Welcome to Multibagg AI

Log in to access personalized features

Multibagg AI is a comprehensive stock research and analysis platform designed to solve the four critical challenges investors face. Those four problems are below:

Whereas Sovrenn is primarily a stock discovery platform trying to address the other three aspects in bits and pieces.

Let’s compare Multibagg AI and Sovrenn across 9 key parameters and conclude with a clear final takeaway.

Let’s start with the basics.

The best technology should feel like magic, and the best design should feel like no design.

That is exactly how Multibagg AI feels.

The UI is minimal, modern, and elegant. Navigation is seamless across stock pages, charts, and timelines. You can select any two time points and instantly see return percentages. Thoughtful design touches are visible everywhere. When a user lands on the platform for the first time, they immediately know what to do. The journey is clearly laid out, and personalized with guided recipes for someone interacting with a Search or Ask AI style platform for the first time. Everything is well thought through. Even feature names are self explanatory.

Sovrenn’s UI is dominantly static. The moment you land, it can feel like an educational platform selling stock market investment courses. The design feels dated and slightly out of touch with today’s users who regularly use ChatGPT and Perplexity like platforms.

Verdict: Multibagg AI’s UIUX is far superior.

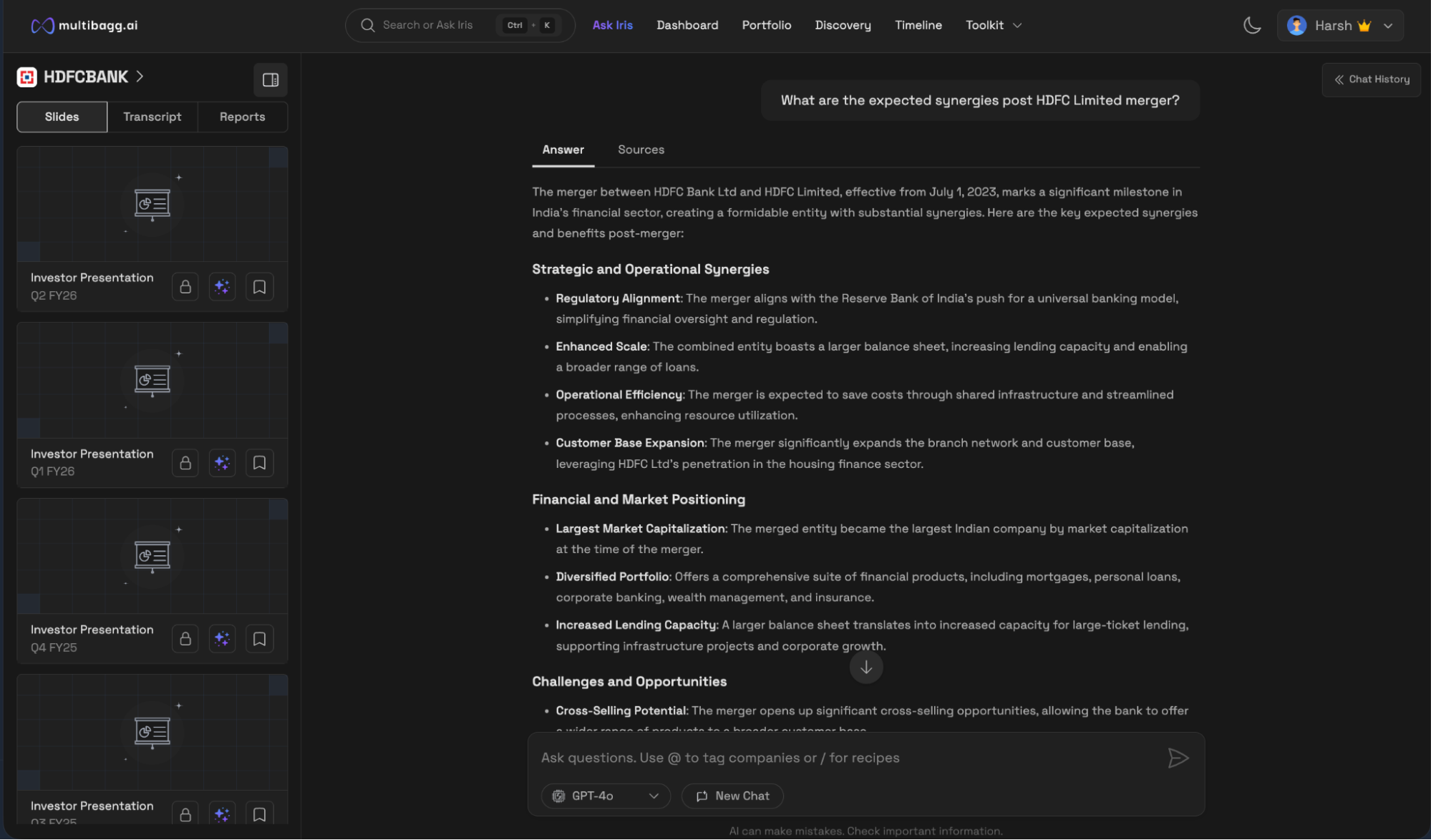

Multibagg AI offers a powerful chatbot called Iris. Users can literally ask anything to Iris. It answers questions related to stocks, IPOs, ETFs, indices, and much more like:

“What is Reliance planning in the AI sector?”

Not only that, Iris can also answer questions related to the user’s portfolio, such as:

“What are the red flags in my portfolio?”

Iris can even be used to screen companies using natural language, like:

“Give me a list of low PE, high ROE companies in the consumer durables sector”.

The best part is that the answers come directly from official exchange filings and Multibagg AI’s proprietary knowledge base, not random internet articles. These documents are also accessible within the chat itself and can be opened instantly.

Sovrenn does not have a chatbot.

Verdict: Multibagg AI is the clear winner. Iris is by far the most advanced chatbot in the Indian stock market.

Multibagg AI covers almost every data point. You name it, they have it. It includes price charts, peers, financial statements, analyst verdicts, forecasting and projection data, and insider trades. It also covers corporate actions, announcements, investor presentations, concalls, and annual reports. The platform has more than 10 years of data and over a million news articles from various media houses, on which its sentiment models are built. The systems are highly efficient and consistently accurate.

Sovrenn does not have such exhaustive data. News coverage for small and micro cap stocks is mostly limited to recent exchange filings.

Verdict: Multibagg AI is the clear winner.

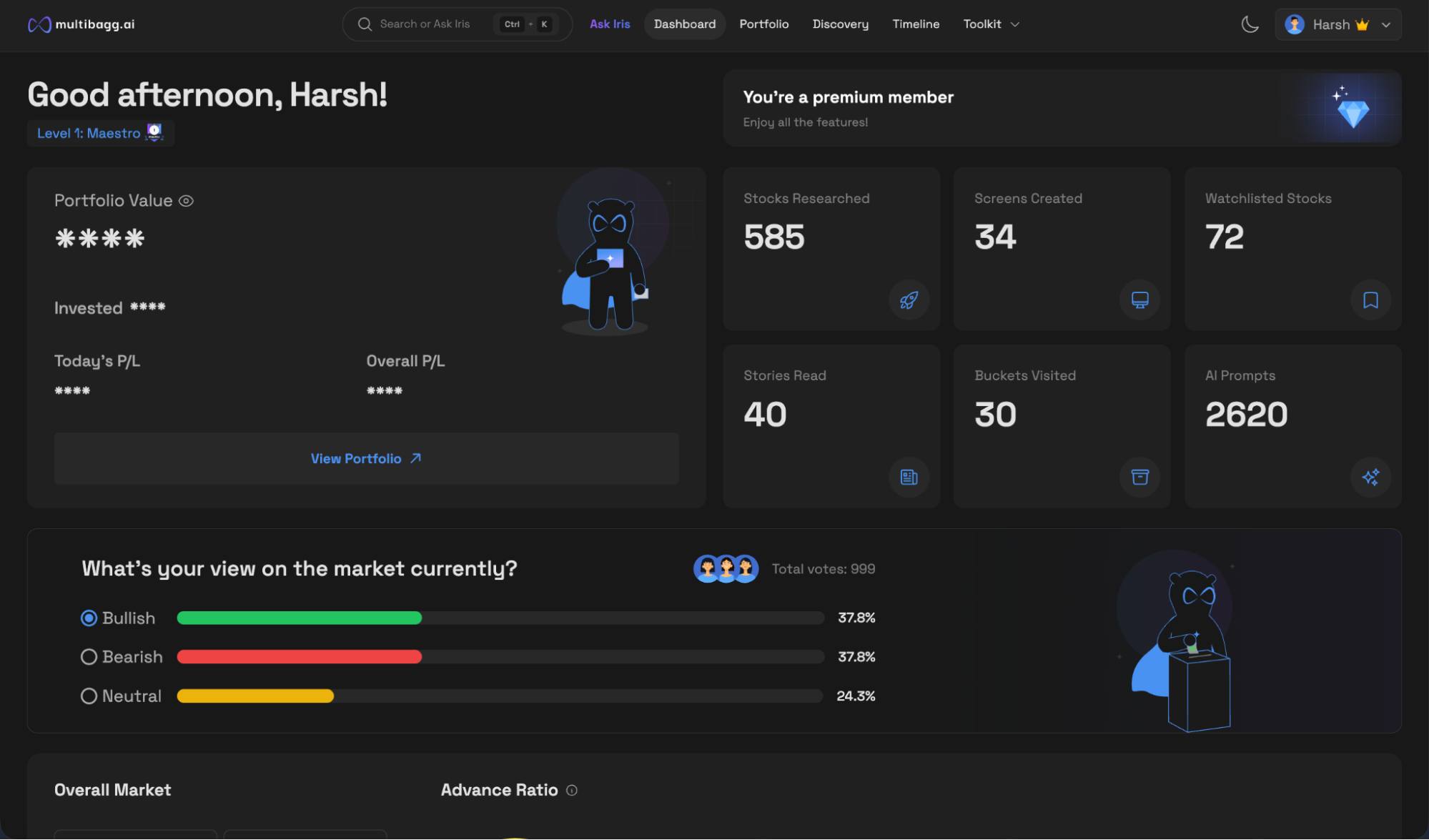

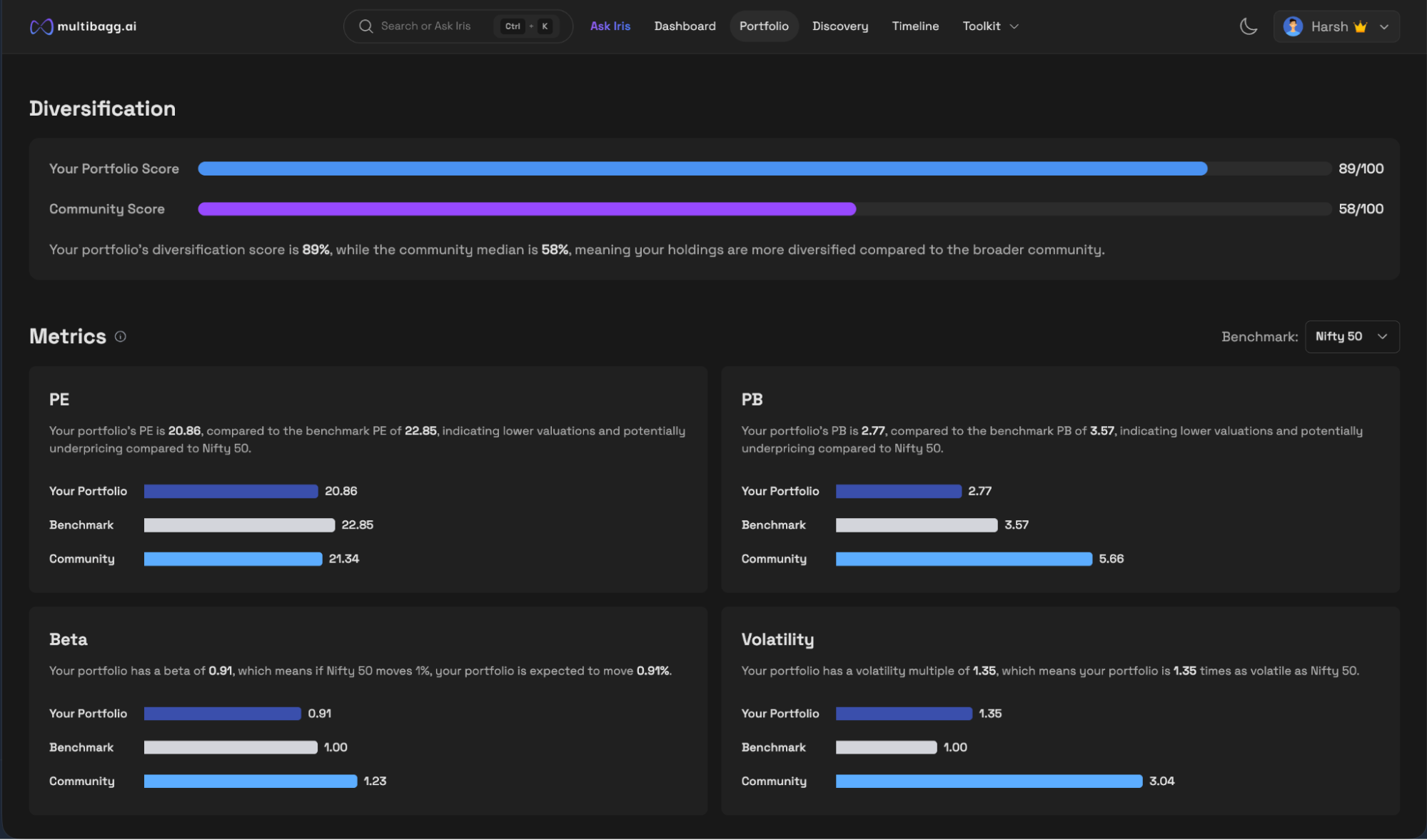

Multibagg AI allows users to connect their portfolios natively within seconds from every major broker in India. Once your portfolio is connected, your dashboard gets ready within 10 seconds. The portfolio dashboard shows everything about your portfolio. From asset allocation to diversification, from benchmarking to redflags, from news to insider trades, everything. It’s definitely one of the best portfolio dashboards I have ever seen.

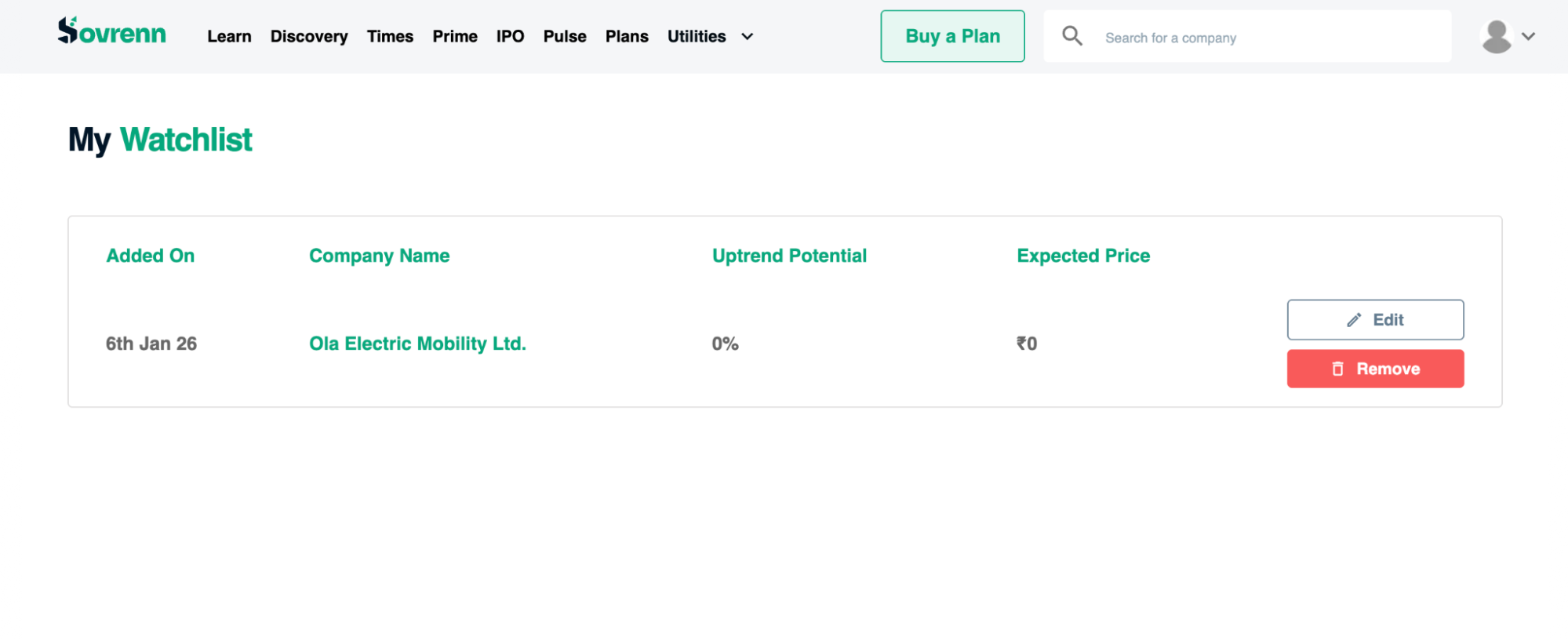

Sovrenn currently does not offer automatic portfolio connection. Users have to manually search for stocks and add them to the “portfolio,” which is essentially a watchlist. It does not capture critical details such as actual shareholding, invested value, or allocation, making it a limited substitute rather than a true portfolio view.

Verdict: Multibagg AI is the clear winner.

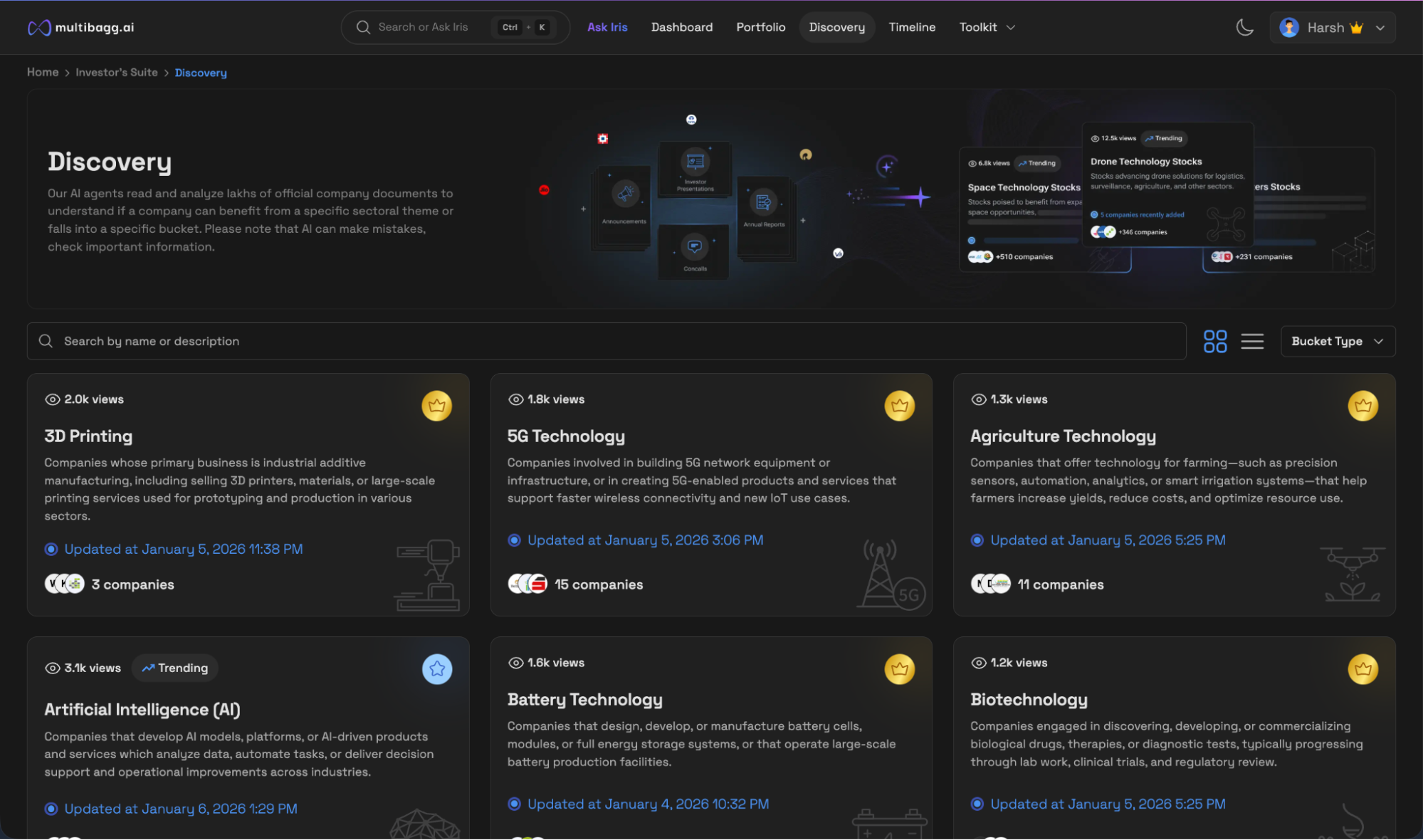

The discovery buckets created by Multibagg AI are truly AI-powered. Everything happens in real time. When you see a company in a particular bucket, you also see the “why” and “when” it was added. You can directly add these companies to your watchlist or open them together in screener mode for advanced analytics.

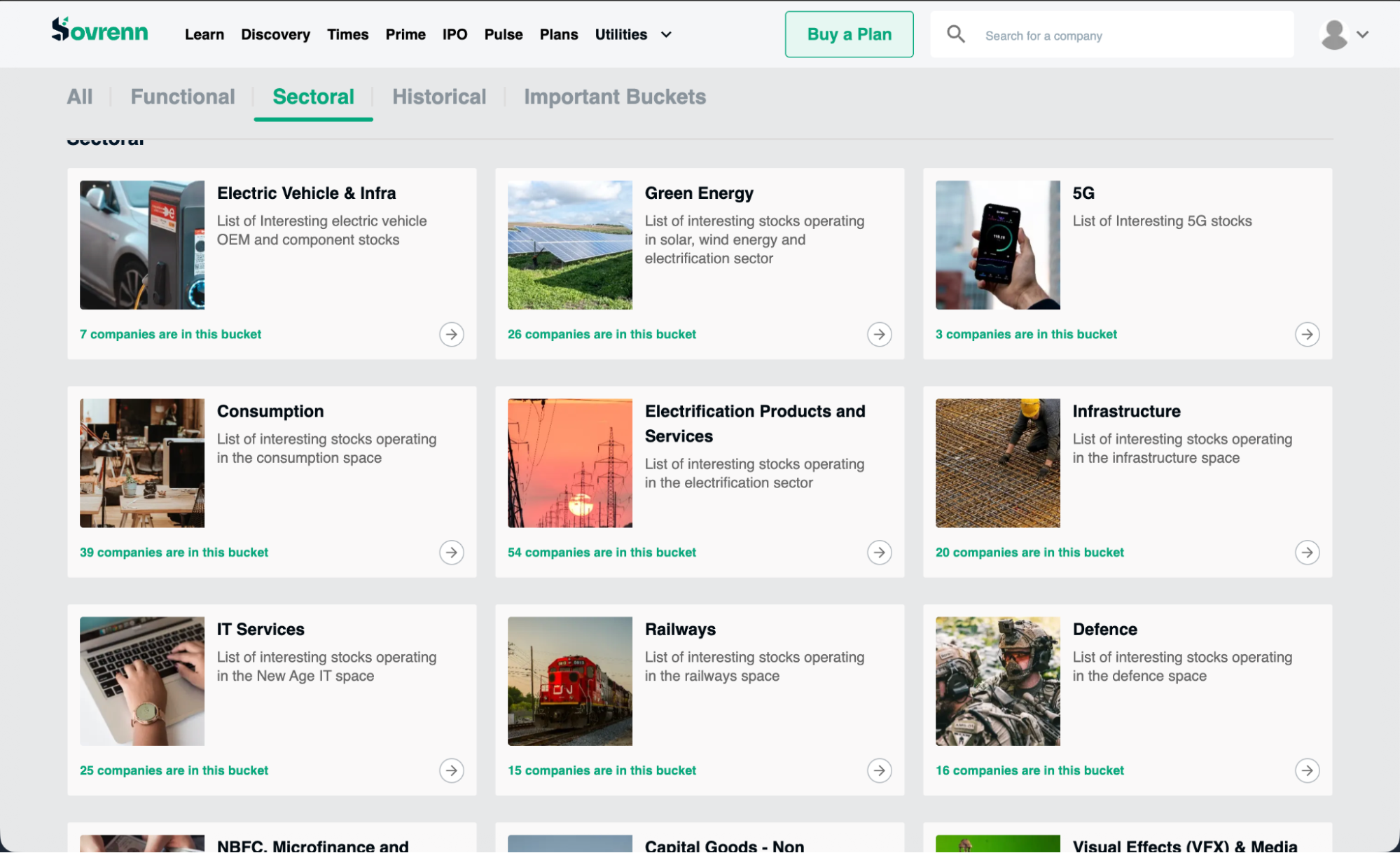

Sovrenn’s discovery feature also offers an exhaustive list of buckets. Buckets are created manually and not AI which has both advantages and disadvantages. Buckets are highly accurate but they are not updated in real-time.

Verdict: It’s a tie.

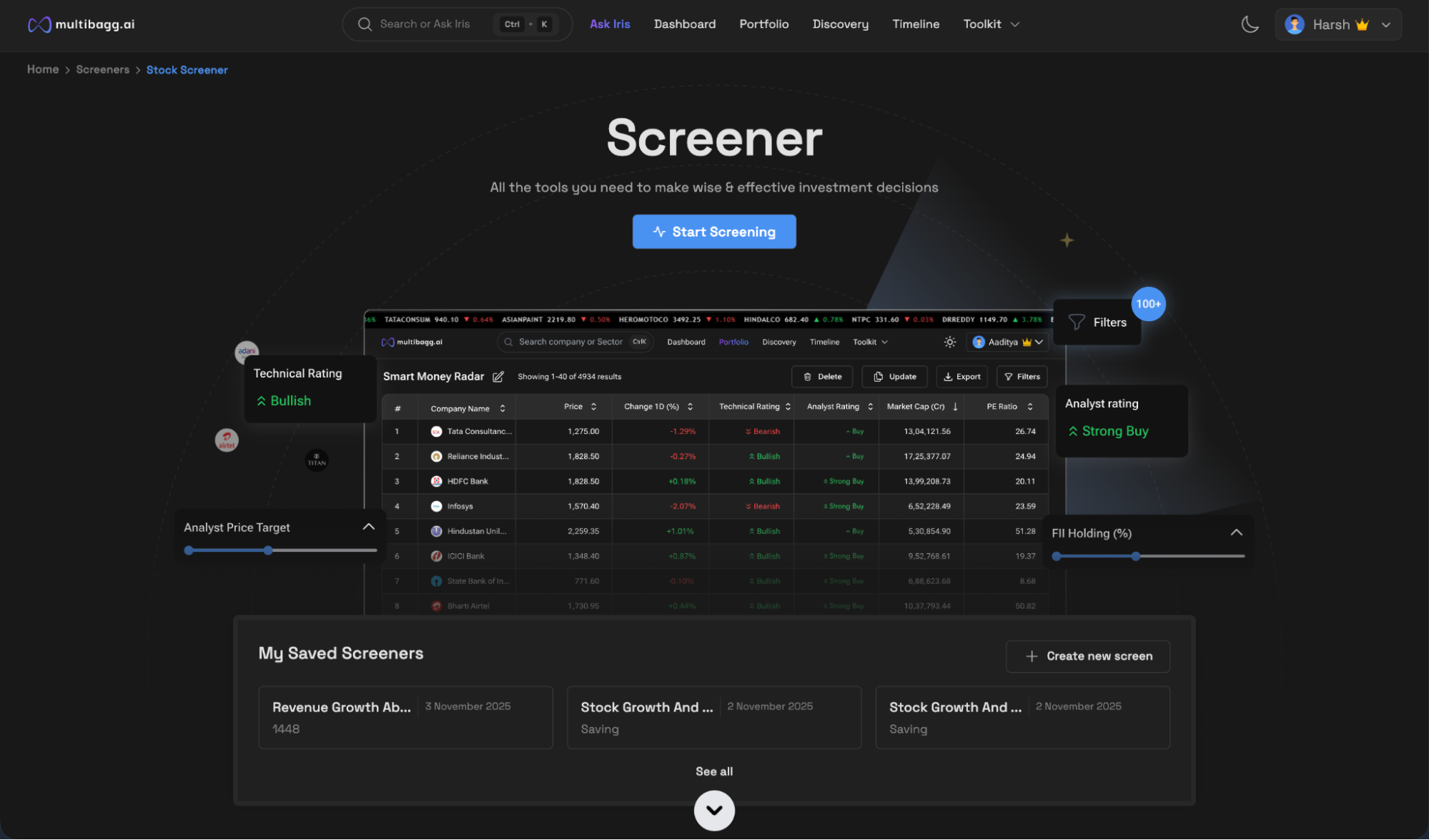

Multibagg AI’s screener is among the best in the market. It offers 8 different screeners, one each for stocks, IPOs, ETFs, indices, sectors, industries, deals, and intraday. In addition, you get more than 100 filters to choose from. You can save multiple screens and also export the data to Excel for offline use.

Sovrenn currently does not have this feature.

Verdict: Multibagg AI is the clear winner.

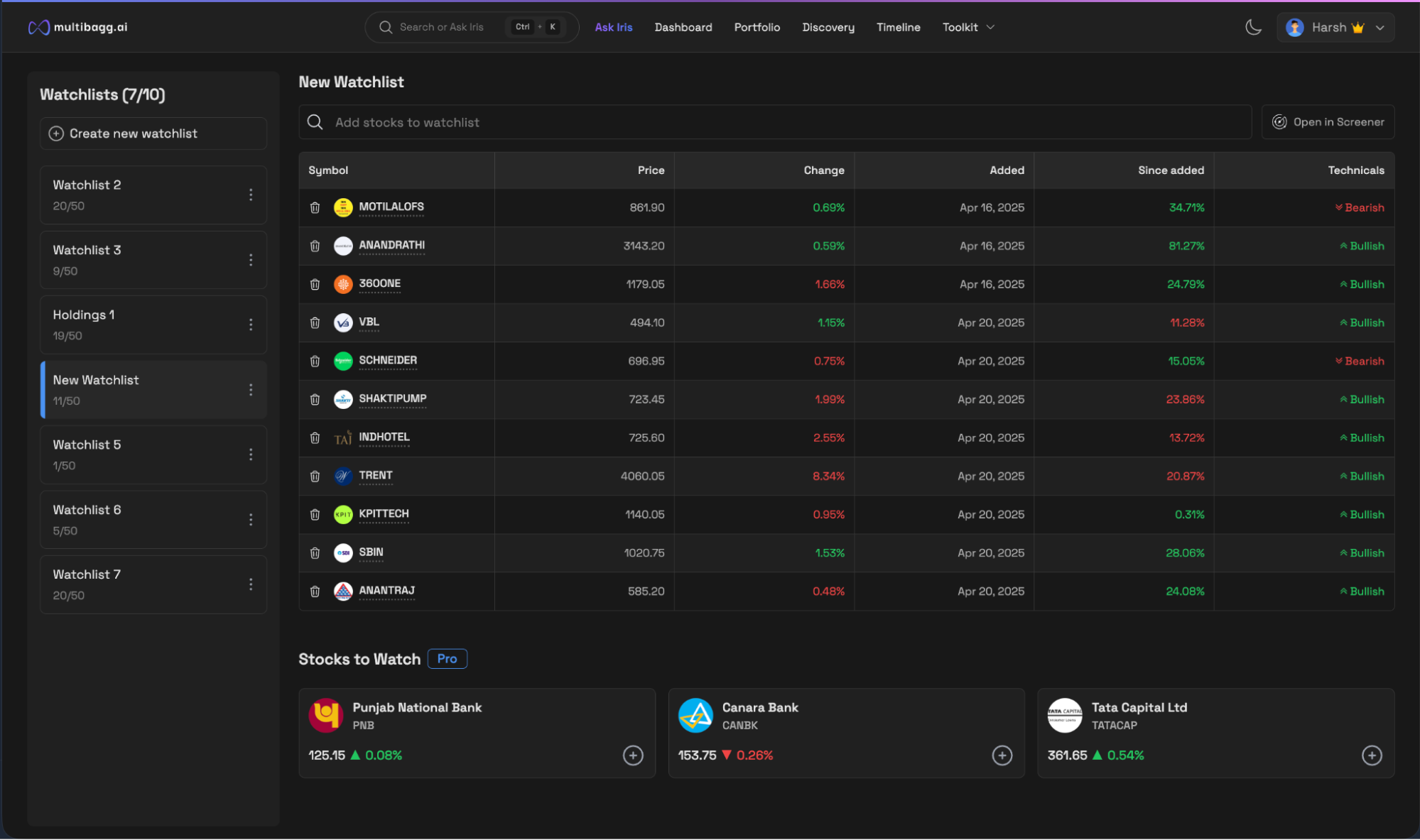

Multibagg AI offers an extremely intuitive watchlist. Users can create and track multiple watchlists, with performance shown from the exact date a stock is added. Many investors buy a single share just to track a stock, which becomes unnecessary once you use Multibagg AI.

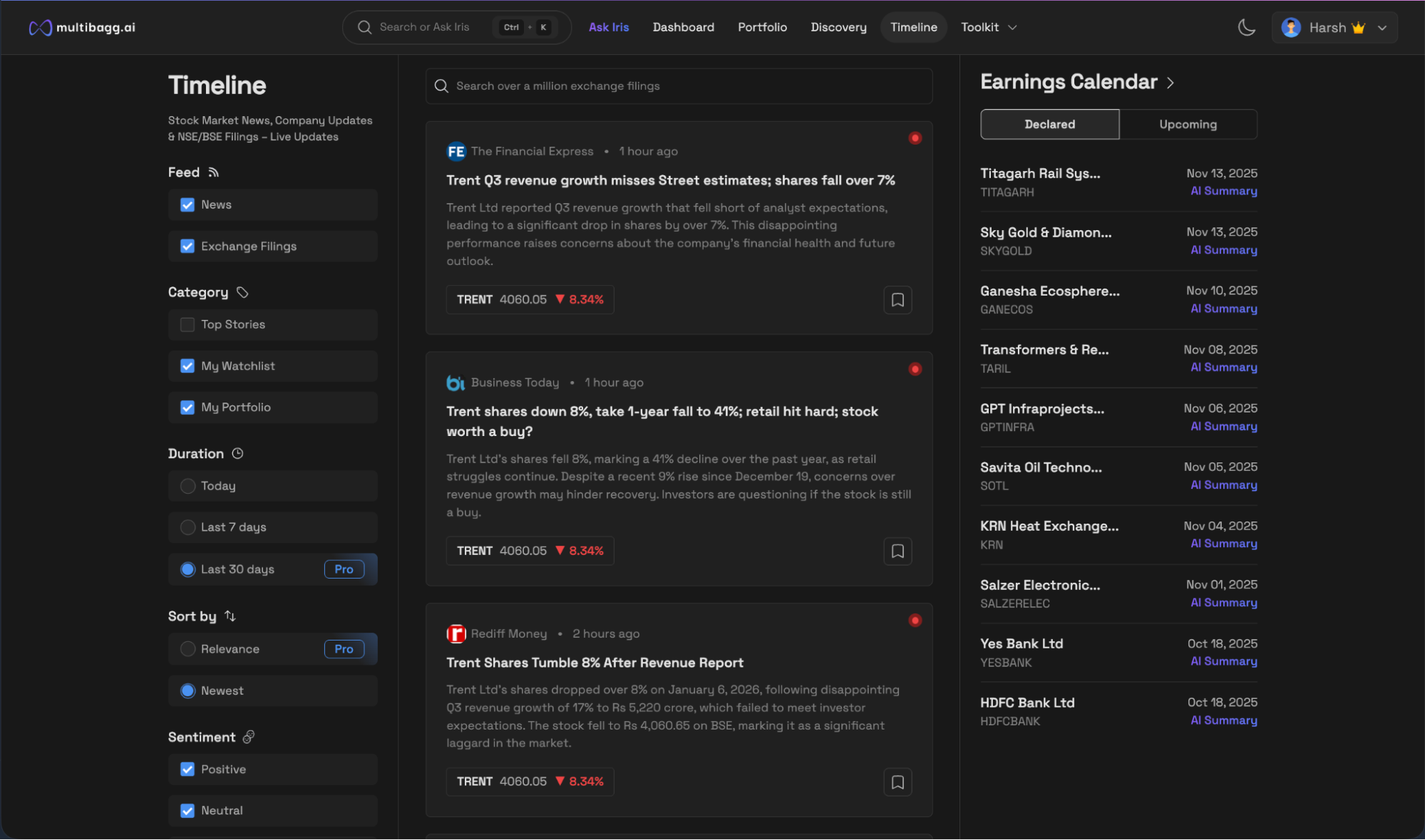

The watchlist seamlessly extends into the Timeline feature. Timeline works like an Instagram feed for stocks, allowing users to filter news by relevance, sentiment, type, time period, and more. News updates in real time, while ML models curate the most relevant stories for each user. The feed is designed so users can quickly grasp key information alongside price movements on the same screen.

Sovrenn allows users to add stocks to a watchlist, but the experience is suboptimal. It offers a feature called Pulse, which is similar in concept to Multibagg AI’s Timeline, but it merely lists news without context, filtering, or deeper insights.

Verdict: Multibagg AI is the winner.

Multibagg AI has an introductory video on the homepage explaining how to use the platform but it doesn’t teach the why and how of investing. Although the platform is very intuitive even for first-time users, it still expects a certain level of user maturity.

Sovrenn does an excellent job in educating investors. Founder of Sovrenn has created multiple videos that teaches the why and how of stock market investing. Videos are embedded throughout the platform to guide users.

Verdict: Sovrenn is the winner.

At a 20% premium pricing, Multibagg AI offers stock discovery, unmatched AI capabilities, data depth, superior UIUX, portfolio integration and other advanced investor tools. Multibagg AI, although expensive, is value for money compared to Sovrenn. With Sovrenn, you can never just have one subscription, you will need multiple subscriptions but Multibagg AI can be your one stop solution.

Verdict: Multibagg AI is the winner.

If you only want to discover new stocks, especially in the micro-cap segment, Sovrenn is the go-to platform. But if you are looking for something that goes beyond just stock discovery and helps you deeply research stocks, understand portfolios with AI, and track companies, then you should choose Multibagg AI.

With Multibagg AI, you become a 360-degree investor with deep knowledge. You understand the process and do not fall behind in the age of AI. With Multibagg AI, the sky is the limit. It is entirely up to the user how deep they want to go. The philosophy is freedom. It does not bind you. It sets you free to explore how powerful investing can be.

Final takeaway: Multibagg AI is built brick by brick by an engineer investor with immense love for the investor community.

Whatever you can do with Sovrenn, you can do with Multibagg AI, 10x better. But the other way round is not true.