Welcome to Multibagg AI

Log in to access personalized features

Multibagg AI is a comprehensive stock research and analysis platform designed to solve four critical challenges investors face:

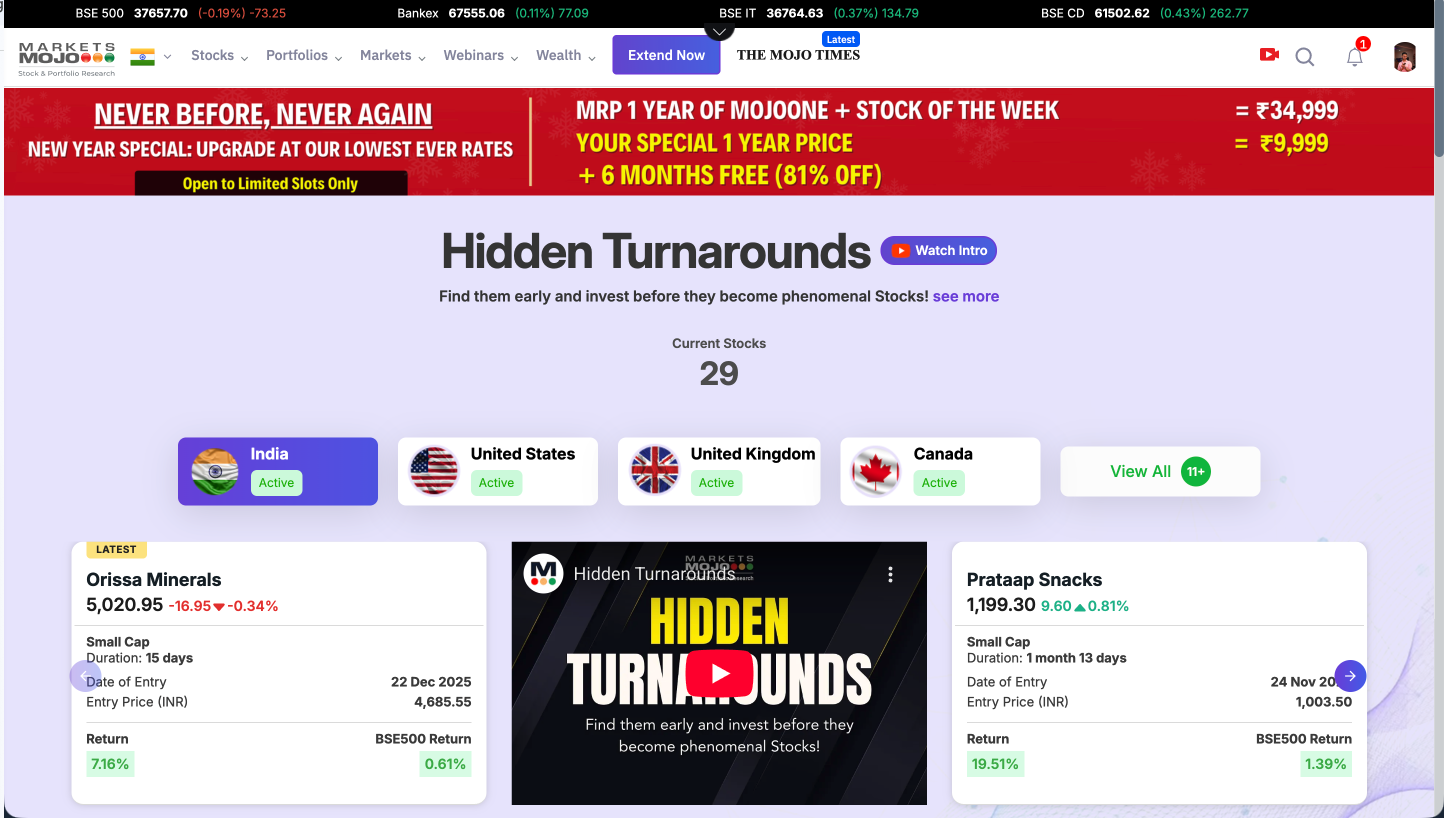

MarketsMojo is primarily a stock analysis and data platform that tries to address parts of problem 1 and 2, but doesn't explicitly cover the other two parts.

Let’s compare Multibagg AI and Marketmojo across 9 key parameters and conclude with a clear final takeaway.

Let’s start with the basics.

The best technology should feel like magic, and the best design should feel like no design.

That is exactly how Multibagg AI feels.

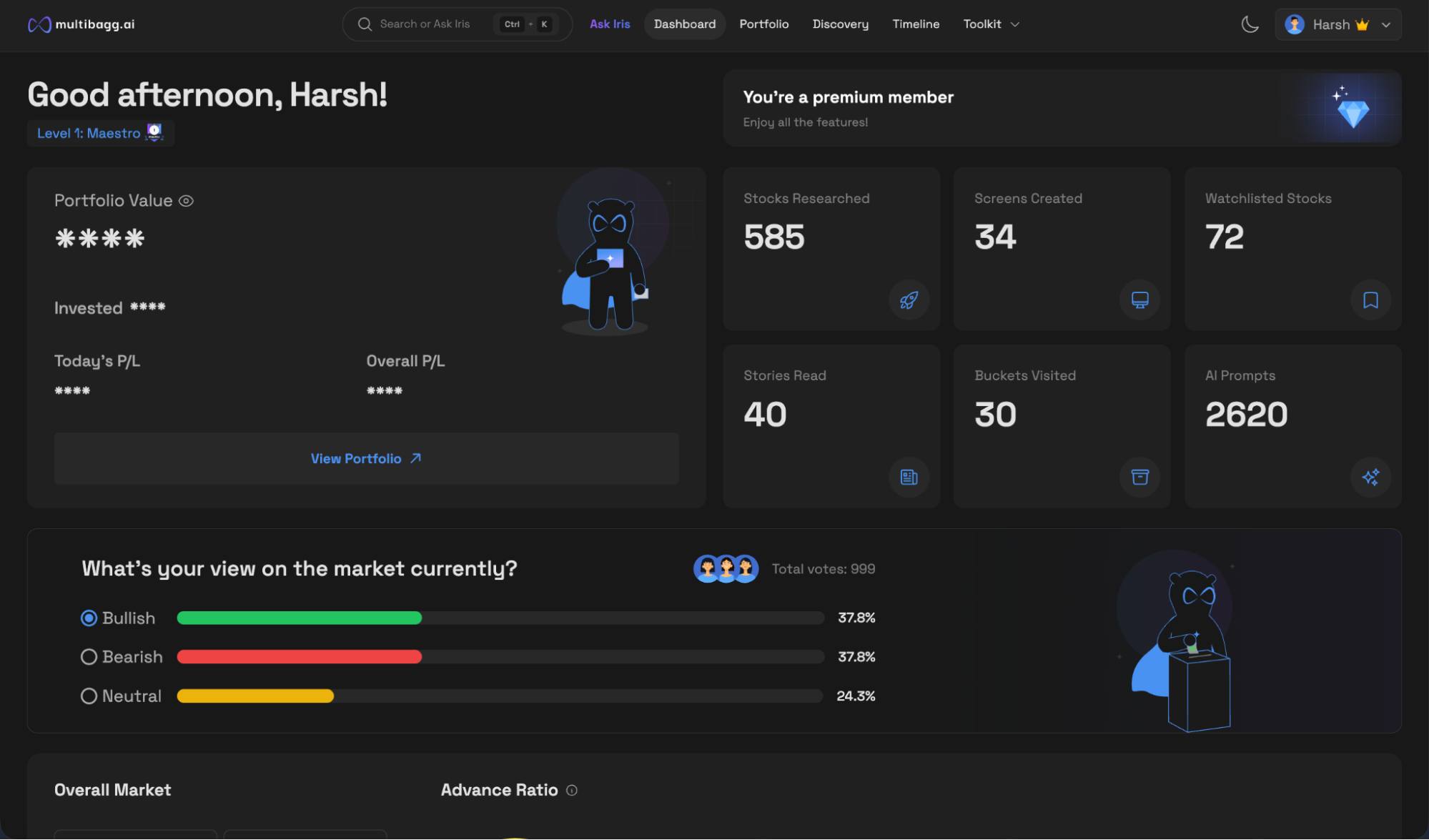

The UI is minimal, modern, and elegant. Navigation is seamless across stock pages, charts, and timelines. You can select any two time points and instantly see return percentages. Thoughtful design touches are visible everywhere. When a user lands on the platform for the first time, they immediately know what to do. The journey is clearly laid out, with guided flows for someone interacting with a Search or Ask-AI style platform for the first time. Even feature names are self-explanatory.

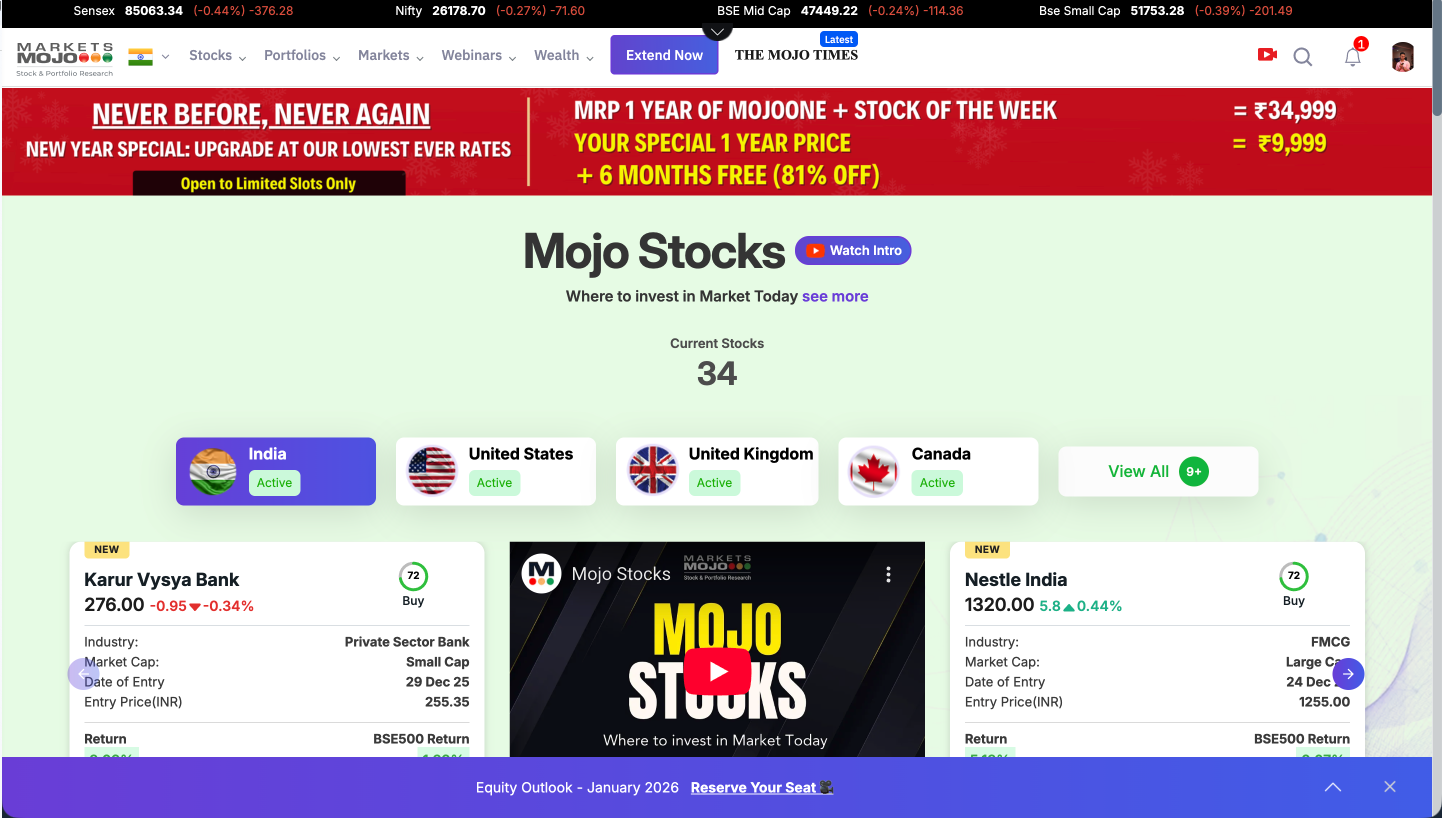

MarketMojo’s UI is functional but outdated. It is dashboard-heavy, metric-dense, and built around scores and reports. Navigation feels rigid and cluttered, and first-time users can find it unprofessional. It also runs banner-like promotions across pages which clearly gives a cheap Ad-like feeling.

Verdict: Multibagg AI wins.

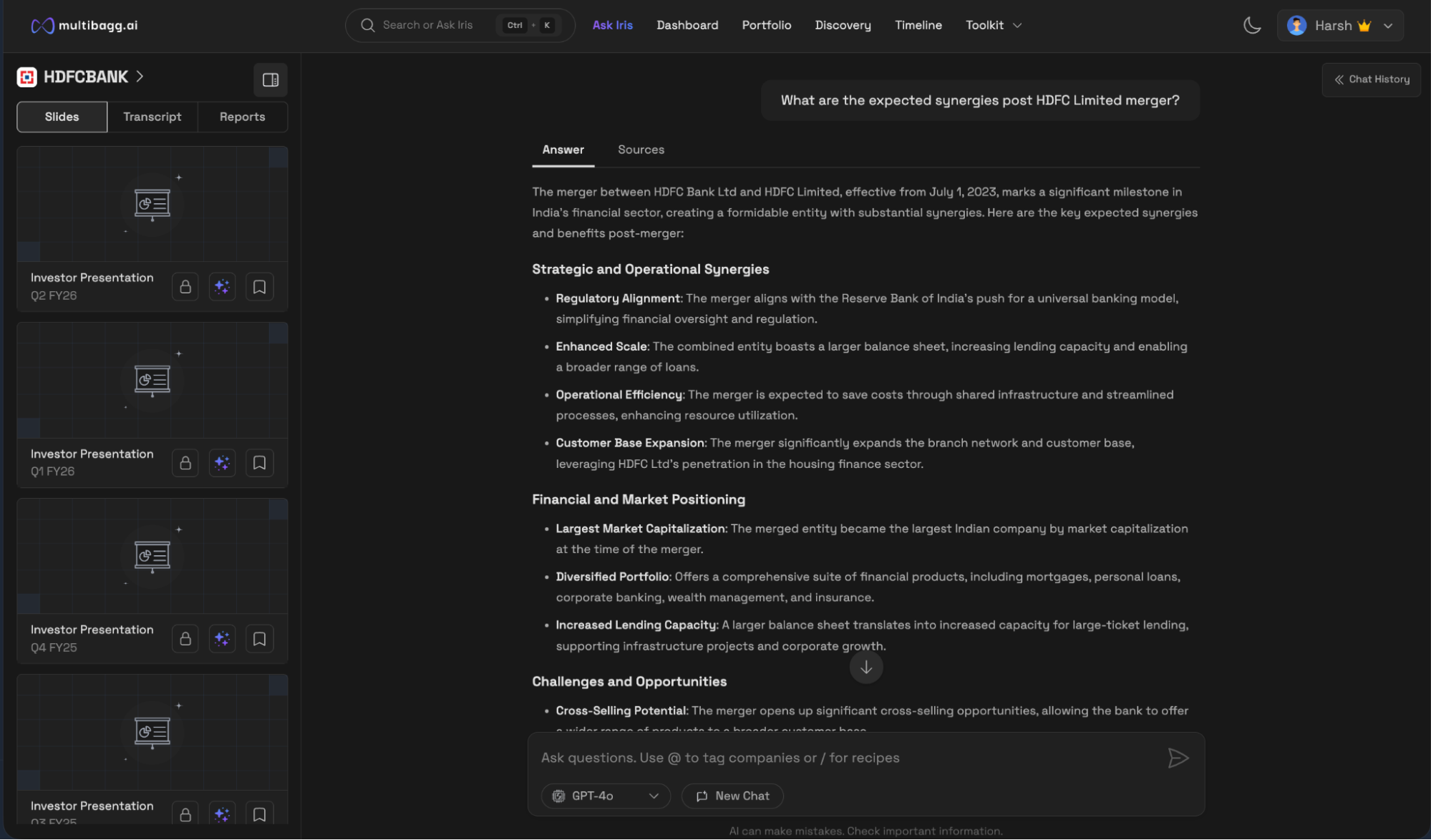

Multibagg AI offers a powerful chatbot called Iris.

Users can ask anything. Questions related to stocks, IPOs, ETFs, indices, or forward-looking queries like:

“What is Reliance planning in the AI sector?”

Iris can also answer portfolio-level questions such as:

“What are the red flags in my portfolio?”

It can even screen companies using natural language, for example:

“Give me a list of low PE, high ROE companies in the consumer durables sector.”

The key advantage is that answers come directly from official exchange filings and Multibagg AI’s proprietary knowledge base, not random internet articles. Source documents are accessible within the chat and can be opened instantly.

MarketsMojo does not offer any chatbot or conversational AI.

Verdict: Multibagg AI is the clear winner.

Multibagg AI covers almost every relevant data point in a very presentable format: price charts, peers, financial statements, analyst verdicts, forecasts and projections, insider trades, corporate actions, announcements, investor presentations, concalls, and annual reports. It offers more than 10 years of historical data and is powered by over a million news articles for sentiment analysis. The systems are efficient and consistently accurate.

Marketsmojo provides necessary data points yet the data depth on Marketsmojo is shallow with.

Verdict: Multibagg AI is the clear winner.

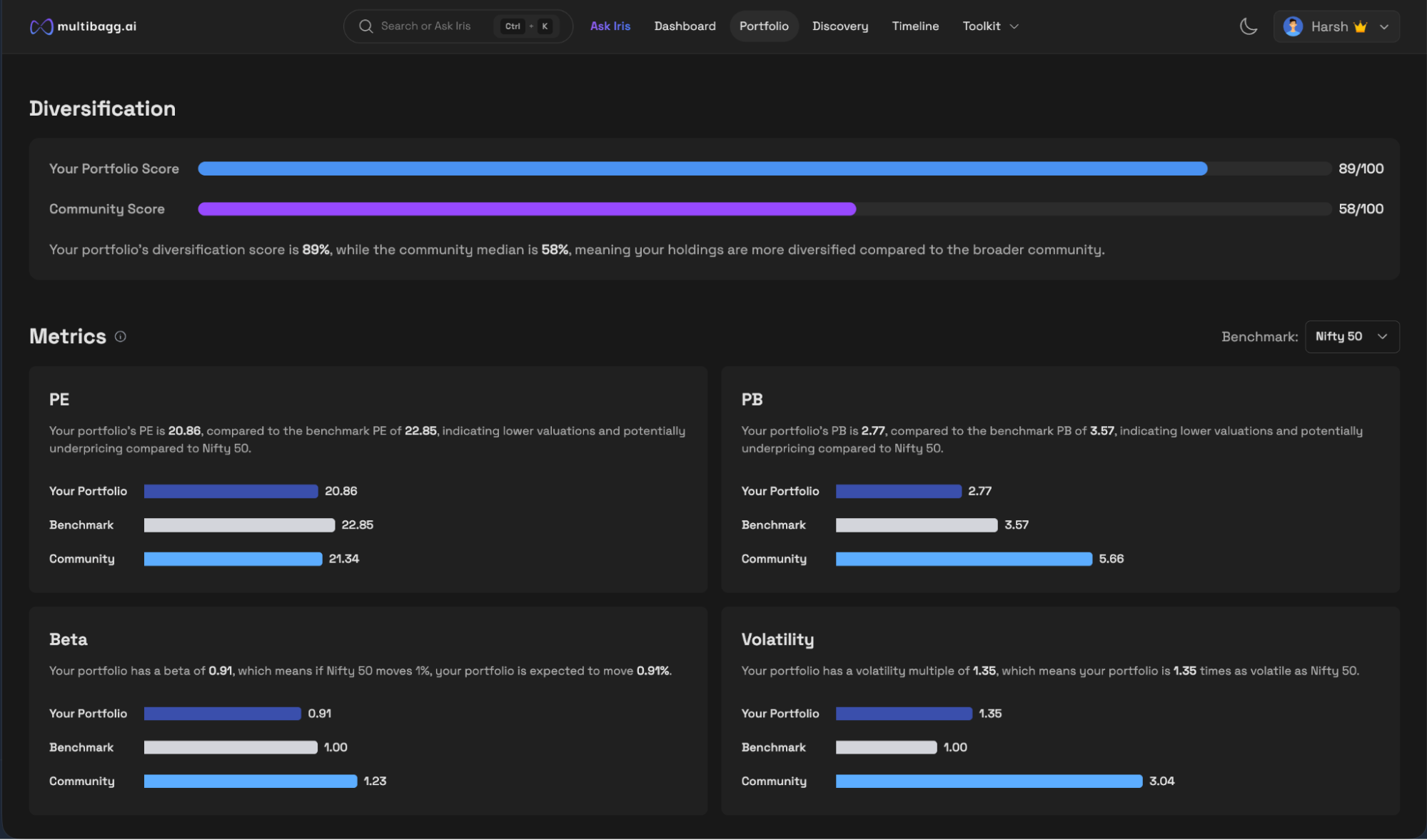

Multibagg AI allows users to connect portfolios natively within seconds from all major Indian brokers. Once connected, the portfolio dashboard is ready in under 10 seconds.

The dashboard covers everything: asset allocation, diversification, benchmarking, red flags, insider trades, company-level news, and portfolio-level insights, all powered by AI. Users can open the portfolio in Screener mode for custom analysis or use Iris to ask portfolio-level questions with source-backed answers. It is one of the strongest portfolio dashboards available today.

Marketsmojo also allows portfolio tracking but it is largely limited in terms of insights and data pointers and the upload process is manual and only offers a one way interaction due to lack of a chatbot.

Verdict: Multibagg AI is the clear winner.

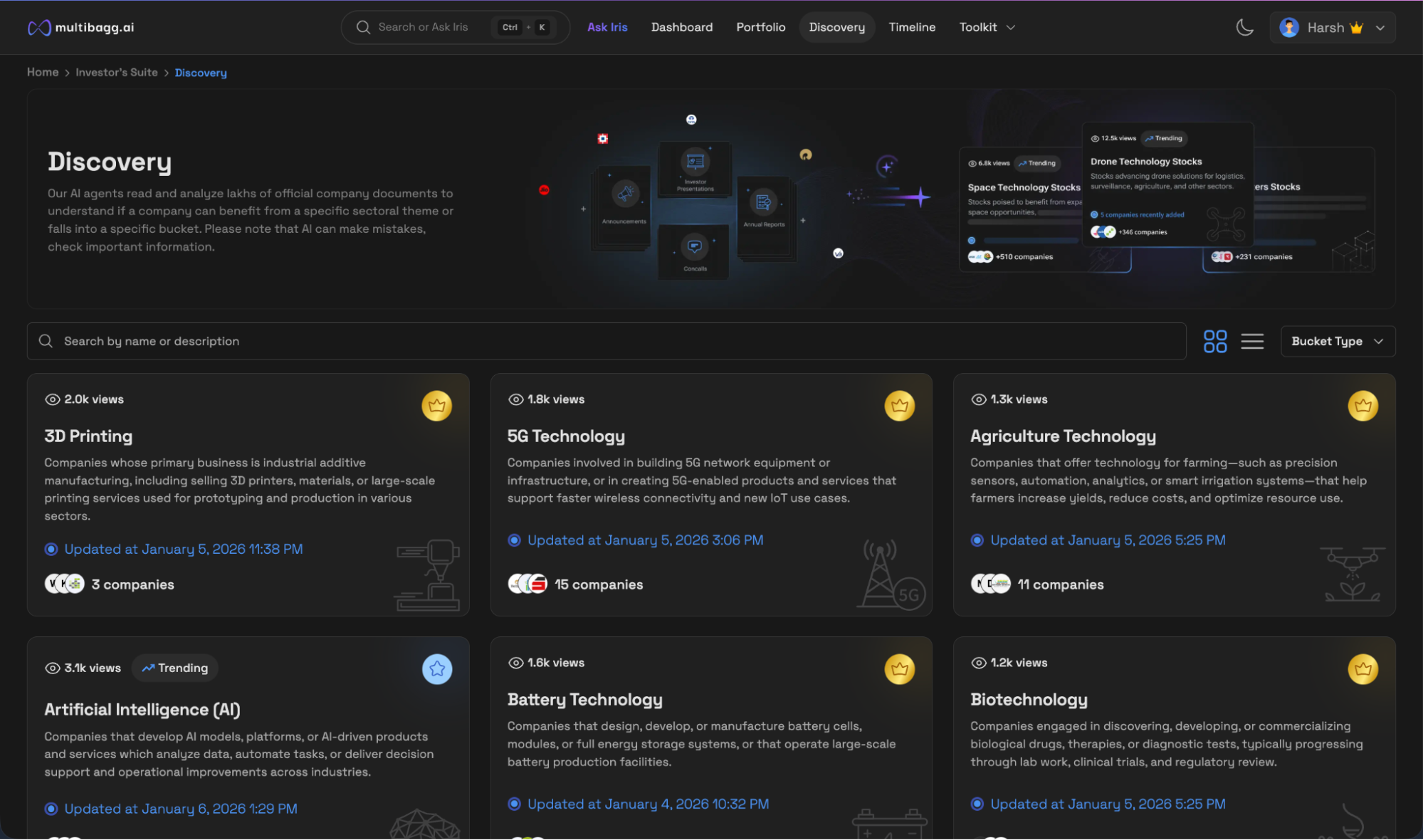

The discovery buckets on Multibagg AI are truly AI-powered and work in real time. When a company appears in a bucket, users can see why and when it was added. Stocks can be instantly added to watchlists or opened together in screener mode for deeper analysis.

Marketsmojo has some classified stock sections acting as buckets but there is no clear reason why and when those stocks were flagged in that specific criteria.

Verdict: Multibagg AI is the clear winner.

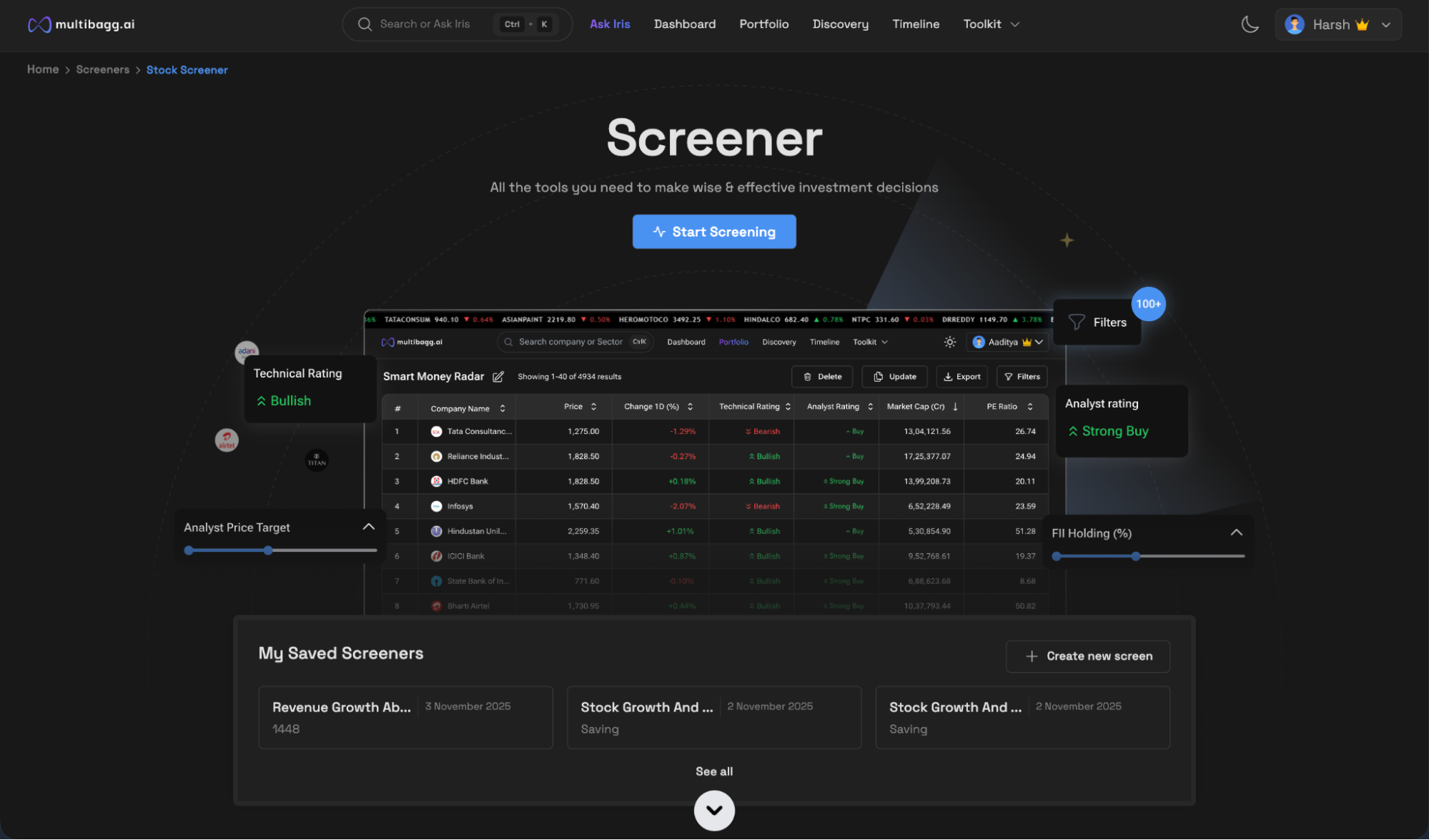

Multibagg AI’s screener is among the best in the market. It offers multiple screeners across stocks, IPOs, ETFs, indices, sectors, industries, deals, and intraday setups. Users get more than 100 filters, can save multiple screens, and export data to Excel. Screening flows seamlessly into deeper research or AI-led analysis.

Marketsmojo has a limited screener. It lacks many financial metrics and ratios on which screening can work. It lacks sectoral and industrial screeners. The experience is rigid, and offers limited flexibility. There is no AI or natural-language screening.

Verdict: Multibagg AI is the clear winner.

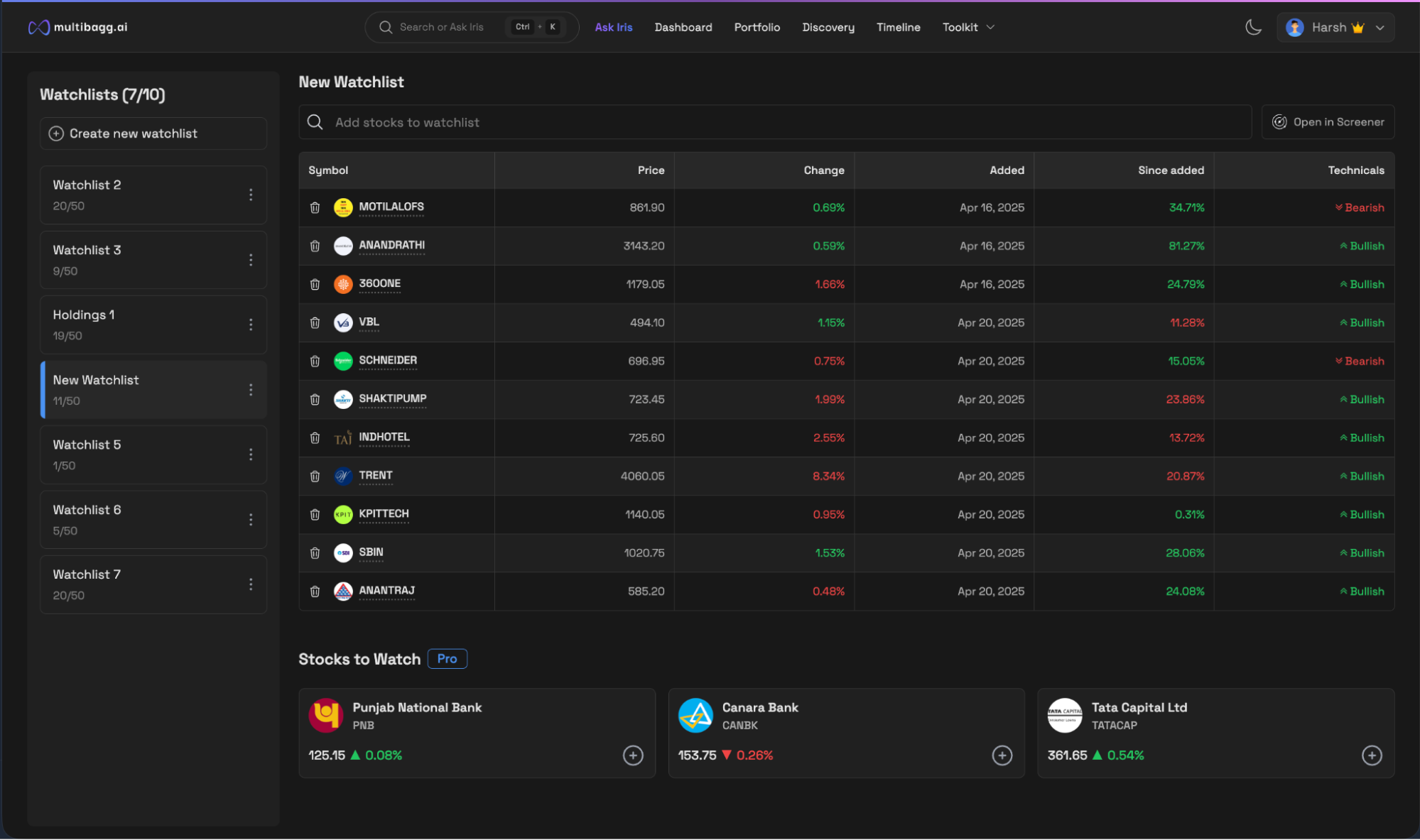

Multibagg AI offers an intuitive watchlist where performance is tracked from the exact date a stock is added.

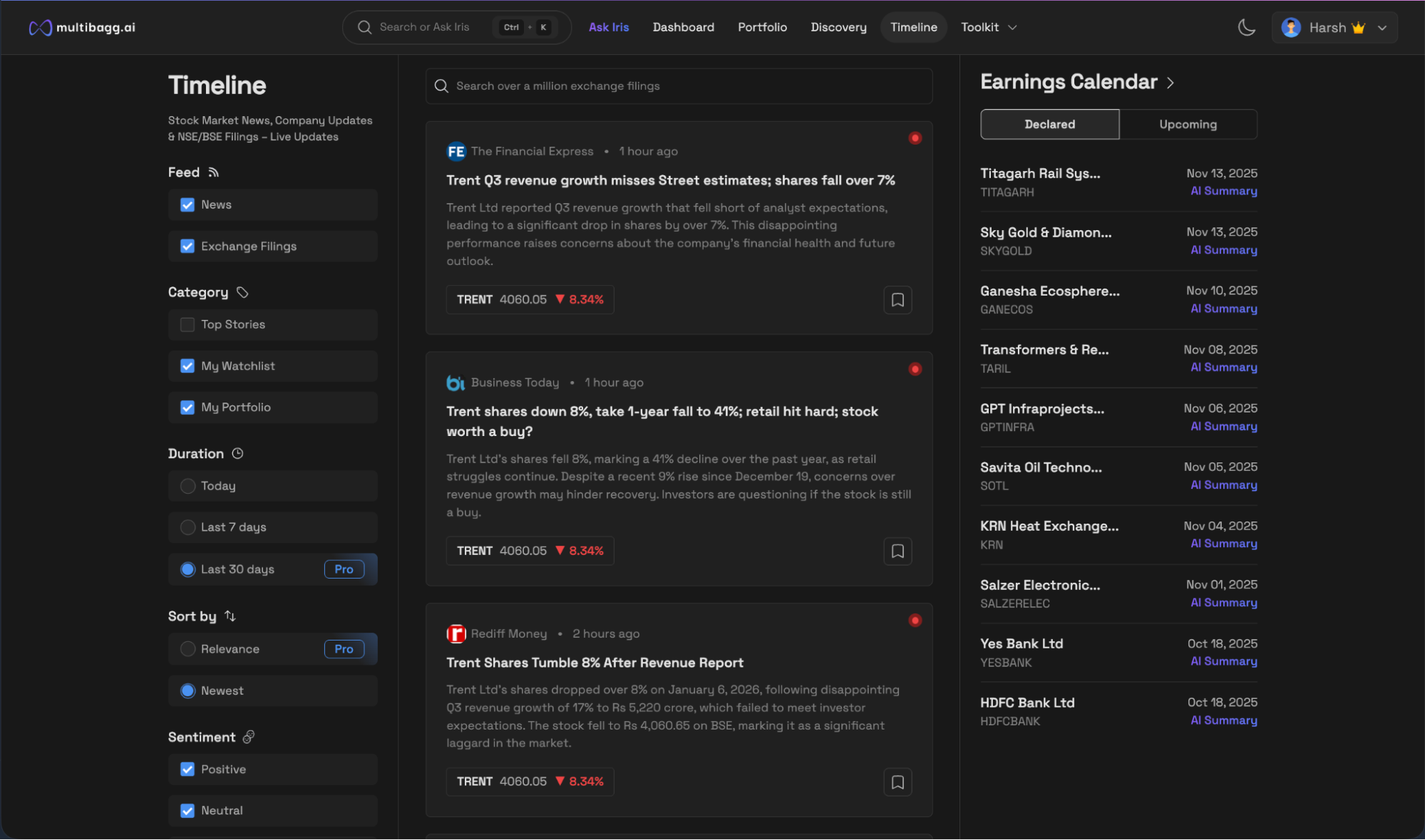

The experience extends into the Timeline feature, which works like a social feed for stocks. Users can filter news by relevance, sentiment, type, and time period. Updates are real time, and price movement is shown alongside news, making it easy to understand impact. News refresh is significantly faster, allowing users to stay on top of developments immediately.

Marketsmojo allows watchlists and price related alerts, but the experience is shallow. Price related alerts would be fine for traders but it does not keep users updated about the news and announcements around the stocks.

Verdict: Multibagg AI is the winner.

Multibagg AI offers an introductory video and guided tours to help first-time users navigate the platform. It assumes a certain level of investing maturity and does not focus on teaching theory.

Marketsmojo hosts Webinars around the stock market and the outlook along with QnAs.

Verdict: Marketsmojo is the winner.

MarketMojo is priced higher and is aimed at investors who prefer rule-based scoring and dated, report-style analysis. The value comes primarily from Mojo scores, price alerts, and curated stock lists. However, the overall experience remains static and metric-driven, with limited depth, flexibility, and interactivity, requiring users to manually interpret most insights.

Multibagg AI, at a lower annual price, bundles AI-driven discovery, deep research, conversational analysis, portfolio intelligence, timeline-based tracking, and advanced screening into a single platform. Instead of consuming fixed scores and reports, users interact with data dynamically and move faster from insight to action, without relying on multiple tools.

Verdict: Multibagg AI offers better value for serious investors.

If you prefer score-driven, rules-based analysis with predefined recommendations, MarketMojo works as a basic, disciplined framework for stock evaluation.

But if you want to go beyond static scores and limited features, discover ideas proactively, research companies faster using AI, interact with portfolios conversationally, and track developments in real time, Multibagg AI is the better choice.

In an environment where time and attention are scarce, Multibagg AI focuses on clarity, speed, and decision-making, while MarketMojo largely expects users to interpret numbers and scores on their own.

Final takeaway: MarketMojo offers score-based stock analysis for rule-following investors.

Multibagg AI gives you an AI-first, end-to-end investing workflow with everything an investor needs – all under one platform.