Welcome to Multibagg AI

Log in to access personalized features

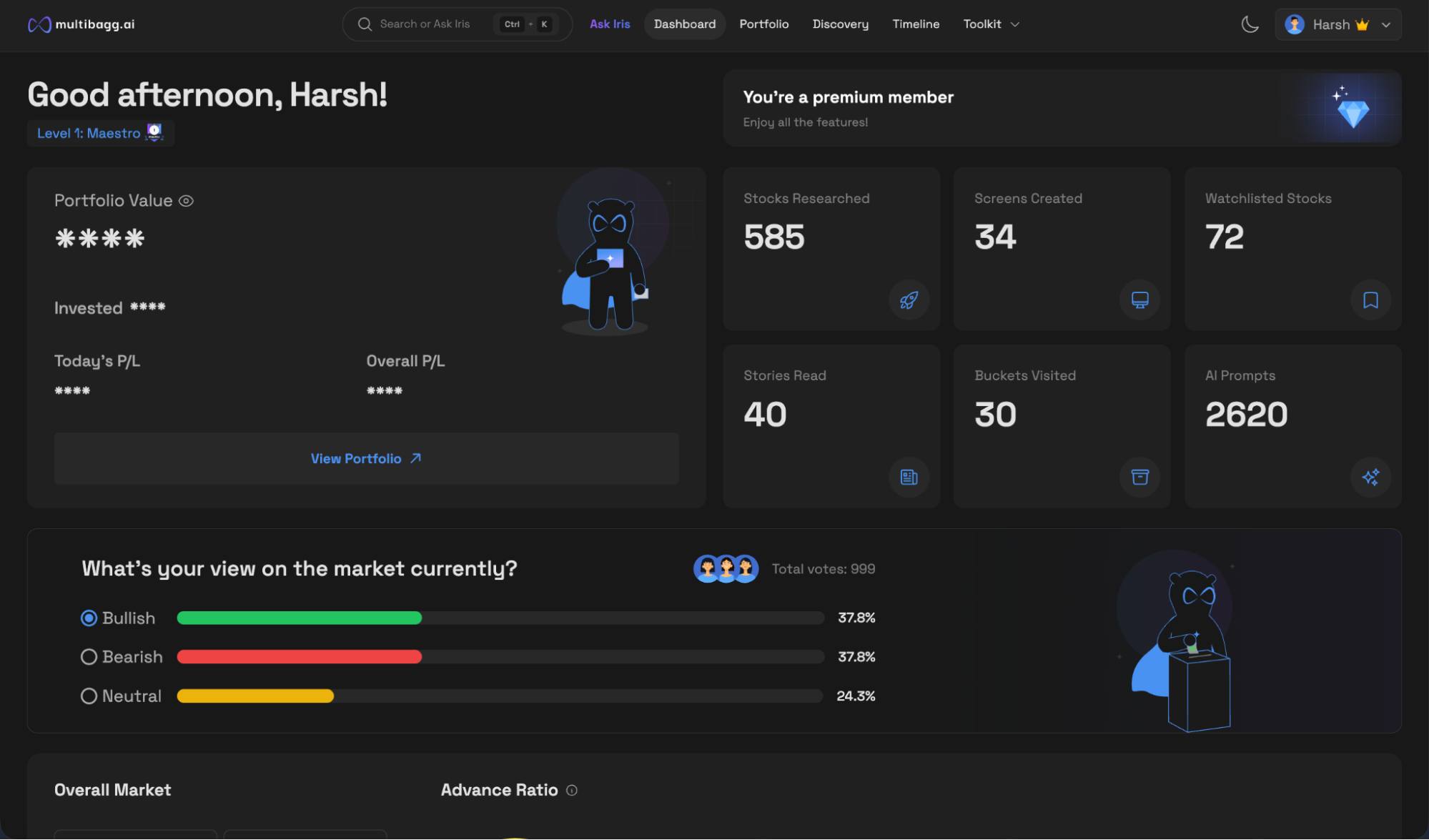

Multibagg AI is a comprehensive stock research and analysis platform designed to solve four critical challenges investors face:

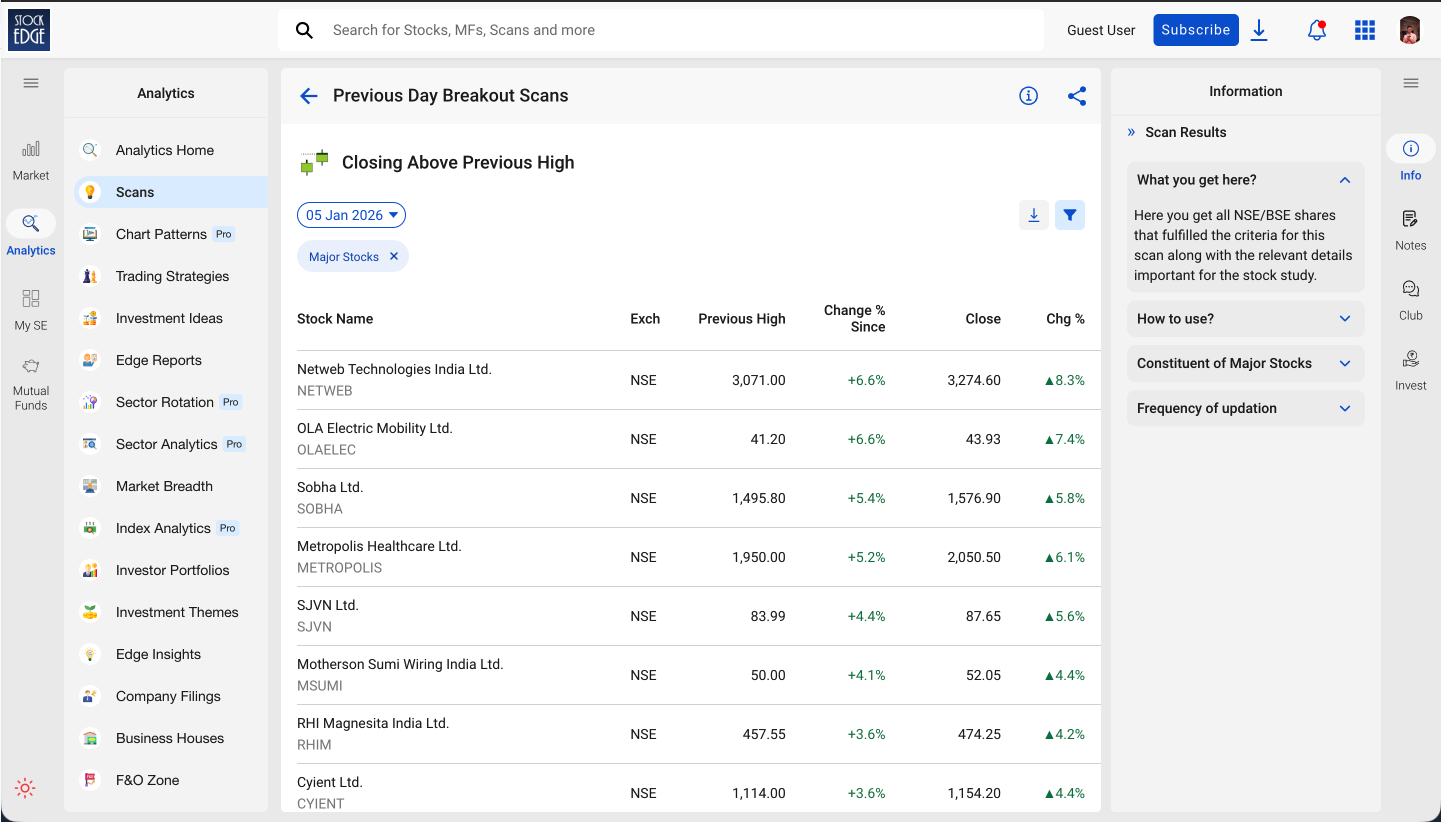

Stockedge is primarily a trader-focused analytics platform, built around scans, market data, sector rotation, derivatives, and quantitative models. It is geared more toward active traders and power users than long-term, workflow-driven investors.

Let’s compare Multibagg AI and StockEdge across 9 key parameters and conclude with a clear final takeaway.

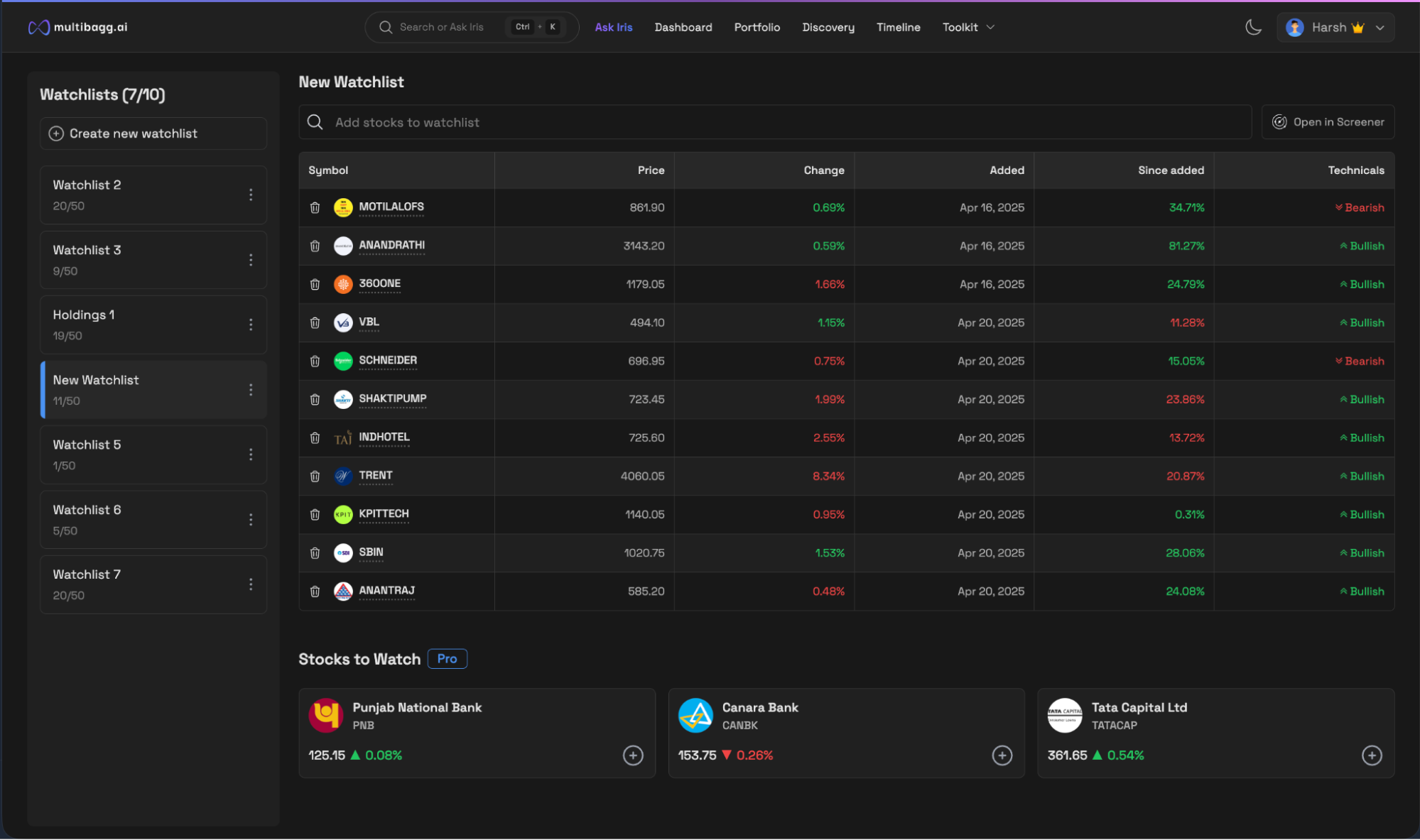

Multibagg AI’s UI is minimal, modern, and elegant. Navigation across stocks, portfolios, timelines, and screeners is seamless. The platform is workflow-driven and clearly guides users toward discovery, research, and decision-making with very low cognitive load.

StockEdge has a clean and usable UI, especially compared to older platforms. However, it is data-heavy and scan-centric, which can feel overwhelming. While powerful, it is less guided and better suited for users who already know exactly what they are looking for.

Verdict: Multibagg AI wins.

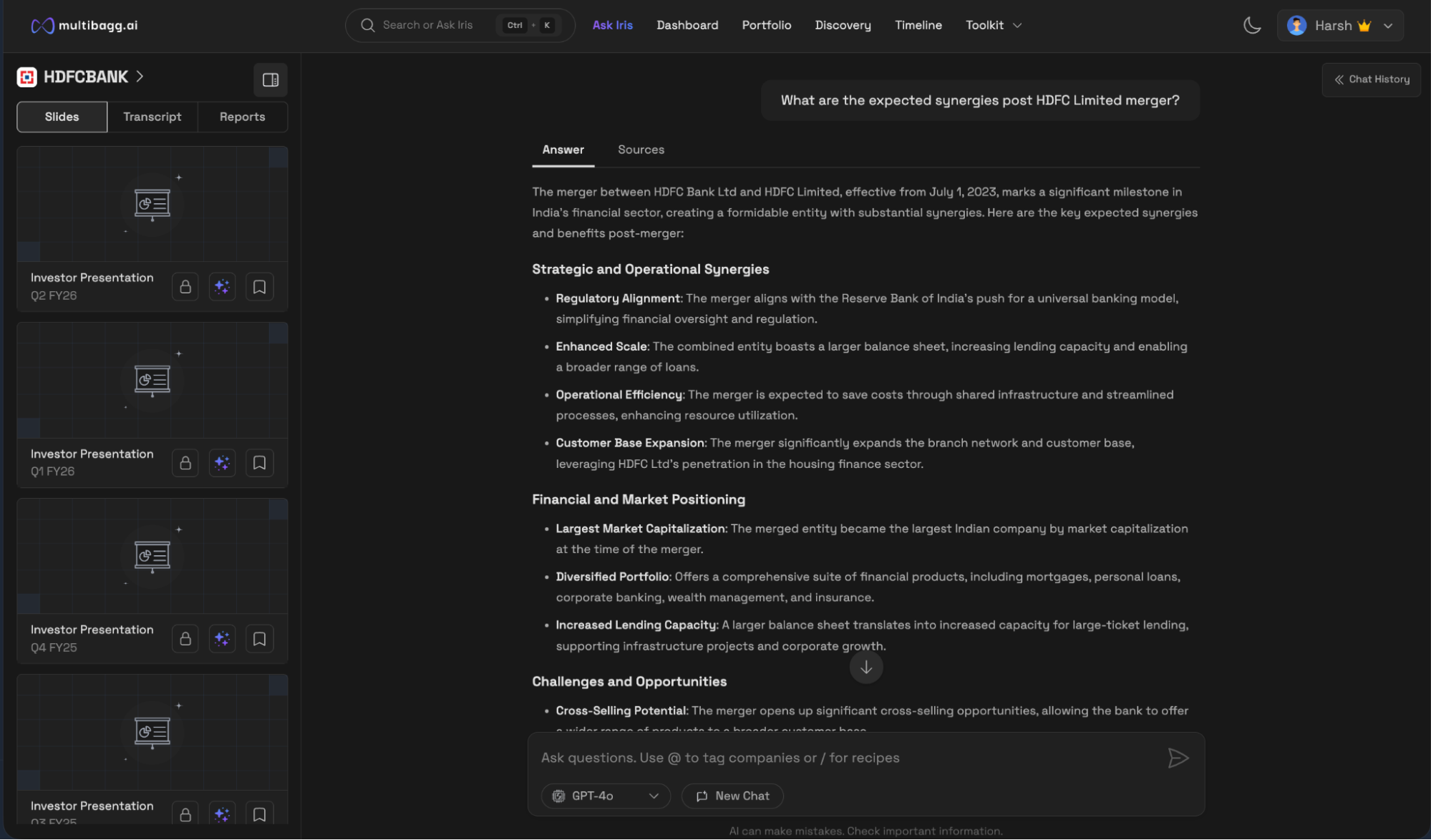

Multibagg AI offers a powerful chatbot called Iris.

Users can ask anything. Questions related to stocks, IPOs, ETFs, indices, or forward-looking queries like:

“What is Reliance planning in the AI sector?”

Iris can also answer portfolio-level questions such as:

“What are the red flags in my portfolio?”

It can even screen companies using natural language, for example:

“Give me a list of low PE, high ROE companies in the consumer durables sector.”

The key advantage is that answers come directly from official exchange filings and Multibagg AI’s proprietary knowledge base, not random internet articles. Source documents are accessible within the chat and can be opened instantly.

StockEdge does not offer any chatbot or conversational AI. All analysis is manual and scan-driven.

Verdict: Multibagg AI is the clear winner.

Multibagg AI provides deep, structured investor-focused data including financials, ratios, peers, filings, concalls, insider trades, sentiment, and long-term historical coverage.

StockEdge, however, wins on overall data depth due to its strong trader-centric datasets. It excels in Open Interest (OI), derivatives, sector and market rotation, momentum indicators, and multiple quantitative and analytical models. This depth is extremely valuable for advanced users, though the volume of data can lead to decision fatigue for non-power users.

Verdict: StockEdge wins.

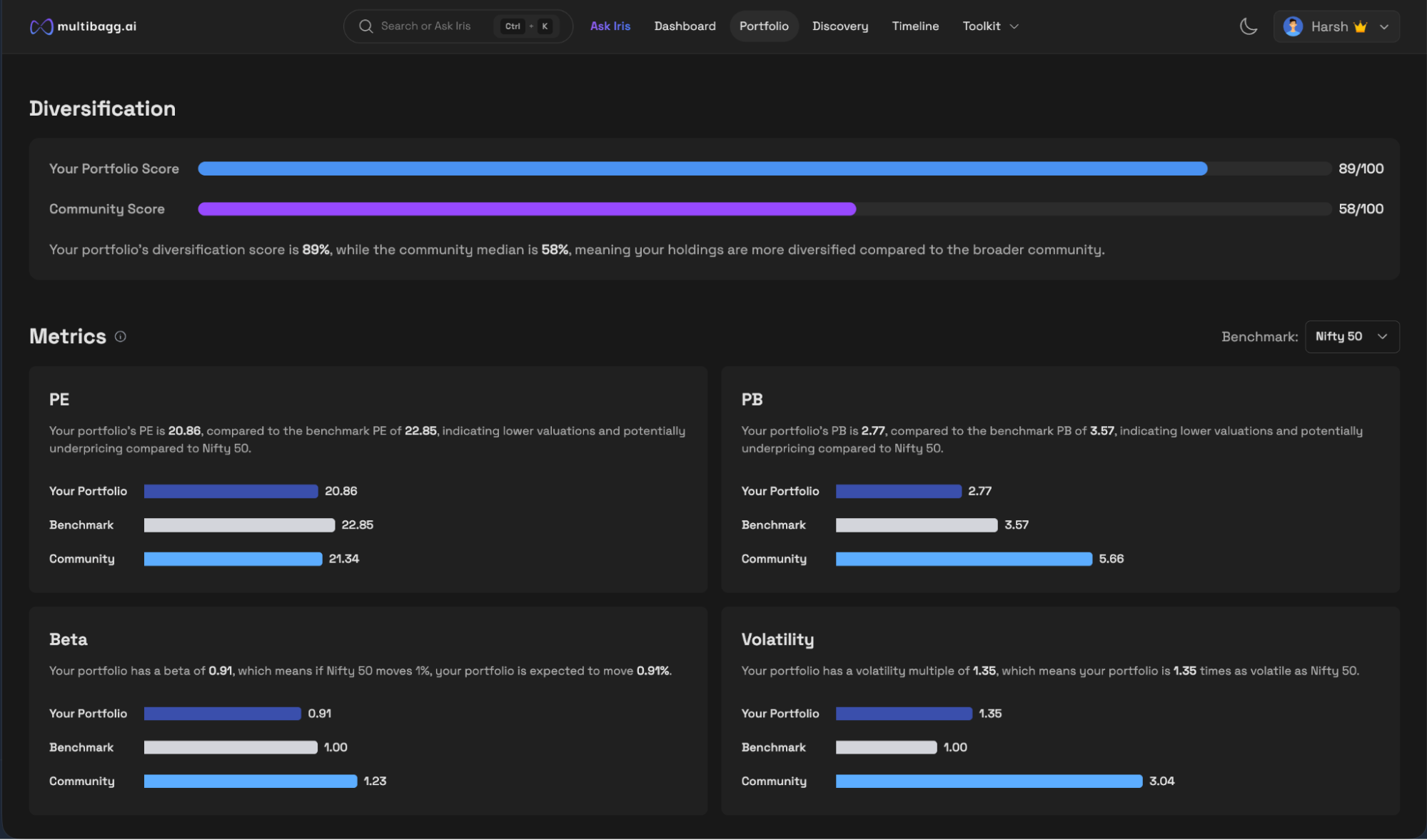

Multibagg AI supports instant portfolio syncing from major Indian brokers, AI-powered red flags, benchmarking, diversification analysis, and conversational portfolio interrogation.

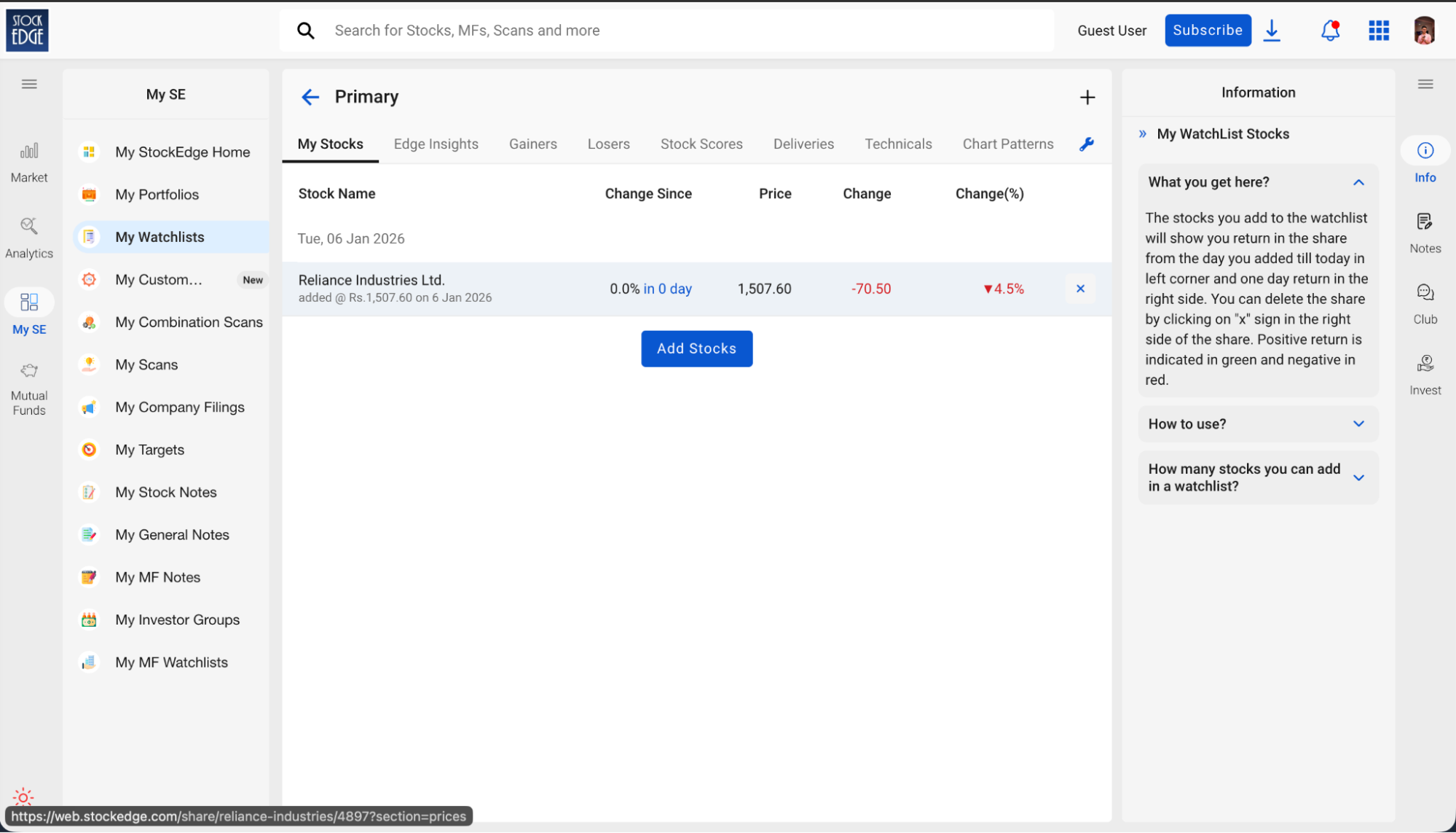

StockEdge offers auto-sync and basic portfolio analytics, mainly in paid plans. Insights are metric-based, and there is no AI-led interpretation or conversational layer.

Verdict: Multibagg AI wins.

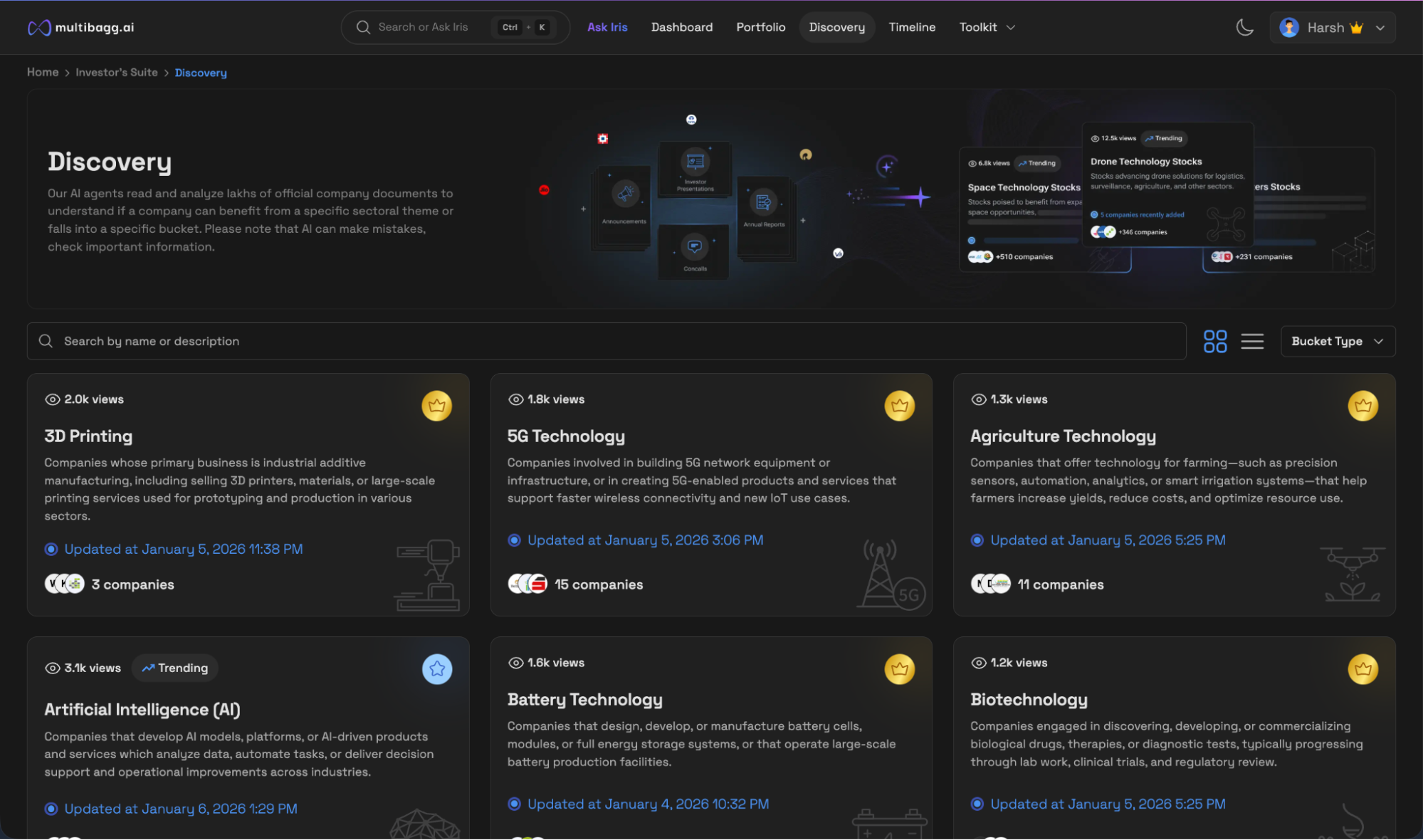

The discovery buckets on Multibagg AI are truly AI-powered and work in real time. When a company appears in a bucket, users can see why and when it was added. Stocks can be instantly added to watchlists or opened together in screener mode for deeper analysis.

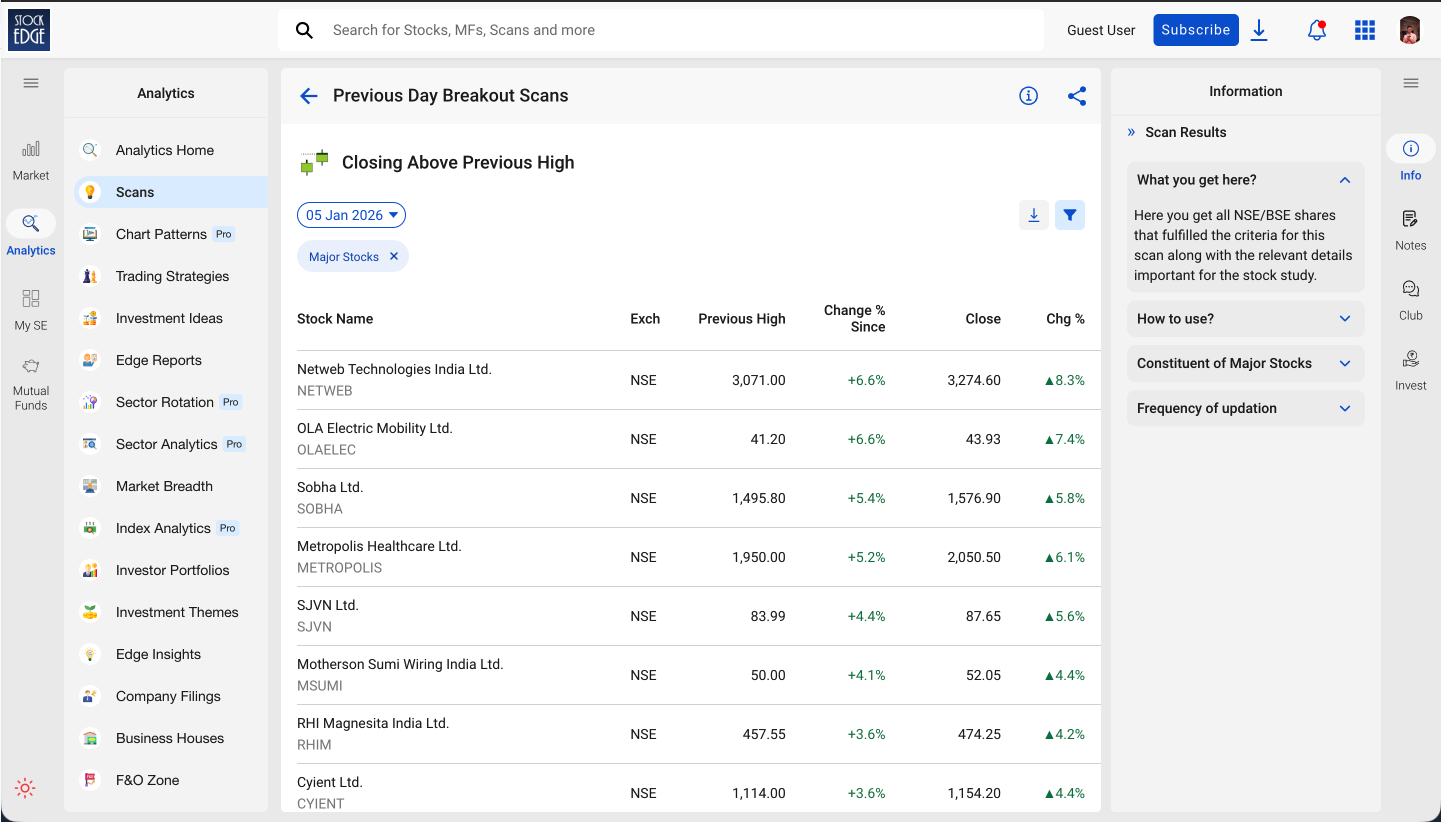

StockEdge offers discovery through predefined scans, quantitative filters, and model-based lists, which effectively act as discovery mechanisms for traders.

Verdict: Tie.

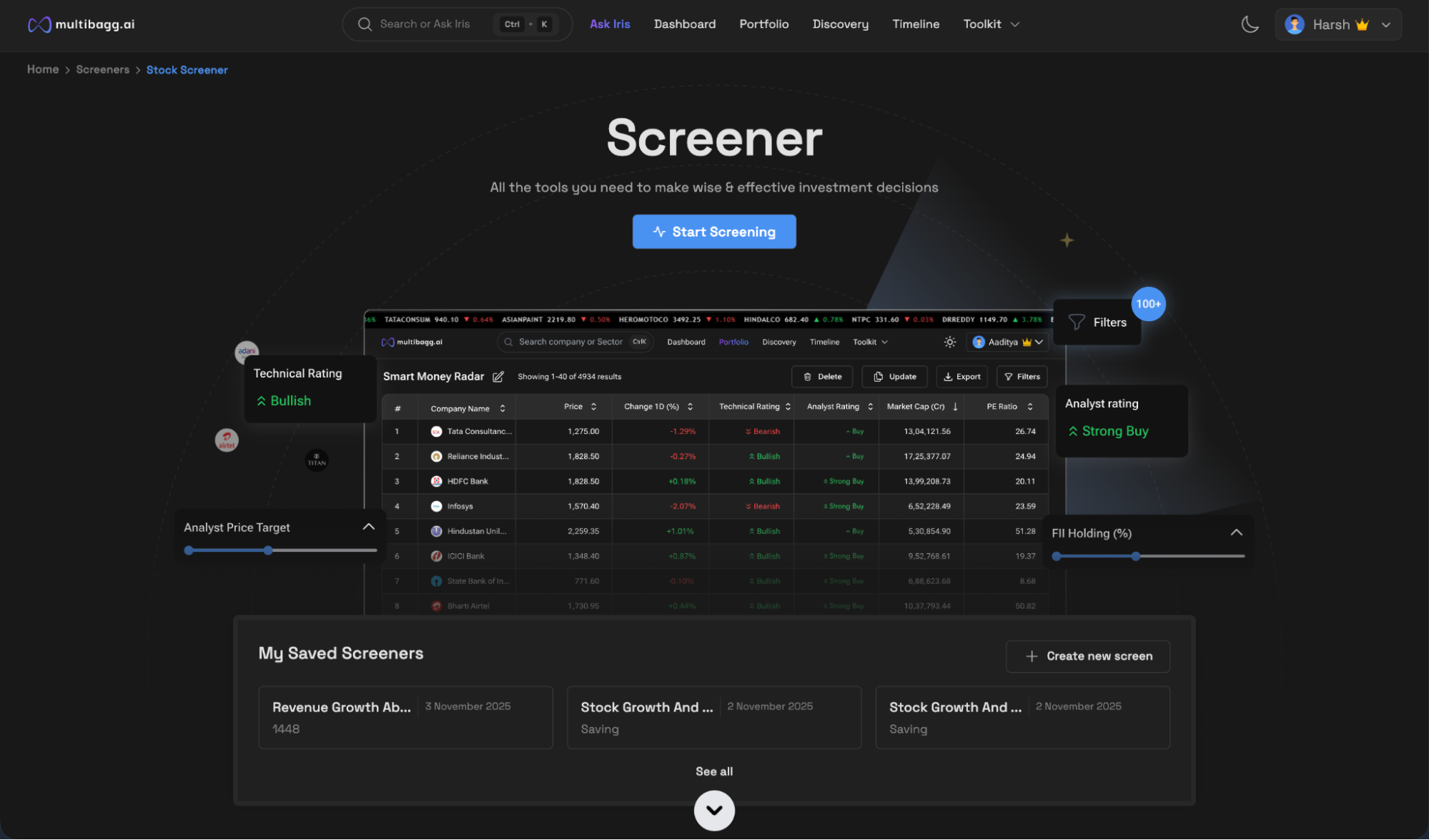

Multibagg AI’s screener supports stocks, IPOs, ETFs, sectors, and indices with 100+ filters, saved screens, Excel exports, and AI-assisted workflows.

StockEdge provides a wide range of scans and screeners in paid plans, particularly strong for technical and derivative-based filtering. However, there is no AI or natural-language screening.

Verdict: Tie.

Multibagg AI offers an intelligent watchlist with performance tracking from the exact date of addition and a real-time Timeline that integrates price, news, sentiment, and corporate events.

StockEdge supports watchlists and tracking, but the experience lacks narrative context and does not match the depth or clarity of Multibagg AI’s timeline-driven tracking.

Verdict: Multibagg AI wins.

Multibagg AI offers onboarding videos and guided tours but focuses more on execution than teaching theory.

StockEdge places strong emphasis on education, with extensive learning resources and regular content created by Vivek Bajaj across YouTube, Twitter, and webinars. It is well-suited for users who want to deeply understand market mechanics and trading concepts.

Verdict: StockEdge wins.

StockEdge’s pricing varies widely depending on the plan, with higher tiers unlocking advanced scans, analytics, and trader-focused datasets. Full access can become expensive.

Multibagg AI, at a fixed annual price, bundles AI-driven discovery, deep research, conversational analysis, portfolio intelligence, timeline-based tracking, and advanced screening into one integrated platform.

Verdict: Multibagg AI offers better value for investors seeking a complete workflow.

If you are a power user or trader who thrives on OI data, derivatives, sector rotation, scans, and quantitative models, StockEdge is a strong choice and offers exceptional analytical depth.

But if you want to reduce decision fatigue, discover ideas proactively, research companies faster using AI, manage portfolios intelligently, and track developments in real time, Multibagg AI is the better choice.

Multibagg AI focuses on clarity, speed, and outcomes, while StockEdge prioritises analytical depth for advanced trading-focused users.

Final takeaway: StockEdge is a data powerhouse for trader-focused, scan-heavy analysis.

Multibagg AI gives you an AI-first, end-to-end investing workflow with everything an investor needs – all under one platform.