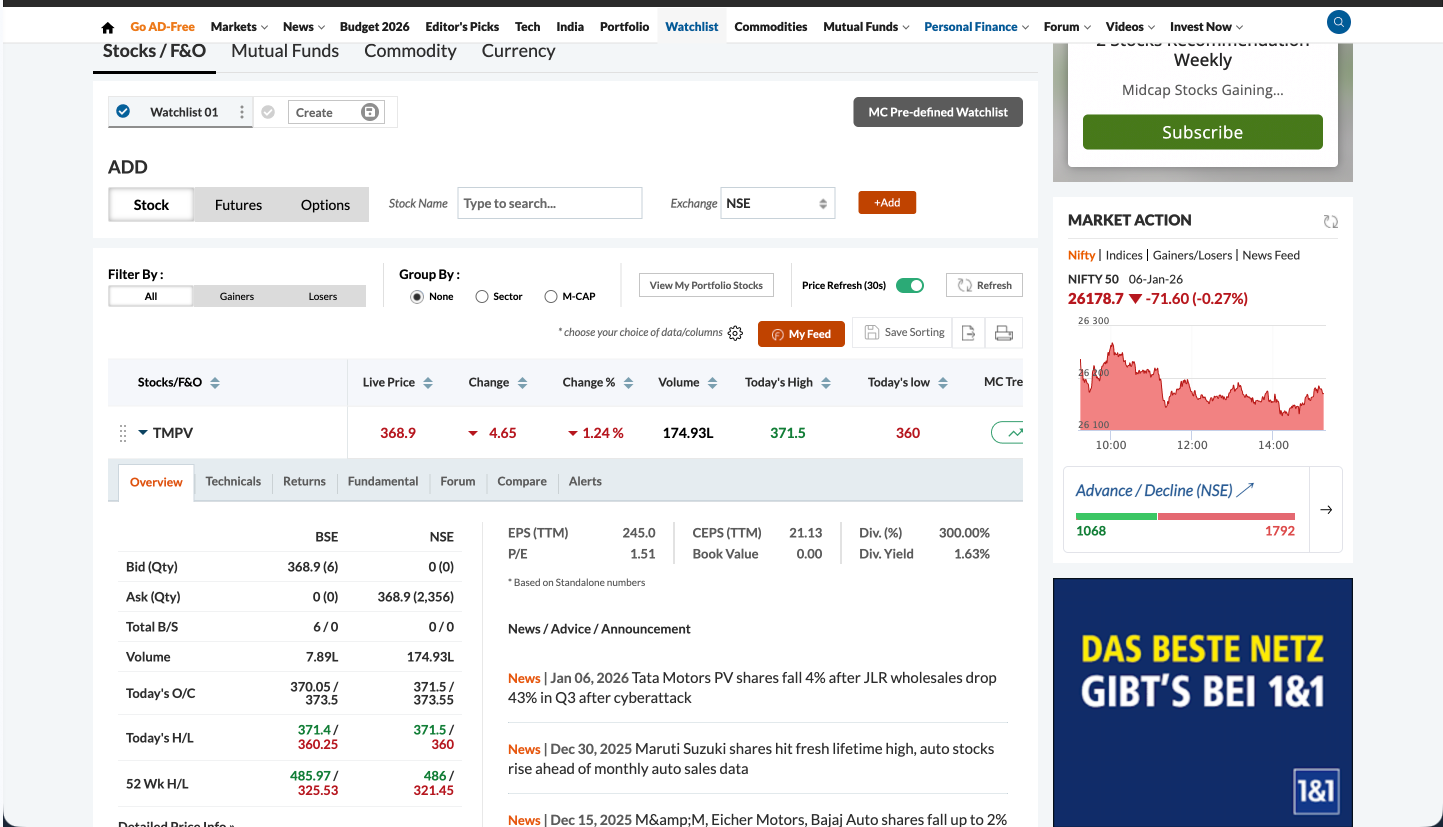

Moneycontrol, on the other hand, tries to be everything at once. It packs news, prices, expert columns, videos, commodities, currencies, mutual funds, derivatives, and more into the same interface. This creates information overload and visual clutter.

Moneycontrol is also largely bombarded with advertisements across its pages, from sponsored products to investment-linked ads, which adds to the visual noise and distracts users from core research tasks. This creates information overload and visual clutter. Multiple sections compete for attention, and advertisements prominently placed across pages.

For a first-time user, Moneycontrol can feel overwhelming and spammy. Instead of guiding the user toward action, the UI presents a flood of information without clear prioritisation.

Verdict: Multibagg AI’s UI/UX is far superior.

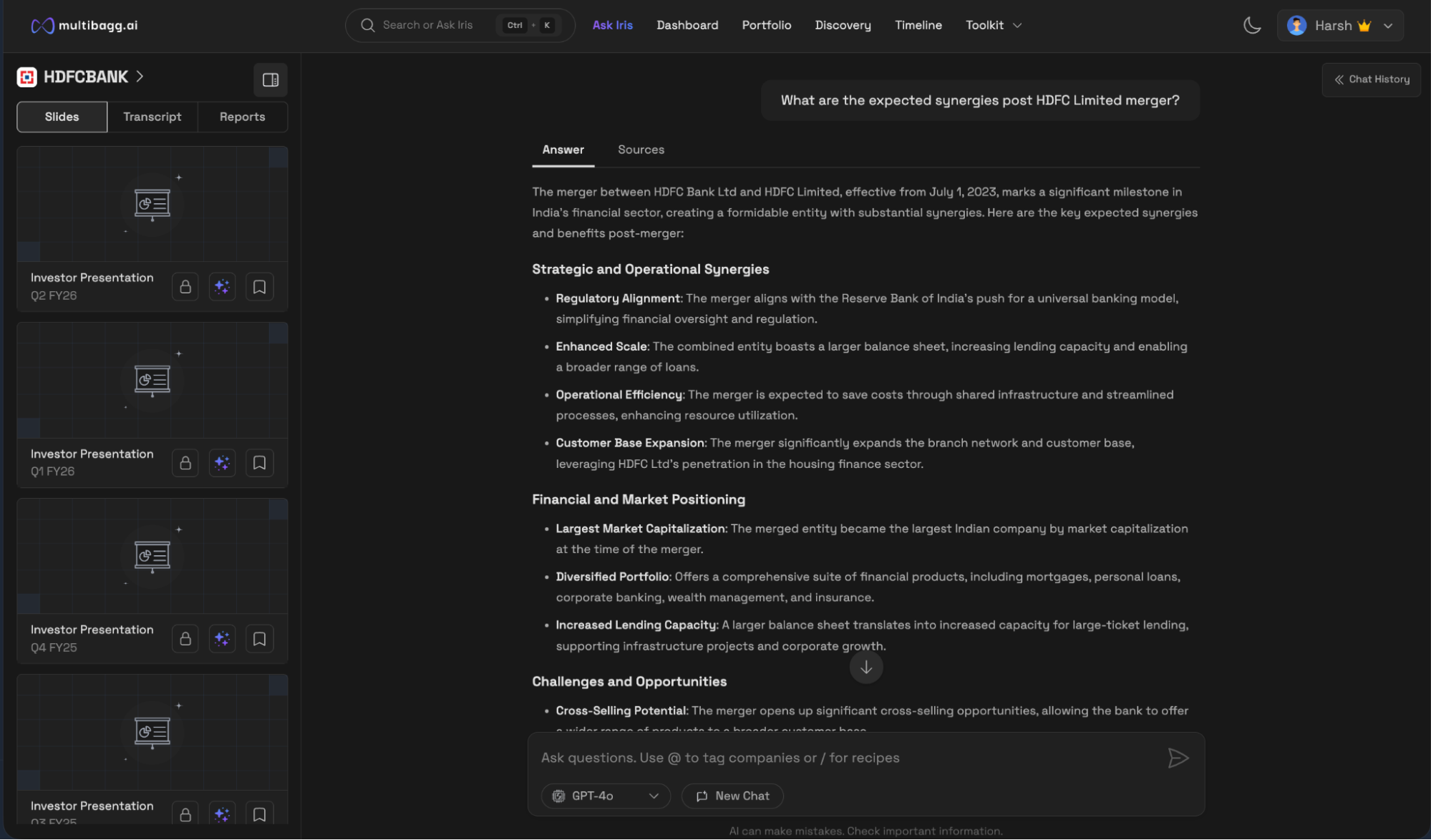

Multibagg AI offers a powerful chatbot called Iris.

Users can ask anything. Questions related to stocks, IPOs, ETFs, indices, or forward-looking queries like:

“What is Reliance planning in the AI sector?”

Iris can also answer portfolio-level questions such as:

“What are the red flags in my portfolio?”

It can even screen companies using natural language, for example:

“Give me a list of low PE, high ROE companies in the consumer durables sector.”

The key advantage is that answers come directly from official exchange filings and Multibagg AI’s proprietary knowledge base, not random internet articles. Source documents are accessible within the chat and can be opened instantly.

Moneycontrol does not offer any chatbot or conversational AI. Interaction is limited to static search and navigation.

Verdict: Multibagg AI is the clear winner.

Multibagg AI covers almost every relevant data point in a very presentable format: price charts, peers, financial statements, analyst verdicts, forecasts and projections, insider trades, corporate actions, announcements, investor presentations, concalls, and annual reports. It offers more than 10 years of historical data and is powered by over a million news articles for sentiment analysis. The systems are efficient and consistently accurate.

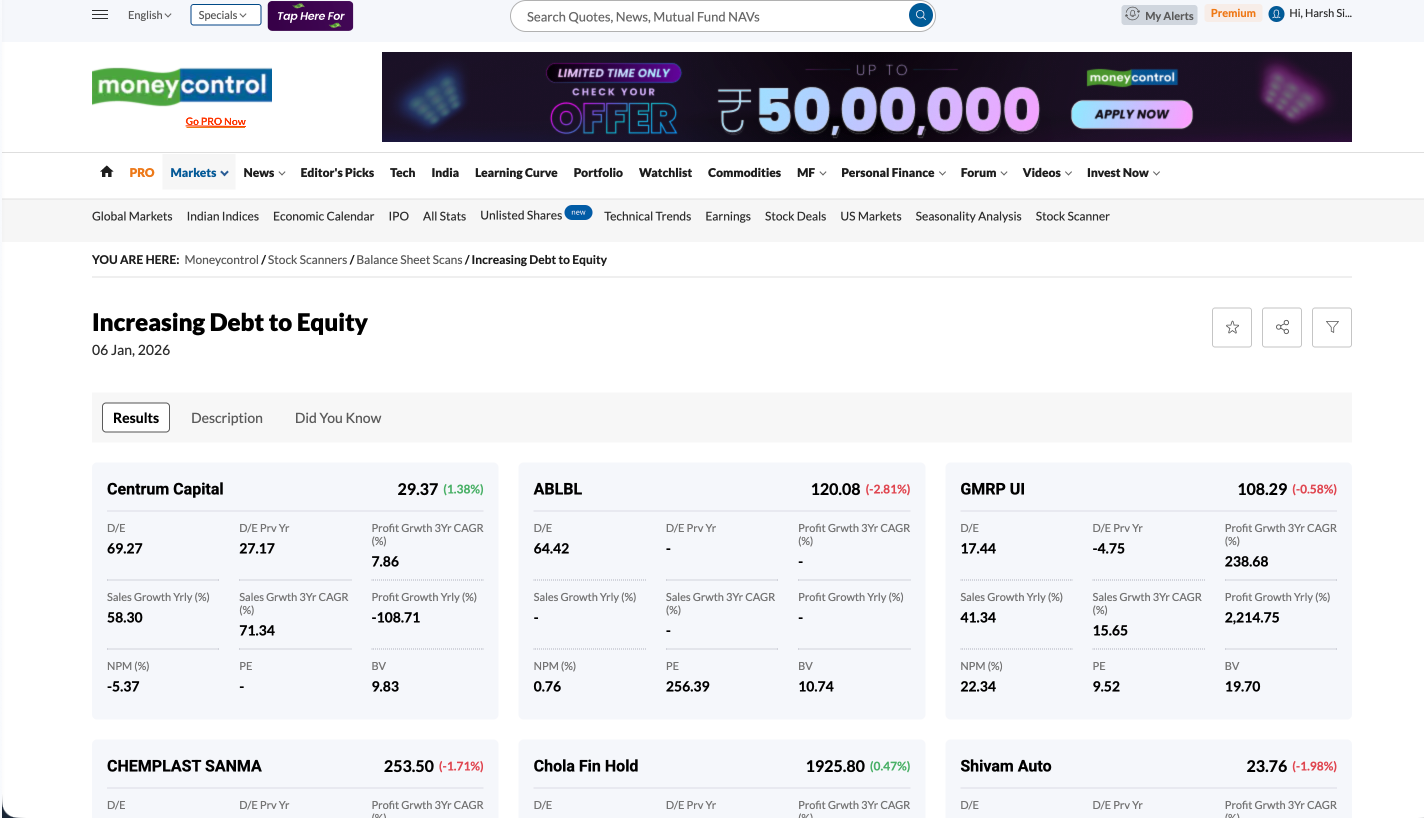

Moneycontrol offers extremely broad data coverage across equities, mutual funds, commodities, currencies, and macro indicators. However, the data is largely presented as isolated datapoints, tables, or articles. Correlating insights across financials, news, and price action requires manual effort.

Verdict: Multibagg AI wins on actionable data presentation, while Moneycontrol offers broader but more fragmented coverage.

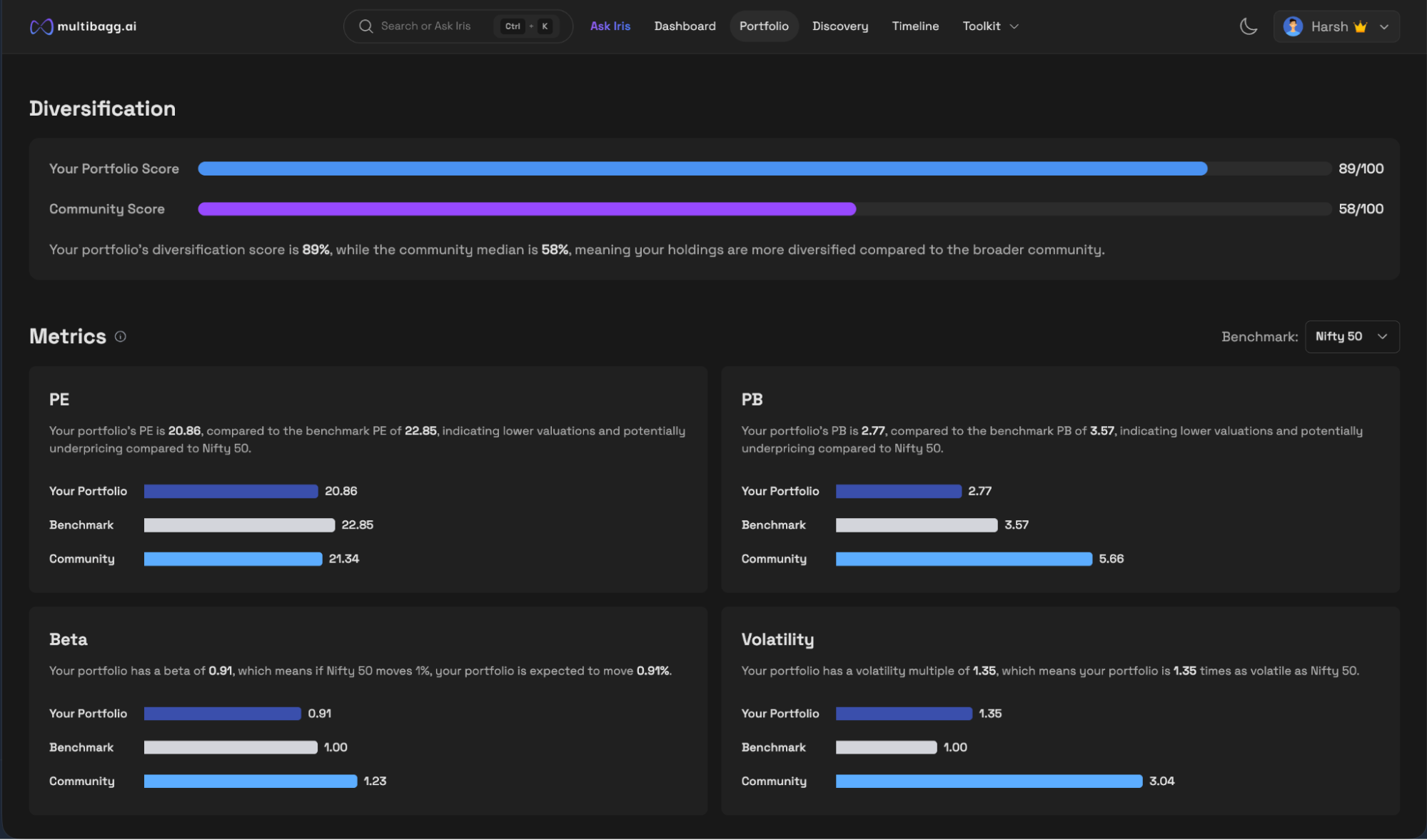

Multibagg AI allows users to connect portfolios natively within seconds from all major Indian brokers. Once connected, the portfolio dashboard is ready in under 10 seconds.

The dashboard covers everything: asset allocation, diversification, benchmarking, red flags, insider trades, company-level news, and portfolio-level insights, all powered by AI. Users can open the portfolio in Screener mode for custom analysis or use Iris to ask portfolio-level questions with source-backed answers. It is one of the strongest portfolio dashboards available today.

Moneycontrol allows users to manually track portfolios and watchlists across stocks and mutual funds. While it shows performance and basic metrics, the experience remains static. There is no AI-driven interpretation or portfolio-level interrogation. It focuses more on tracking than understanding.

Verdict: Multibagg AI is the clear winner.

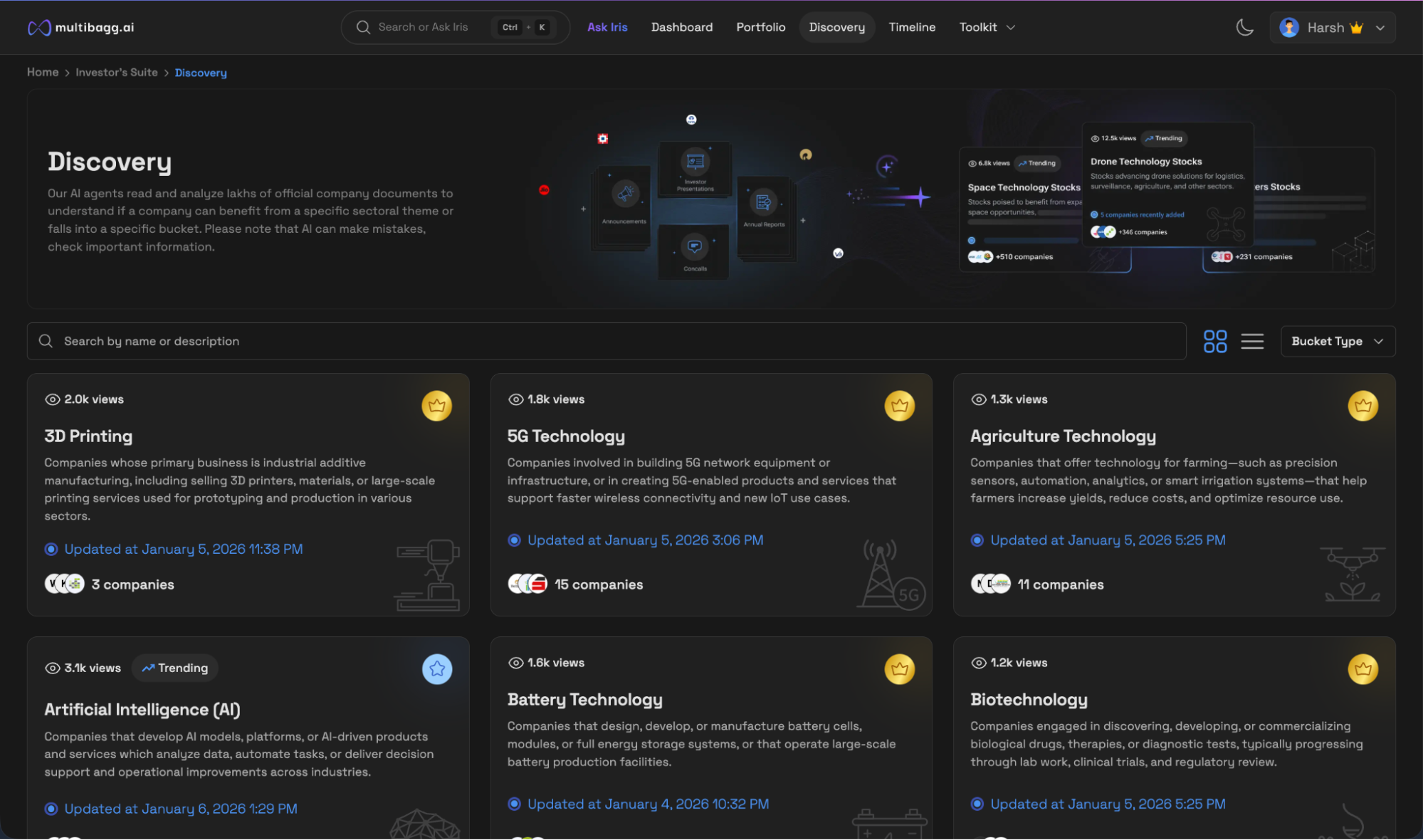

The discovery buckets on Multibagg AI are truly AI-powered and work in real time. When a company appears in a bucket, users can see why and when it was added. Stocks can be instantly added to watchlists or opened together in screener mode for deeper analysis.

Moneycontrol does not offer a discovery or similar feature. Users must manually browse news, lists, or run basic filters to find ideas.

Verdict: Multibagg AI is the clear winner.

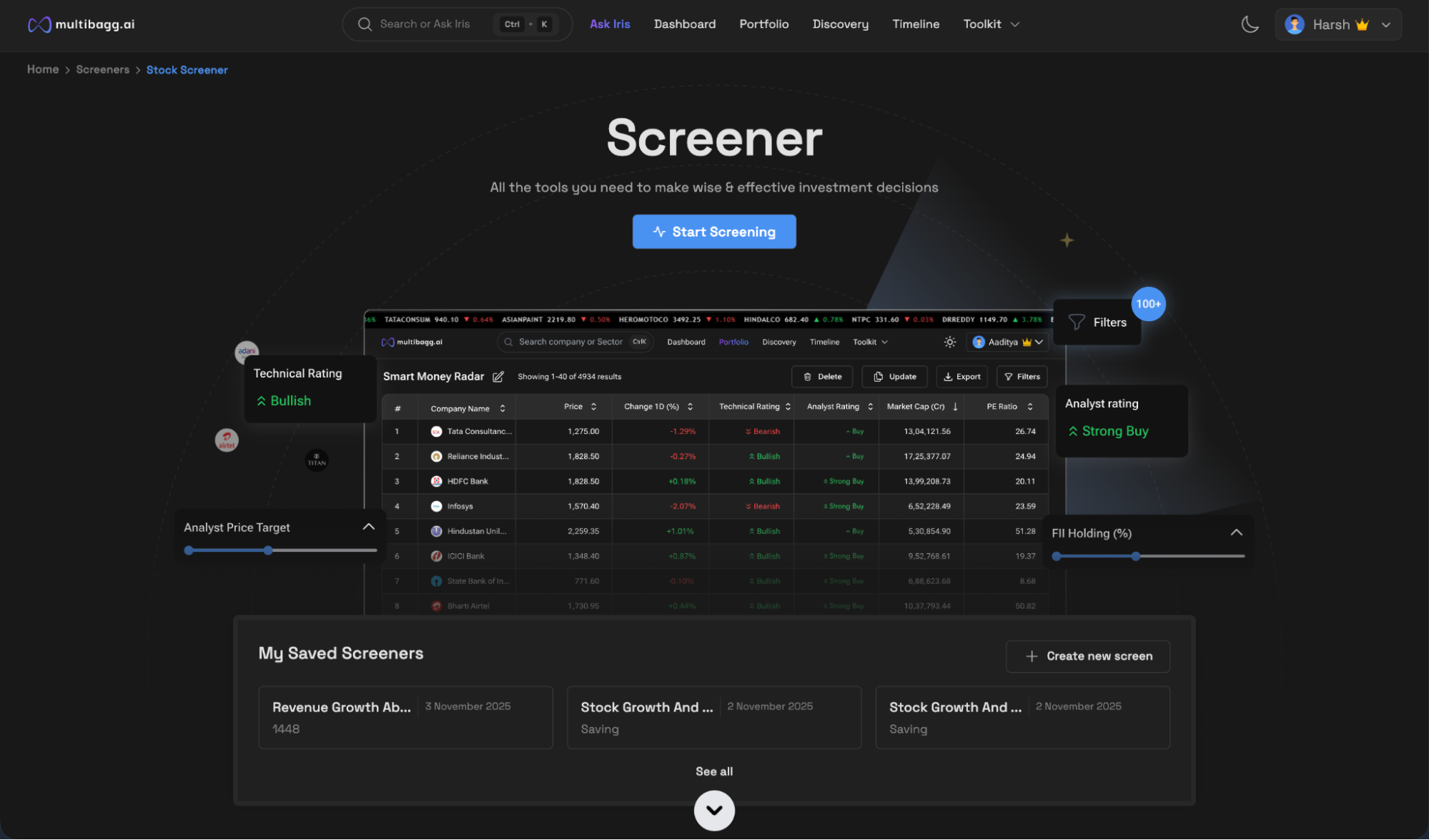

Multibagg AI’s screener is among the best in the market. It offers multiple screeners across stocks, IPOs, ETFs, indices, sectors, industries, deals, and intraday setups. Users get more than 100 filters, can save multiple screens, and export data to Excel. Screening flows seamlessly into deeper research or AI-led analysis.

Moneycontrol provides a basic stock screener with commonly used filters. It lacks advanced workflows, multi-asset screeners, and natural-language querying. Moving from screening to actionable insight requires additional manual steps.

Verdict: Multibagg AI is the clear winner.

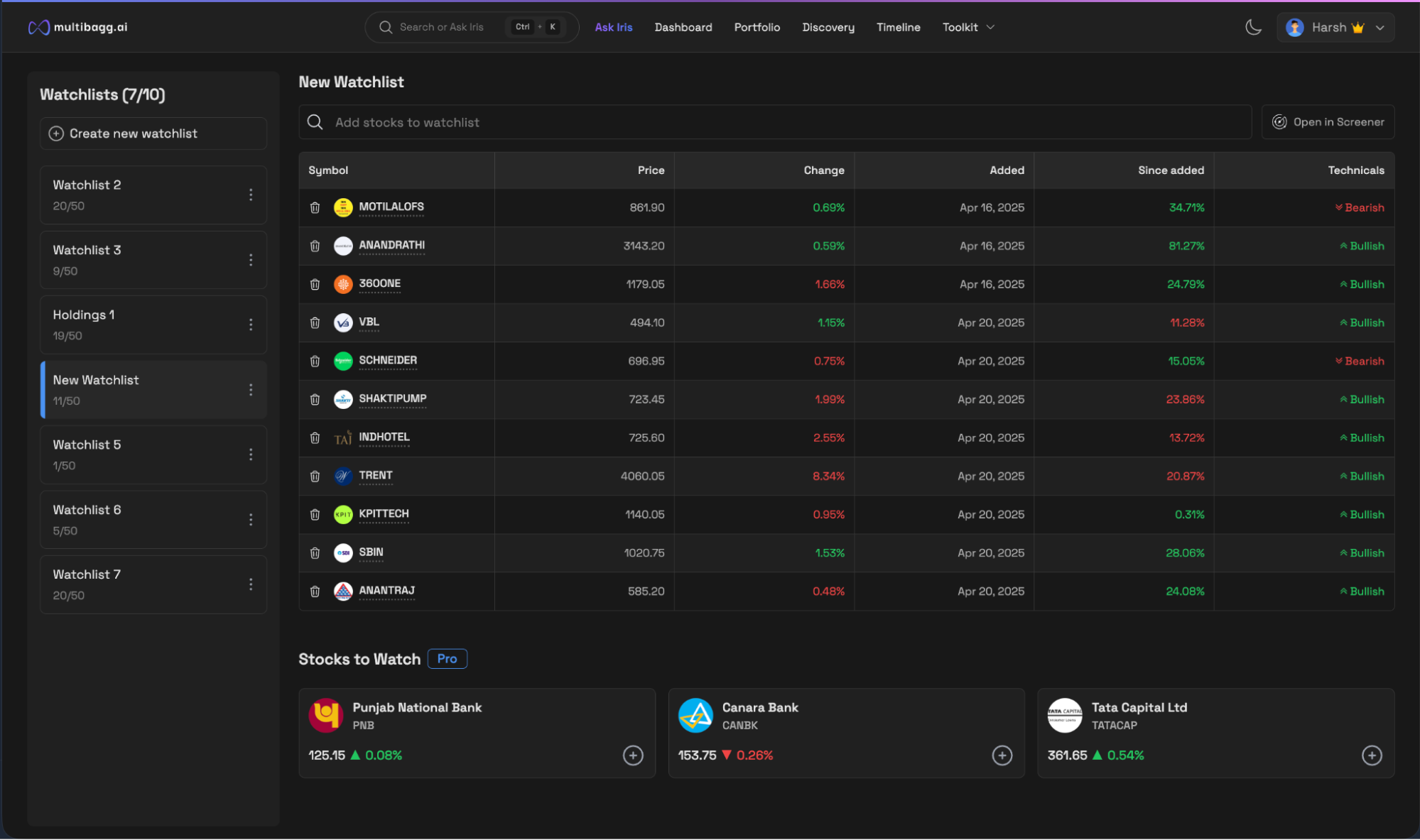

Multibagg AI offers an intuitive watchlist where performance is tracked from the exact date a stock is added.

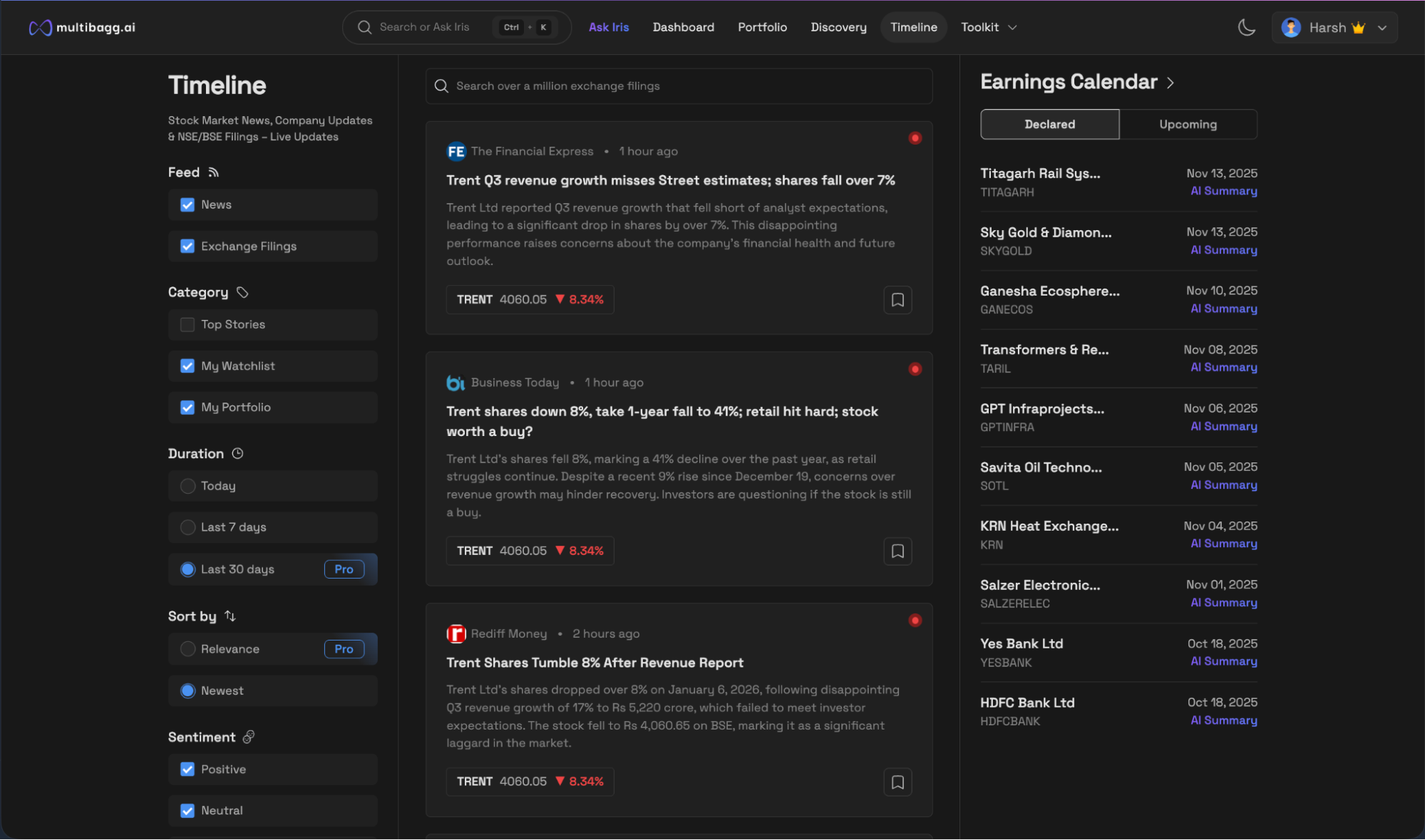

The experience extends into the Timeline feature, which works like a social feed for stocks. Users can filter news by relevance, sentiment, type, and time period. Updates are real time, and price movement is shown alongside news, making it easy to understand impact. News refresh is significantly faster, allowing users to stay on top of developments immediately.

Moneycontrol allows watchlists and alerts, but the experience is basic. News, price updates, and commentary are shown separately even though Moneycontrol is natively a financial news platform, making it harder to quickly assess relevance or impact for users' specific needs.

Verdict: Multibagg AI is the winner.

Multibagg AI offers an introductory video and guided tours to help first-time users navigate the platform. It assumes a certain level of investing maturity and does not focus on teaching theory.

Moneycontrol excels in education. It offers a vast library of articles, videos, explainers, and expert columns covering everything from basic investing concepts to advanced market commentary. Verdict: Moneycontrol wins.

Moneycontrol’s pricing makes it attractive for casual users and beginners who primarily want access to market prices, news, and expert commentary. However, even with the premium plan, advanced analysis still requires users to manually stitch together information across multiple sections and tools.

Multibagg AI, on the other hand, bundles discovery, deep research, AI-driven insights, portfolio intelligence, screening, and tracking into a single integrated workflow. It effectively replaces the need for multiple subscriptions and platforms.

Verdict: Moneycontrol wins on absolute cost, while Multibagg AI offers better value for serious investors considering it over investors preference as a Tie.

If you want broad market coverage, real-time prices, financial news, expert commentary, and educational content across asset classes, Moneycontrol works well as a go-to reference platform.

But if you are looking for something that goes beyond surface-level data and helps you discover ideas proactively, research stocks faster using AI, interact with portfolios conversationally, and track companies intelligently in real time, then Multibagg AI is the better choice.

In today’s age, time and attention are the scarcest resources, and Multibagg AI respects that. Land on the homepage and the platform gives full control to the user without bombarding them with unstructured data. Moneycontrol, in comparison, offers breadth and reach but often leaves the heavy lifting of analysis to the user.

Final takeaway: Moneycontrol gives you news, prices, and broad market data, but expects you to connect the dots yourself.

Multibagg AI gives you freedom to explore, analyse, and invest the way you want, with everything a modern investor needs, all under one platform.